Question: only boxes outlined in blue need an answer Timpanogos Incorporated is an accrual-method, calendar-yer corporation. For 2022, it reported financial statement income after taxes of

only boxes outlined in blue need an answer

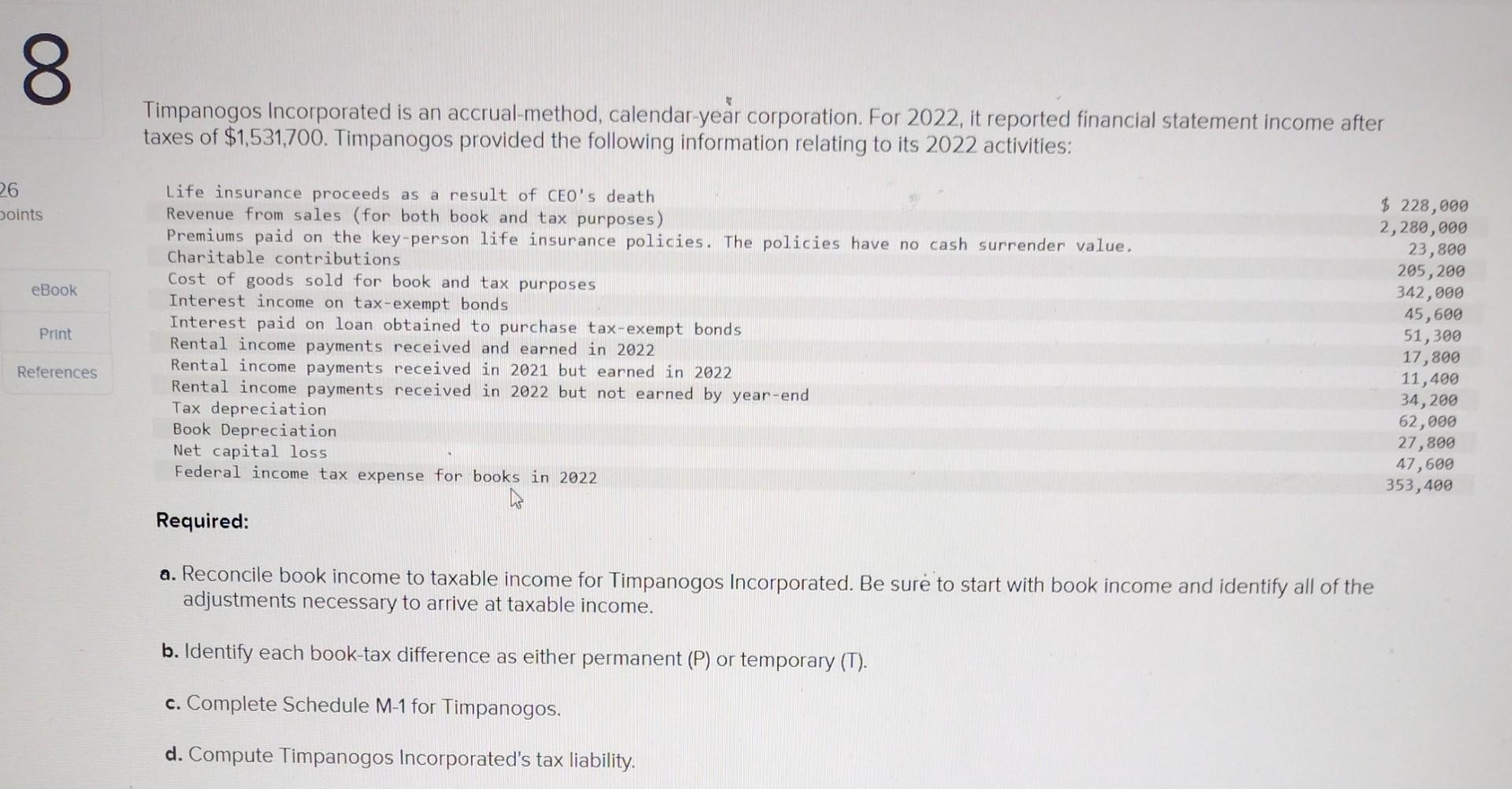

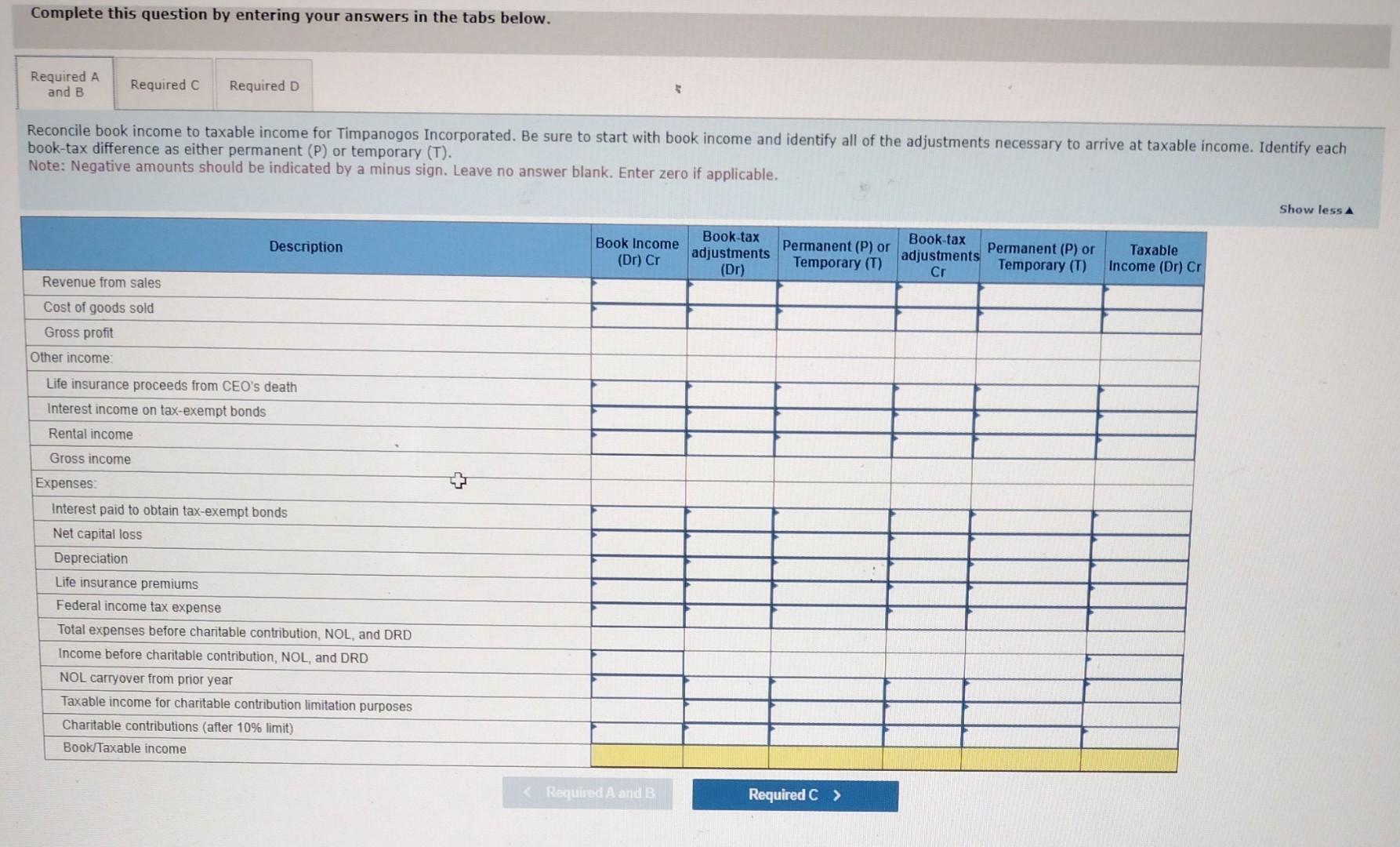

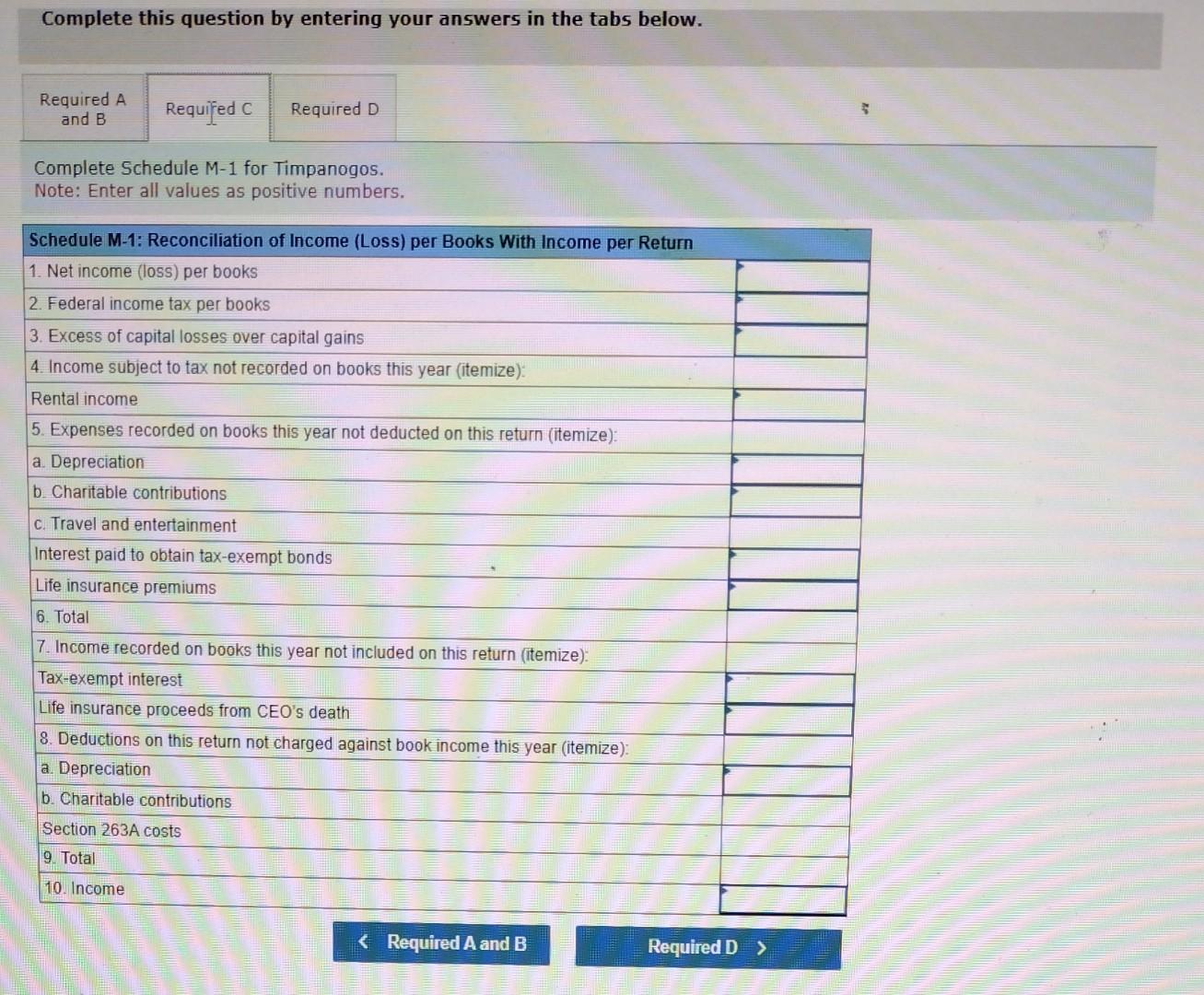

Timpanogos Incorporated is an accrual-method, calendar-yer corporation. For 2022, it reported financial statement income after taxes of $1,531,700. Timpanogos provided the following information relating to its 2022 activities: Life insurance proceeds as a result of CEO's death Revenue from sales (for both book and tax purposes) Premiums paid on the key-person life insurance policies. The policies have no cash surrender value. Charitable contributions Cost of goods sold for book and tax purposes Interest income on tax-exempt bonds Interest paid on loan obtained to purchase tax-exempt bonds Rental income payments received and earned in 2022 Rental income payments received in 2021 but earned in 2022 Rental income payments received in 2022 but not earned by year-end Tax depreciation Book Depreciation Net capital loss Federal income tax expense for books in 2022 Required: a. Reconcile book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of the adjustments necessary to arrive at taxable income. b. Identify each book-tax difference as either permanent (P) or temporary (T). c. Complete Schedule M1 for Timpanogos. d. Compute Timpanogos Incorporated's tax liability. Complete this question by entering your answers in the tabs below. Reconcile book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of the adjustments necessary to arrive at taxable income. Identify each book-tax difference as either permanent (P) or temporary (T). Note: Negative amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Complete this question by entering your answers in the tabs below. Complete Schedule M-1 for Timpanogos. Note: Enter all values as positive numbers. Complete this question by entering your answers in the tabs below. Compute Timpanogos Incorporated's tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts