Question: ONLY NEED HELP WITH PART C ! ! ! ! ! Thank you! Assume that on December 3 1 . 2 0 2 4 .

ONLY NEED HELP WITH PART C Thank you!

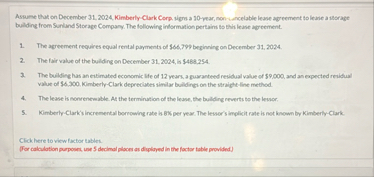

Assume that on December Kimberly Clark Corp. signs a pear, nonsuncelable lease agreement so lease a slorage building from Sunlund Storage Company. The following indormation pertains to this lease agreement.

The agreement requires equal rental puyments of $ beginning on December

The fair wabe of the bulding en Derember in

The building has an eitimated economic life of years, a guaranteed residual value of $ and an expected revidual value of $ KimberlyClark depreclates similar buldings on the straightline method.

The lease is nonenemable. At the termination of the lease, the building reverts to the lever:

KimbertyClark's incremental bornowing rate is per year. The lessor's implicit rate is not known by KinberlyClark.

Click here to view factor tablei.

For calculation purposes, use decimel places as displayed in the foctor table providedjournal entries on the lessee's books to reflect the signing of the lease agreement and to record the payments and lated to this lease for the years and KimberlyClark's fiscal yearend ls December flist aft detir e credit entries. Credit account bitles are automatically indented when amount is entered. Do not indent manually, If no entry if ect No Entry" for the account titles and enter Of for the amounts. Round answerto Decimal places e

Account Titles and Explanation

Debit

Credit

To record the lease

To record first lease payment

To record amortization of the rightofuse asset

Interest Expense

To record interest experse

To record amortiation of the rightofuse asset

To recond interest expenseb

Your answer is correct.

Suppose the same facts as above, except that KimberlyClark incurred liegal fees resulting from the exeoution of the lease of $ and received a lease incentive from Sunland to enter the lease of $ ow woud the intial measurement of the leas: Thattly and ridit d'use asset be alfected under this situation?

Righted vneases $

e Textbook and Media

List of Accounts

Attempts: of usedc

X Your answer is incorrect.

Suppose that in addition to the $ annual rental paymerts, KimberlyClarl is abso required to pay $ for insurance costs each year on the building directly to the lessor, Surland Storage. How modat this eaccutary cost affect the initial measurement of the lease liability and rightofuse anset? Round answer to declay places ezs

Lease liability $

eTextbook and Media

Lhe of Accounts

Alsumpts ef used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock