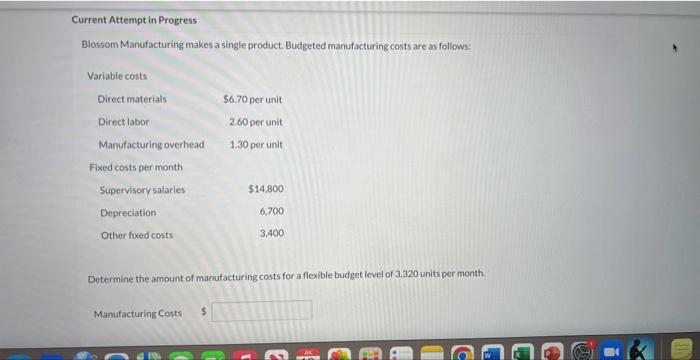

Question: only have 20 minutes, please help Current Attempt in Progress Blossom Manufacturing makes a single product. Budgeted manufacturing costs are as follows: Variable costs Direct

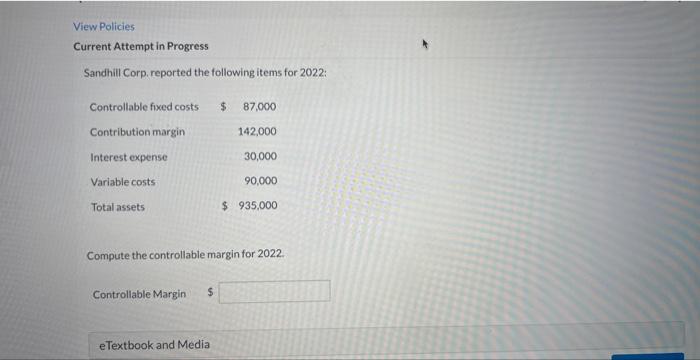

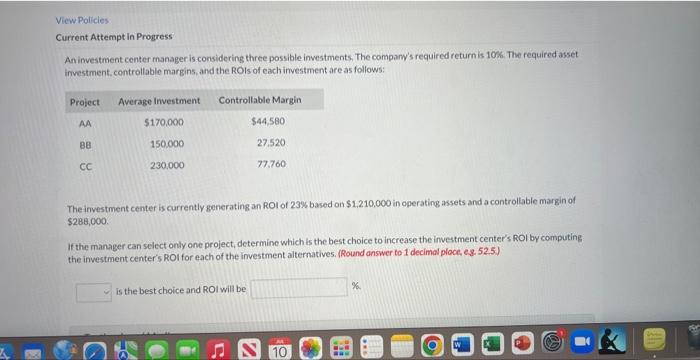

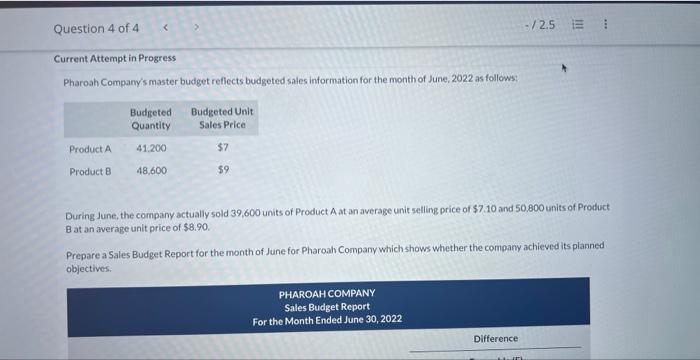

Current Attempt in Progress Blossom Manufacturing makes a single product. Budgeted manufacturing costs are as follows: Variable costs Direct materials Direct labor Manufacturing overhead Fixed costs per month Supervisory salaries Depreciation Other fixed costs $6.70 per unit Manufacturing Costs $ 2.60 per unit 1.30 per unit $14,800 6,700 3,400 Determine the amount of manufacturing costs for a flexible budget level of 3.320 units per month. View Policies Current Attempt in Progress Sandhill Corp. reported the following items for 2022: Controllable fixed costs Contribution margin Interest expense Variable costs Total assets Controllable Margin $ $ 87,000 142,000 30,000 90,000 Compute the controllable margin for 2022. eTextbook and Media $935,000 View Policies Current Attempt in Progress An investment center manager is considering three possible investments. The company's required return is 10%. The required asset investment, controllable margins, and the ROIs of each investment are as follows: Project Average Investment AA 88 CC $170,000 150,000 230,000 Controllable Margin $44,580 27,520 77.760 The investment center is currently generating an ROI of 23% based on $1,210,000 in operating assets and a controllable margin of $288,000. If the manager can select only one project, determine which is the best choice to increase the investment center's ROI by computing the investment center's ROI for each of the investment alternatives. (Round answer to 1 decimal place, e.g. 52.5.) is the best choice and ROI will be 10 %. for Question 4 of 41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts