Question: Only need help with part C & D. c) Assume that the beta of the new debt (valued at $12M) equals 0.05. What is the

Only need help with part C & D.

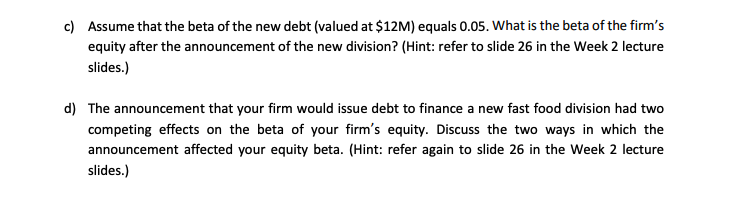

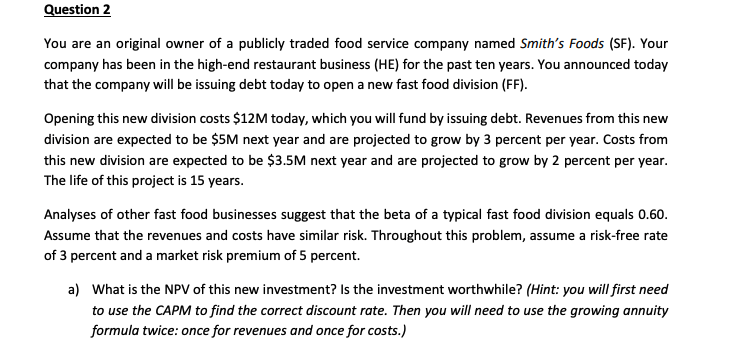

c) Assume that the beta of the new debt (valued at $12M) equals 0.05. What is the beta of the firm's equity after the announcement of the new division? (Hint: refer to slide 26 in the Week 2 lecture slides.) d) The announcement that your firm would issue debt to finance a new fast food division had two competing effects on the beta of your firm's equity. Discuss the two ways in which the announcement affected your equity beta. (Hint: refer again to slide 26 in the Week 2 lecture slides.) Question 2 You are an original owner of a publicly traded food service company named Smith's Foods (SF). Your company has been in the high-end restaurant business (HE) for the past ten years. You announced today that the company will be issuing debt today to open a new fast food division (FF). Opening this new division costs $12M today, which you will fund by issuing debt. Revenues from this new division are expected to be $5M next year and are projected to grow by 3 percent per year. Costs from this new division are expected to be $3.5M next year and are projected to grow by 2 percent per year. The life of this project is 15 years. Analyses of other fast food businesses suggest that the beta of a typical fast food division equals 0.60. Assume that the revenues and costs have similar risk. Throughout this problem, assume a risk-free rate of 3 percent and a market risk premium of 5 percent. a) What is the NPV of this new investment? Is the investment worthwhile? (Hint: you will first need to use the CAPM to find the correct discount rate. Then you will need to use the growing annuity formula twice: once for revenues and once for costs.) c) Assume that the beta of the new debt (valued at $12M) equals 0.05. What is the beta of the firm's equity after the announcement of the new division? (Hint: refer to slide 26 in the Week 2 lecture slides.) d) The announcement that your firm would issue debt to finance a new fast food division had two competing effects on the beta of your firm's equity. Discuss the two ways in which the announcement affected your equity beta. (Hint: refer again to slide 26 in the Week 2 lecture slides.) Question 2 You are an original owner of a publicly traded food service company named Smith's Foods (SF). Your company has been in the high-end restaurant business (HE) for the past ten years. You announced today that the company will be issuing debt today to open a new fast food division (FF). Opening this new division costs $12M today, which you will fund by issuing debt. Revenues from this new division are expected to be $5M next year and are projected to grow by 3 percent per year. Costs from this new division are expected to be $3.5M next year and are projected to grow by 2 percent per year. The life of this project is 15 years. Analyses of other fast food businesses suggest that the beta of a typical fast food division equals 0.60. Assume that the revenues and costs have similar risk. Throughout this problem, assume a risk-free rate of 3 percent and a market risk premium of 5 percent. a) What is the NPV of this new investment? Is the investment worthwhile? (Hint: you will first need to use the CAPM to find the correct discount rate. Then you will need to use the growing annuity formula twice: once for revenues and once for costs.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts