Question: only do part C! I asked this question before and got wrong answers for C so don't put those thanks Problem 5-18 (LG 5-2) A

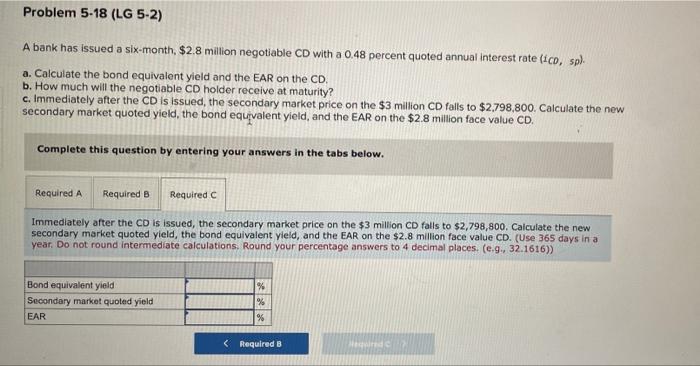

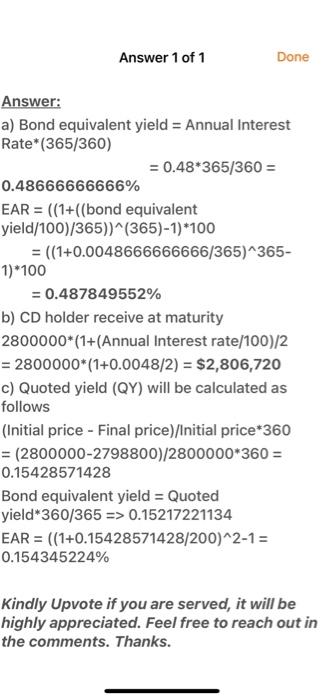

Problem 5-18 (LG 5-2) A bank has issued a six-month. $2.8 million negotiable CD with a 0.48 percent quoted annual interest rate (ico, spl. a. Calculate the bond equivalent yield and the EAR on the CD b. How much will the negotiable CD holder receive at maturity? c. Immediately after the CD is issued, the secondary market price on the $3 million CD falls to $2,798,800. Calculate the new secondary market quoted yield, the bond equvalent yield, and the EAR on the $2.8 million face value CD. Complete this question by entering your answers in the tabs below. Required A Required B Required C Immediately after the CD is issued, the secondary market price on the $3 million CD falls to $2,798,800. Calculate the new secondary market quoted yield, the bond equivalent yield, and the EAR on the $2.8 million face value CD. (Use 365 days in a year. Do not round intermediate calculations. Round your percentage answers to 4 decimal places. (e.g., 32.1616)) Bond equivalent yield Secondary market quoted yield EAR % % % 0.15217221134 EAR = ((1+0.15428571428/200)^2-1 = 0.154345224% Kindly Upvote if you are served, it will be highly appreciated. Feel free to reach out in the comments. Thanks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts