Question: only final answers needed please Assume a firm generates $2,000 in sales and has a $500 increase in accounts receivable during an accounting perioD) Based

only final answers needed please

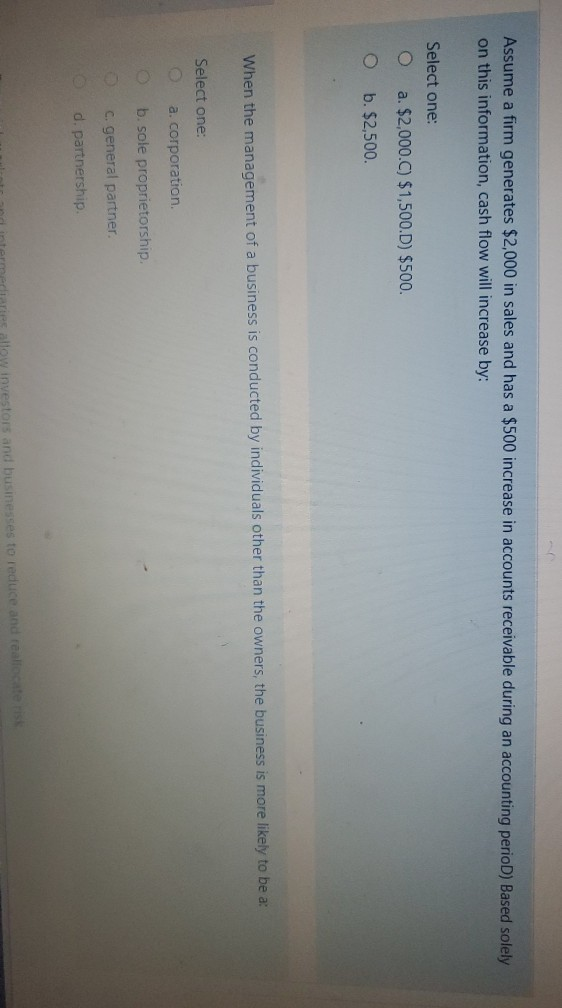

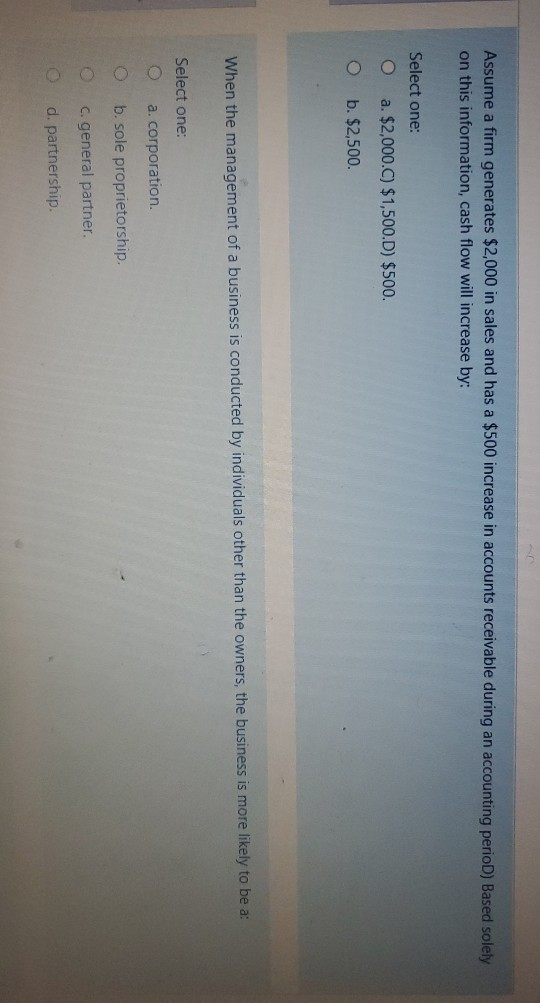

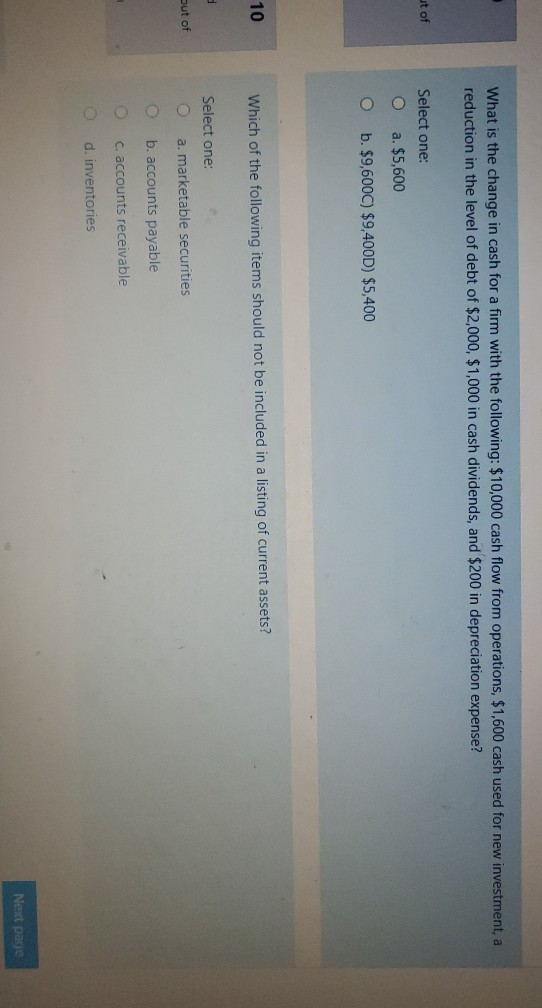

Assume a firm generates $2,000 in sales and has a $500 increase in accounts receivable during an accounting perioD) Based solely on this information, cash flow will increase by: Select one: O a. $2,000.C) $1,500.D) $500. O b. $2,500. When the management of a business is conducted by individuals other than the owners, the business is more likely to be a: Select one: a. corporation b. sole proprietorship. C. general partner. d. partnership ries allow investors and businesses to reduce and reallocate risk Assume a firm generates $2,000 in sales and has a $500 increase in accounts receivable during an accounting perioD) Based solely on this information, cash flow will increase by: Select one: a. $2,000.C) $1,500.D) $500. O b. $2,500. When the management of a business is conducted by individuals other than the owners, the business is more likely to be a: Select one: O a. corporation. b. sole proprietorship. c. general partner. d. partnership What is the change in cash for a firm with the following: $10,000 cash flow from operations, $1,600 cash used for new investment, a reduction in the level of debt of $2,000, $1,000 in cash dividends, and $200 in depreciation expense? ut of Select one: a. $5,600 b. $9,600C) $9,400D) $5,400 10 Which of the following items should not be included in a listing of current assets? Select one: a. marketable securities Out of b. accounts payable c. accounts receivable d. inventories Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts