Question: ONLY DO #3 DONT RESPOND TO THE QUESTION IF YOU DO NOT KNOW HOW TO DO IT. I WILL ONLY GIVE A THUMBS UP IF

ONLY DO #3 DONT RESPOND TO THE QUESTION IF YOU DO NOT KNOW HOW TO DO IT. I WILL ONLY GIVE A THUMBS UP IF YOU RESPOND TO EVERYTHING ASKED THAT IS INCORRECT AND IT IS RIGHT

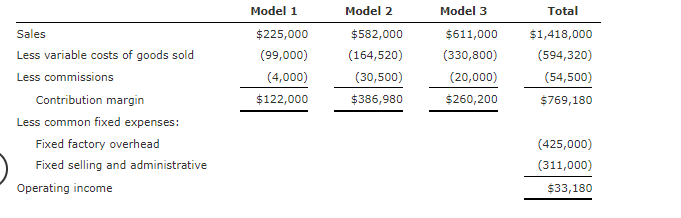

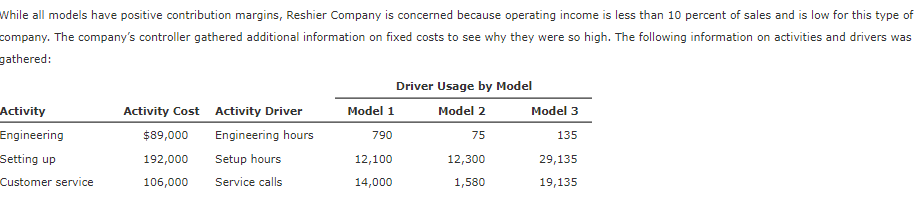

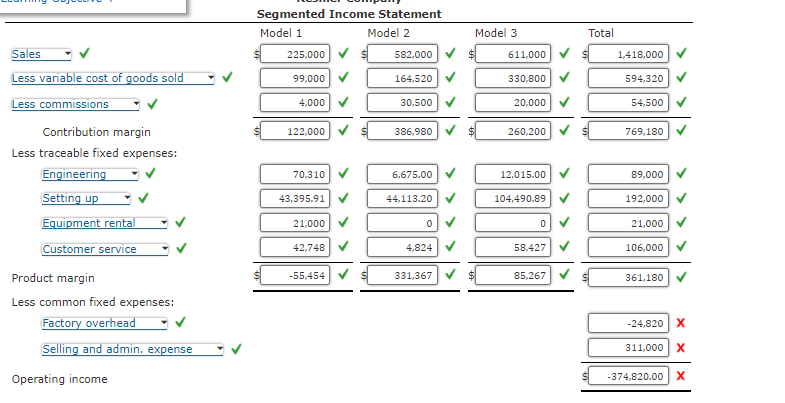

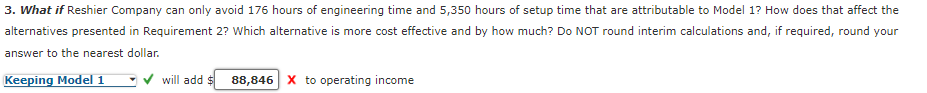

Less common fixed expenses: Fixed factory overhead (425,000) Fixed selling and administrative Operating income $33,180(311,000) While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was athered: Segmented Income Statement Sales Model 1 Less variable cost of goods sold Less commissions Lentribution margin 3. What if Reshier Company can only avoid 176 hours of engineering time and 5,350 hours of setup time that are attributable to Model 1 ? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much? Do NOT round interim calculations and, if required, round your answer to the nearest dollar. will add $ X to operating income Less common fixed expenses: Fixed factory overhead (425,000) Fixed selling and administrative Operating income $33,180(311,000) While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was athered: Segmented Income Statement Sales Model 1 Less variable cost of goods sold Less commissions Lentribution margin 3. What if Reshier Company can only avoid 176 hours of engineering time and 5,350 hours of setup time that are attributable to Model 1 ? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much? Do NOT round interim calculations and, if required, round your answer to the nearest dollar. will add $ X to operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts