Question: *ONLY DO PART 3* Use the information to answer the following questions. The last dividend paid by Klein Company was $1.00. Klein's growth rate is

*ONLY DO PART 3*

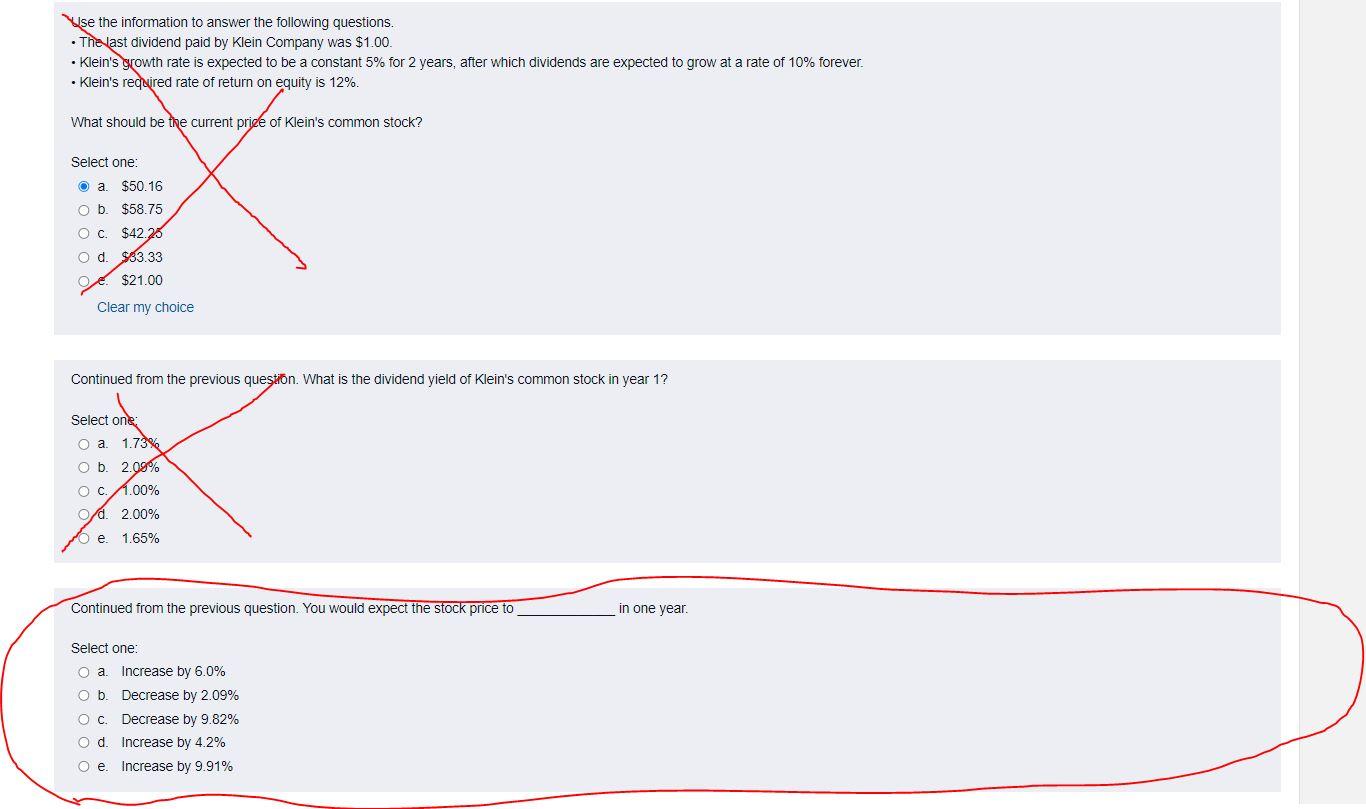

Use the information to answer the following questions. The last dividend paid by Klein Company was $1.00. Klein's growth rate is expected to be a constant 5% for 2 years, after which dividends are expected to grow at a rate of 10% forever. Klein's required rate of return on equity is 12%. What should be the current pride of Klein's common stock? Select one: a $50.16 O b. $58.75 . $42.26 O d. $83.33 $21.00 Clear my choice Continued from the previous question. What is the dividend yield of Klein's common stock in year 1? Select one: O a 1.73% Ob 2.09% OC 1.00% d. 2.00% . 1.65% Continued from the previous question. You would expect the stock price to in one year. Select one: O a Increase by 6.0% O b. Decrease by 2.09% O C. Decrease by 9.82% Od. Increase by 4.2% O e. Increase by 9.91%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts