Question: only need help 4 only need assitance with number 4 The Johnson Drafting Company was started on March 1 to draw blueprints for building contractors.

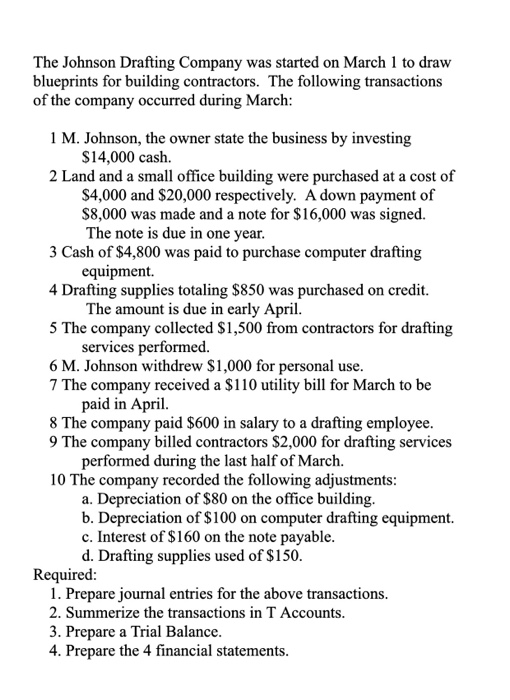

The Johnson Drafting Company was started on March 1 to draw blueprints for building contractors. The following transactions of the company occurred during March: 1 M. Johnson, the owner state the business by investing $14,000 cash. 2 Land and a small office building were purchased at a cost of $4,000 and $20,000 respectively. A down payment of $8,000 was made and a note for $16,000 was signed. The note is due in one year. 3 Cash of $4,800 was paid to purchase computer drafting equipment. 4 Drafting supplies totaling $850 was purchased on credit. The amount is due in early April. 5 The company collected $1,500 from contractors for drafting services performed. 6 M. Johnson withdrew $1,000 for personal use. 7 The company received a $110 utility bill for March to be paid in April. 8 The company paid $600 in salary to a drafting employee. 9 The company billed contractors $2,000 for drafting services performed during the last half of March. 10 The company recorded the following adjustments: a. Depreciation of $80 on the office building. b. Depreciation of $100 on computer drafting equipment. c. Interest of $160 on the note payable. d. Drafting supplies used of $150. Required: 1. Prepare journal entries for the above transactions. 2. Summerize the transactions in T Accounts. 3. Prepare a Trial Balance. 4. Prepare the 4 financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts