Question: only need help wit part c. is the answer $81.25 because the tax would only be on the capital gain? otherwise please advise. DO fits

only need help wit part c. is the answer $81.25 because the tax would only be on the capital gain? otherwise please advise.

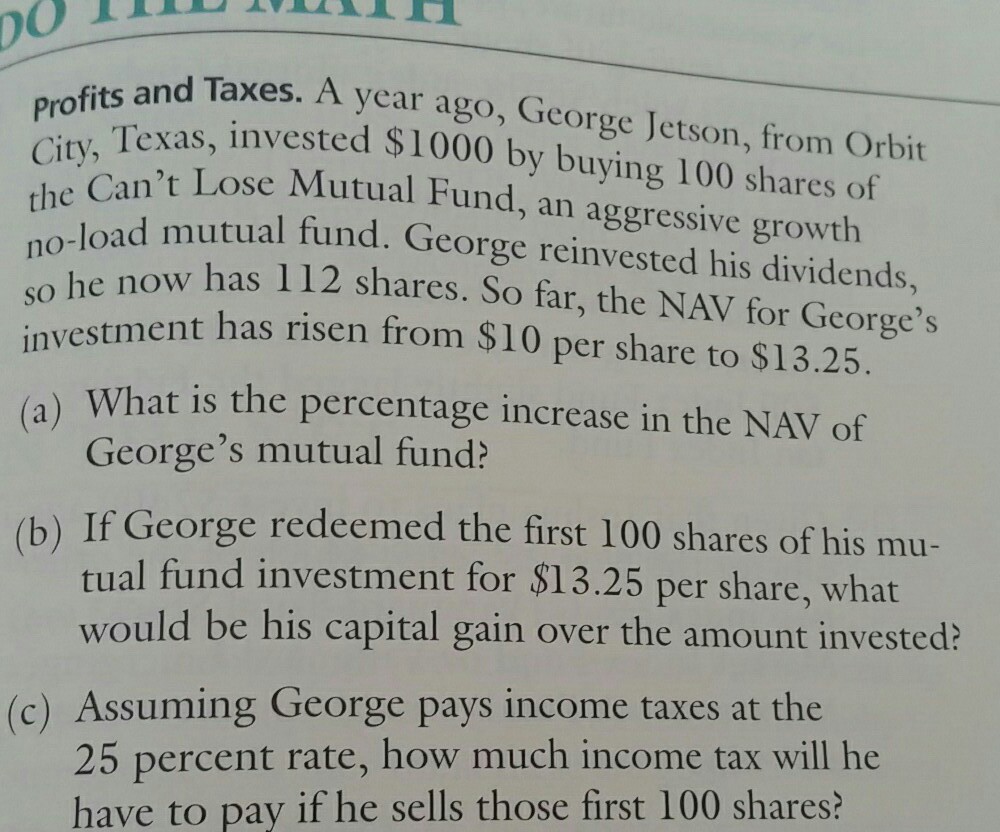

DO fits and Taxes. A year ago, George Jetson, from Orbit Texas, invested $1000 by buying 100 shares of t Lose Mutual Fund, an aggressive growth load mutual fund the Can't so he now has 112 investment has risen from $10 . George reinvested his dividends, res. So far, the NAV for Gcorge's per share to $13.25. ) What is the percentage increase in the NAV of George's mutual fund? (b) If George redeemed the first 100 shares of his mu- tual fund investment for $13.25 per share, what would be his capital gain over the amount invested? (c) Assuming George pays income taxes at the 25 percent rate, how much income tax will he have to pay if he sells those first 100 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts