Question: Only b and C part ACCT 102-F2020 Assignment #14 Question: The following data has been gathered for Reynolds Company to assist you in preparing the

Only b and C part

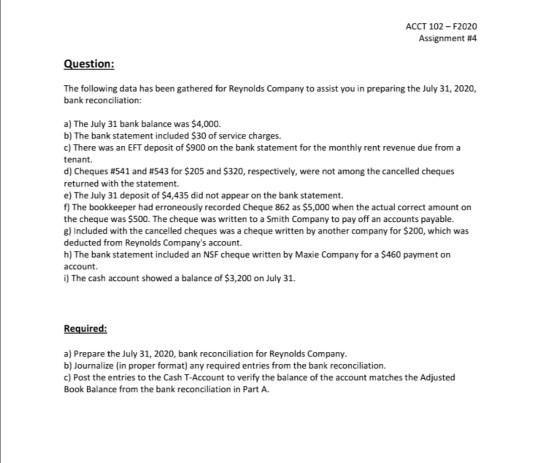

ACCT 102-F2020 Assignment #14 Question: The following data has been gathered for Reynolds Company to assist you in preparing the July 31, 2020, bank reconciliation: a) The July 31 bank balance was $4,000 b) The bank statement included $30 of service charges. c) There was an EFT deposit of $900 on the bank statement for the monthly rent revenue due from a tenant d) Cheques #541 and 4543 for $205 and $320, respectively, were not among the cancelled cheques returned with the statement e) The July 31 deposit of $4,435 did not appear on the bank statement. The bookkeeper had erroneously recorded Cheque 862 as $5,000 when the actual correct amount on the cheque was $500. The cheque was written to a Smith Company to pay off an accounts payable. B) Included with the cancelled cheques was a cheque written by another company for $200, which deducted from Reynolds Company's account. h) The bank statement included an NSF cheque written by Maxie Company for a $460 payment on account il The cash account showed a balance of $3,200 on July 31. Required: a) Prepare the July 31, 2020, bank reconciliation for Reynolds Company b) Journalize (in proper format) any required entries from the bank reconciliation c) Post the entries to the Cash T-Account to verify the balance of the account matches the Adjusted Book Balance from the bank reconciliation in Part A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts