Question: ONLY ATTEMPT TO ANSWER THIS QUESTION IF YOU ANSWER EVERY SINGLE PART OF THIS POST. Which of the following is a valid approach for calculating

ONLY ATTEMPT TO ANSWER THIS QUESTION IF YOU ANSWER EVERY SINGLE PART OF THIS POST.

Which of the following is a valid approach for calculating the cost of unused capacity? Multiple Choice

(Actual amount of the allocation base - Amount of allocation base at capacity)Predetermined overhead rate

(Amount of allocation base at capacity - Actual amount of the allocation base)Predetermined overhead rate

(Amount of allocation base at capacity - Actual amount of the allocation base)Predetermined overhead rate

(Actual amount of the allocation base - Amount of allocation base at capacity)Predetermined overhead rate

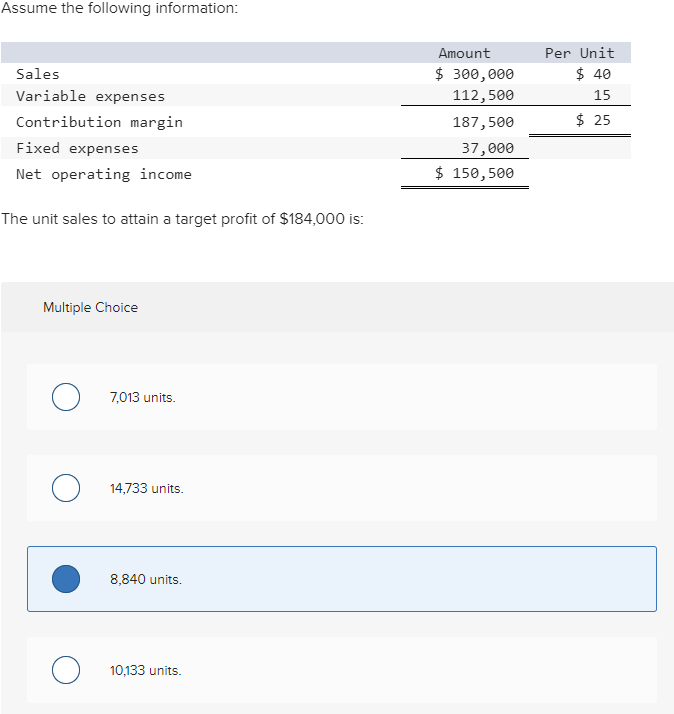

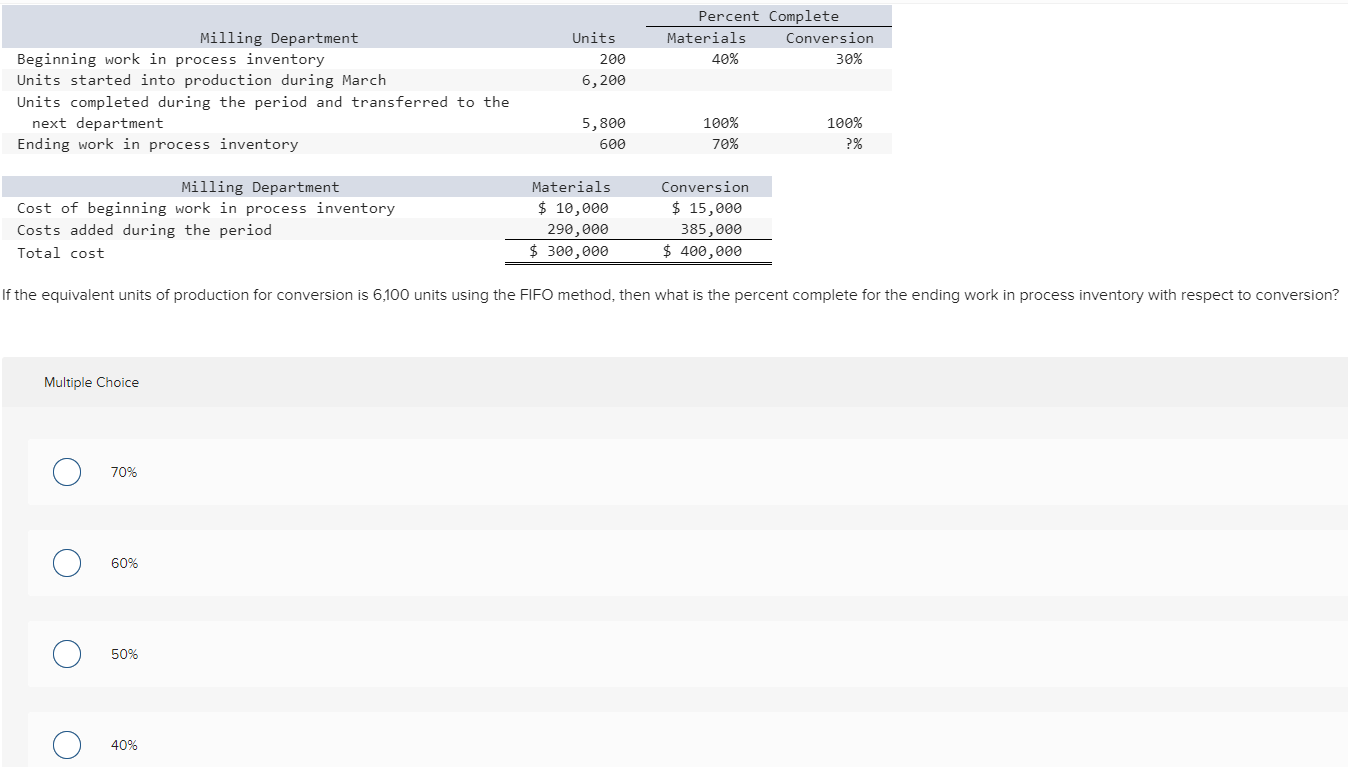

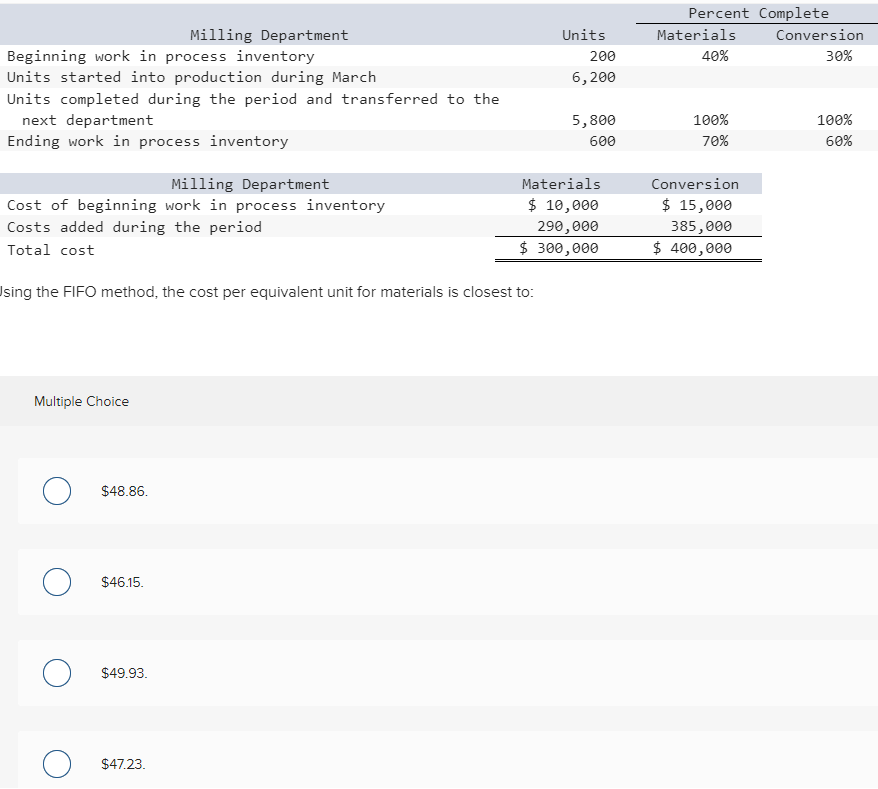

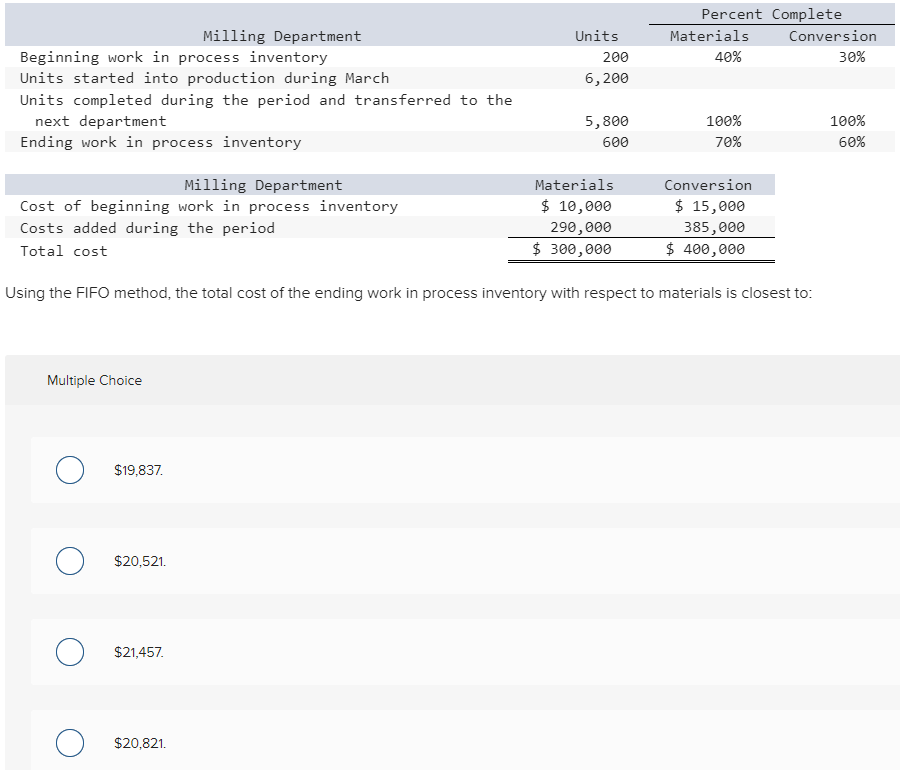

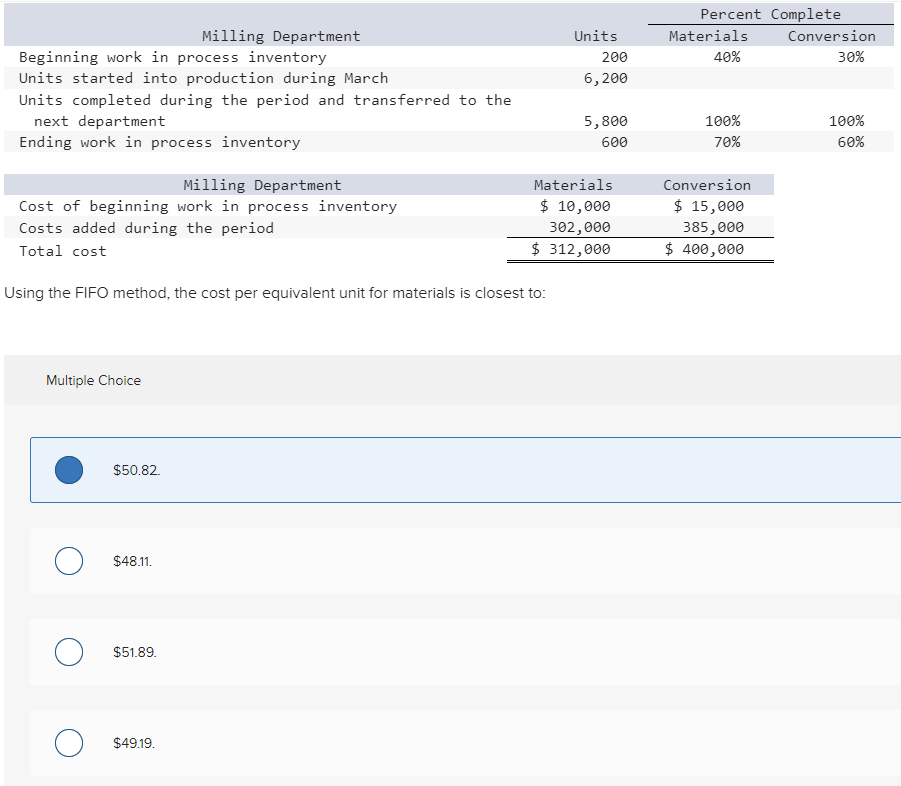

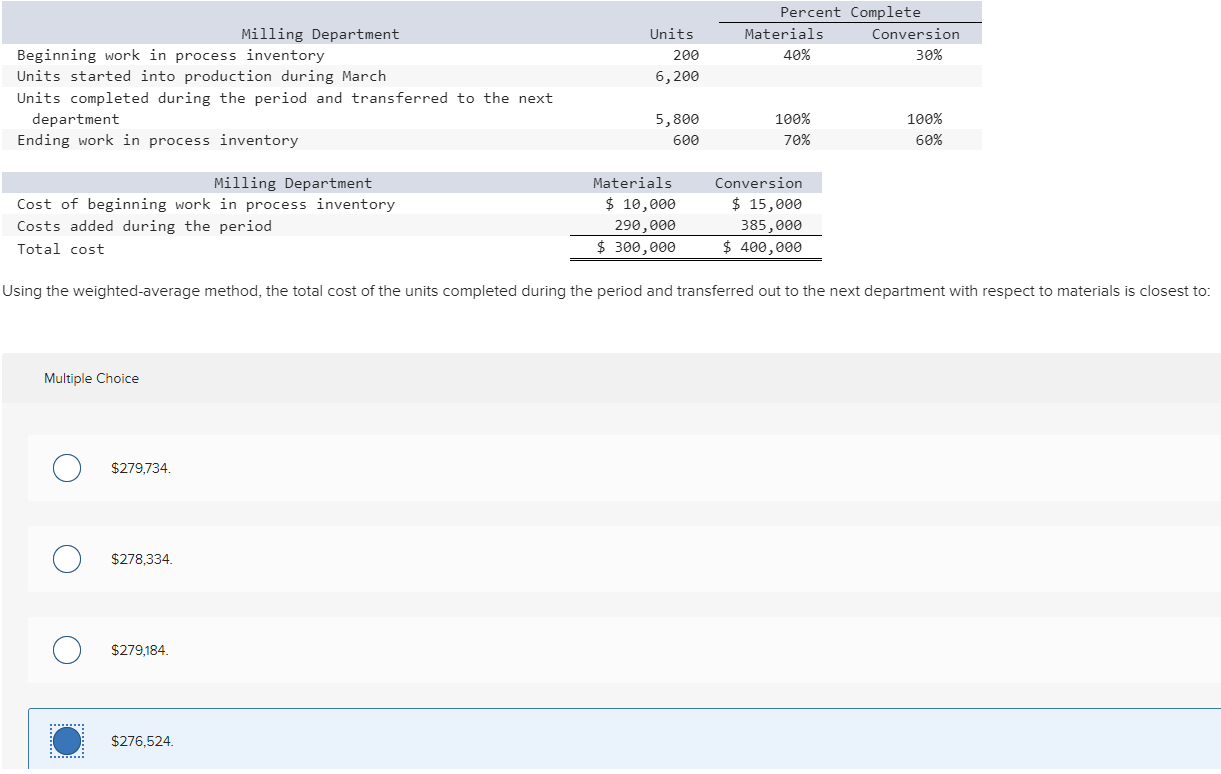

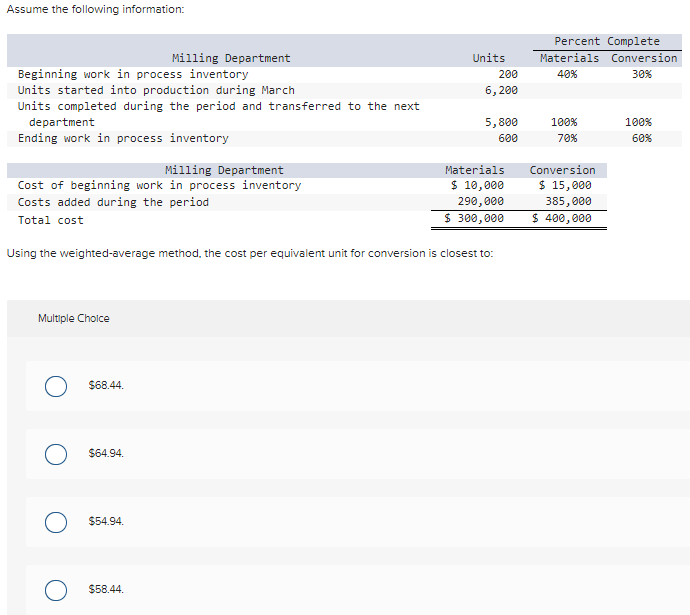

Assume the following information: The unit sales to attain a target profit of $184,000 is: Multiple Choice 7,013 units. 14,733 units. 8,840 units. 10,133 units. Multiple Choice 70% 60% 50% 40% sing the FIFO method, the cost per equivalent unit for materials is closest to: Multiple Choice $48.86 $46.15 $49.93 $47.23 Jsing the FIFO method, the total cost of the ending work in process inventory with respect to materials is closest to: Multiple Choice $19,837. $20,521. $21,457. $20,821 Using the FIFO method, the cost per equivalent unit for materials is closest to: Multiple Choice $50.82 $48.11. $51.89 $49.19 Multiple Choice $279,734. $278,334. $279,184. $276,524. Assume the following information: Using the weighted-average method, the cost per equivalent unit for conversion is closest to: Multiple Cholce 568.44 $64.94 554.94 $58.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts