Question: only Need 5B, 6B, and 7B please Adjustment for accrued revenues PE 3-5B At the end of the current year, $17,555 of fees have been

only Need 5B, 6B, and 7B please

only Need 5B, 6B, and 7B please

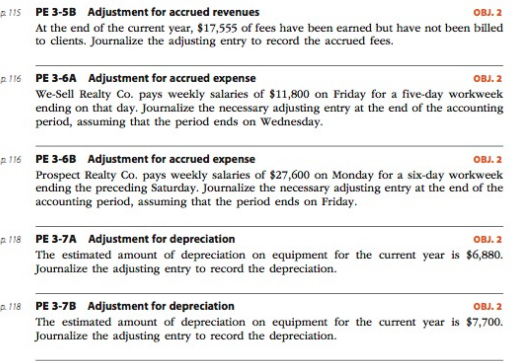

Adjustment for accrued revenues PE 3-5B At the end of the current year, $17,555 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees. p 115 OBJ.2 p 116 PE 3-6A Adjustment for accrued expense OBL 2 We-Sell Realty Co. pays weekly salaries of $11,800 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Wednesday 116 PE 3-6B Adjustment for accrued expense OBJ.2 Prospect Realty Co. pays weekly salaries of $27,600 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Friday. Adjustment for depreciation PE 3-7A The estimated amount of depreciation on equipment for the current year is $6,880. Journalize the adjusting entry to record the depreciation. p 118 OBJ.2 Adjustment for depreciation PE 3-7B The estimated amount of depreciation on equipment for the current year is $7,700 Journalize the adjusting entry to record the depreciation p 118 OBJ.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts