Question: only need help with 4,5,6, q1,2,3 is for context Question 4 Not yet saved Marked out of 1.00 P Flag question Donald decides to call

only need help with 4,5,6, q1,2,3 is for context

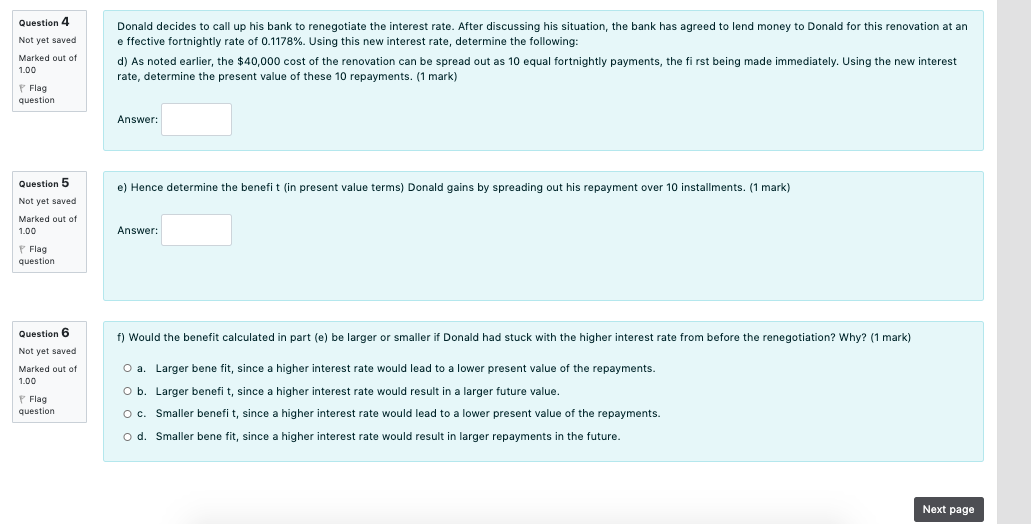

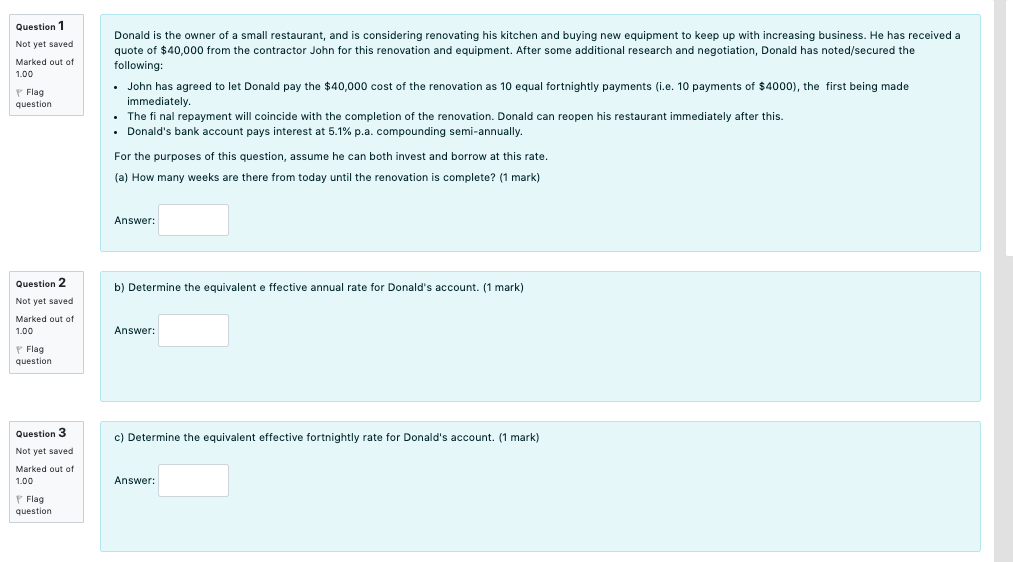

Question 4 Not yet saved Marked out of 1.00 P Flag question Donald decides to call up his bank to renegotiate the interest rate. After discussing his situation, the bank has agreed to lend money to Donald for this renovation at an e ffective fortnightly rate of 0.1178%. Using this new interest rate, determine the following: d) As noted earlier, the $40,000 cost of the renovation can be spread out as 10 equal fortnightly payments, the first being made immediately. Using the new interest rate, determine the present value of these 10 repayments. (1 mark) Answer: e) Hence determine the benefit (in present value terms) Donald gains by spreading out his repayment over 10 installments. (1 mark) Question 5 Not yet saved Marked out of 1.00 P Flag question Answer: f) Would the benefit calculated in part (e) be larger or smaller if Donald had stuck with the higher interest rate from before the renegotiation? Why? (1 mark) Question 6 Not yet saved Marked out of 1.00 P Flag question O a. Larger bene fit, since a higher interest rate would lead to a lower present value of the repayments. Ob. Larger benefit, since a higher interest rate would result in a larger future value. O c. Smaller benefit, since a higher interest rate would lead to a lower present value of the repayments. O d. Smaller bene fit, since a higher interest rate would result in larger repayments in the future. Next page Question 1 Not yet saved Marked out of 1.00 P Flag question Donald is the owner of a small restaurant, and is considering renovating his kitchen and buying new equipment to keep up with increasing business. He has received a quote of $40,000 from the contractor John for this renovation and equipment. After some additional research and negotiation, Donald has noted/secured the following: John has agreed to let Donald pay the $40,000 cost of the renovation as 10 equal fortnightly payments (i.e. 10 payments of $4000), the first being made immediately. The final repayment will coincide with the completion of the renovation. Donald can reopen his restaurant immediately after this. Donald's bank account pays interest at 5.1% p.a. compounding semi-annually. For the purposes of this question, assume he can both invest and borrow at this rate. (a) How many weeks are there from today until the renovation is complete? (1 mark) Answer: b) Determine the equivalent effective annual rate for Donald's account. (1 mark) Question 2 Not yet saved Marked out of 1.00 Answer: P Flag question c) Determine the equivalent effective fortnightly rate for Donald's account. (1 mark) Question 3 Not yet saved Marked out of 1.00 Answer: P Flag question Question 4 Not yet saved Marked out of 1.00 P Flag question Donald decides to call up his bank to renegotiate the interest rate. After discussing his situation, the bank has agreed to lend money to Donald for this renovation at an e ffective fortnightly rate of 0.1178%. Using this new interest rate, determine the following: d) As noted earlier, the $40,000 cost of the renovation can be spread out as 10 equal fortnightly payments, the first being made immediately. Using the new interest rate, determine the present value of these 10 repayments. (1 mark) Answer: e) Hence determine the benefit (in present value terms) Donald gains by spreading out his repayment over 10 installments. (1 mark) Question 5 Not yet saved Marked out of 1.00 P Flag question Answer: f) Would the benefit calculated in part (e) be larger or smaller if Donald had stuck with the higher interest rate from before the renegotiation? Why? (1 mark) Question 6 Not yet saved Marked out of 1.00 P Flag question O a. Larger bene fit, since a higher interest rate would lead to a lower present value of the repayments. Ob. Larger benefit, since a higher interest rate would result in a larger future value. O c. Smaller benefit, since a higher interest rate would lead to a lower present value of the repayments. O d. Smaller bene fit, since a higher interest rate would result in larger repayments in the future. Next page Question 1 Not yet saved Marked out of 1.00 P Flag question Donald is the owner of a small restaurant, and is considering renovating his kitchen and buying new equipment to keep up with increasing business. He has received a quote of $40,000 from the contractor John for this renovation and equipment. After some additional research and negotiation, Donald has noted/secured the following: John has agreed to let Donald pay the $40,000 cost of the renovation as 10 equal fortnightly payments (i.e. 10 payments of $4000), the first being made immediately. The final repayment will coincide with the completion of the renovation. Donald can reopen his restaurant immediately after this. Donald's bank account pays interest at 5.1% p.a. compounding semi-annually. For the purposes of this question, assume he can both invest and borrow at this rate. (a) How many weeks are there from today until the renovation is complete? (1 mark) Answer: b) Determine the equivalent effective annual rate for Donald's account. (1 mark) Question 2 Not yet saved Marked out of 1.00 Answer: P Flag question c) Determine the equivalent effective fortnightly rate for Donald's account. (1 mark) Question 3 Not yet saved Marked out of 1.00 Answer: P Flag

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts