Question: Only need calculation process of question 2. The answer is new_beta=0.755 r_p=0.082 As a mutual fund manager, you have a portfolio worth $10,000 consisting of

Only need calculation process of question 2.

The answer is

new_beta=0.755

r_p=0.082

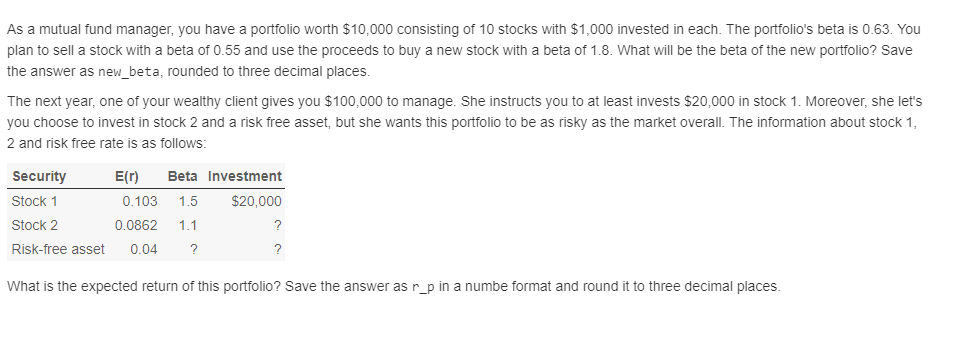

As a mutual fund manager, you have a portfolio worth $10,000 consisting of 10 stocks with $1,000 invested in each. The portfolio's beta is 0.63. You plan to sell a stock with a beta of 0.55 and use the proceeds to buy a new stock with a beta of 1.8. What will be the beta of the new portfolio? Save the answer as new_beta, rounded to three decimal places. The next year, one of your wealthy client gives you $100,000 to manage. She instructs you to at least invests $20,000 in stock 1. Moreover, she let's you choose to invest in stock 2 and a risk free asset, but she wants this portfolio to be as risky as the market overall. The information about stock 1, 2 and risk free rate is as follows: Security E(r) Beta Investment Stock 1 0.103 1.5 $20,000 Stock 2 0.0862 1.1 ? Risk-free asset 0.04 ? ? What is the expected return of this portfolio? Save the answer as r_p in a numbe format and round it to three decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts