Question: only need answers. No calculation required Consider the following $5,000,000 fund that contains three stocks. The expected return on the market is 11% and the

only need answers. No calculation required

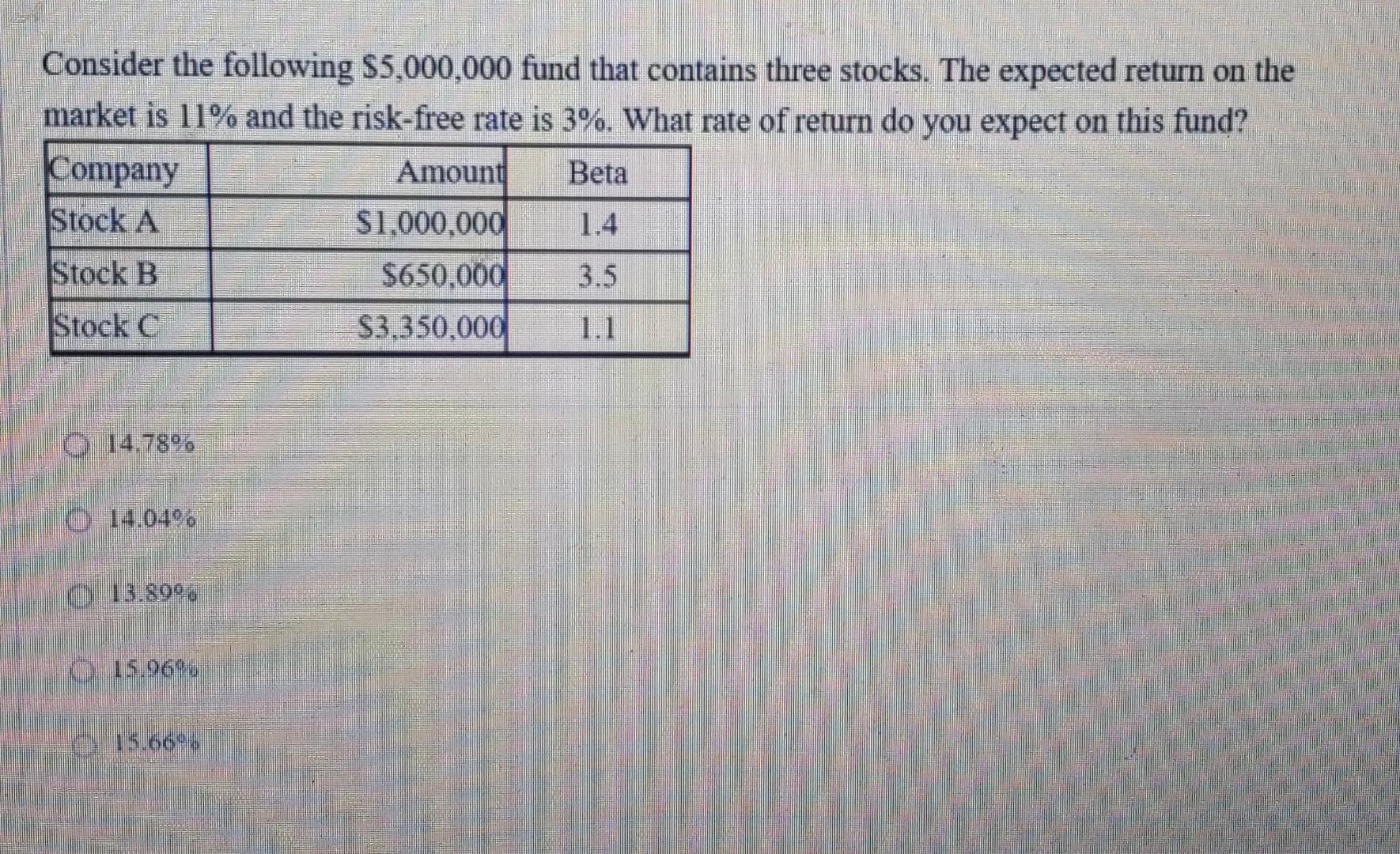

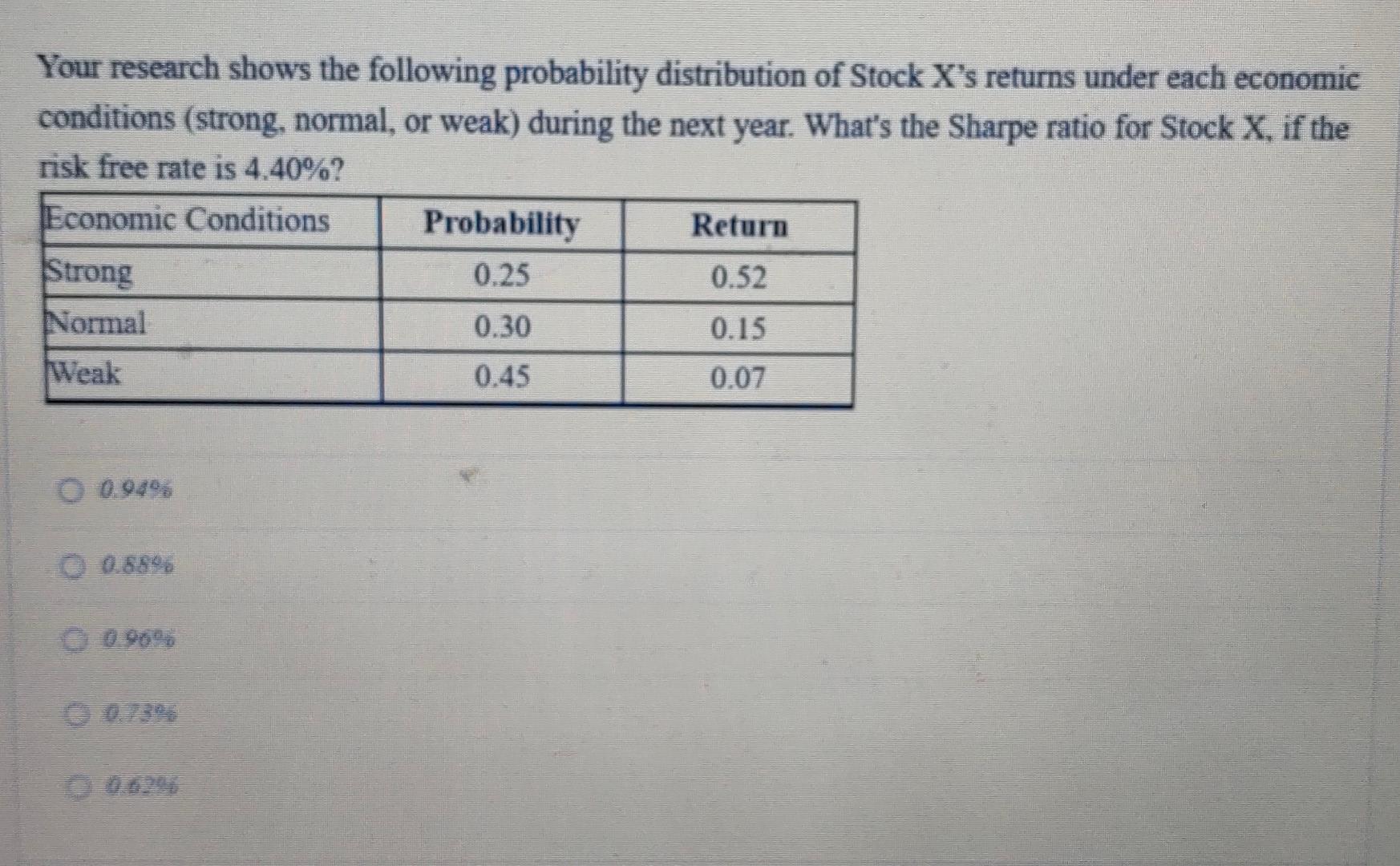

Consider the following $5,000,000 fund that contains three stocks. The expected return on the market is 11% and the risk-free rate is 3%. What rate of return do you expect on this fund? Company Amount Beta Stock A $1,000,000 1.4 Stock B $650,000 3.5 Stock S3.350,000 1.1 0 14.7896 O 14.04% @ 13.8996 15.960 15.6696 Your research shows the following probability distribution of Stock X's returns under each economic conditions (strong, normal, or weak) during the next year. What's the Sharpe ratio for Stock X. if the risk free rate is 4.40%? Economic Conditions Probability Return Strong 0.25 0.52 Normal 0.30 0.15 Weak 0.45 0.07 O 0.949 0.8896

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts