Question: Only need help with part g and on, any help is apreciated, g. Cost of goods sold budget h. Selling and administrative expenses budget i.

Only need help with part g and on, any help is apreciated, g. Cost of goods sold budget h. Selling and administrative expenses budget i. Cash budget j. Pro forma income statement k. Pro forma balance sheet

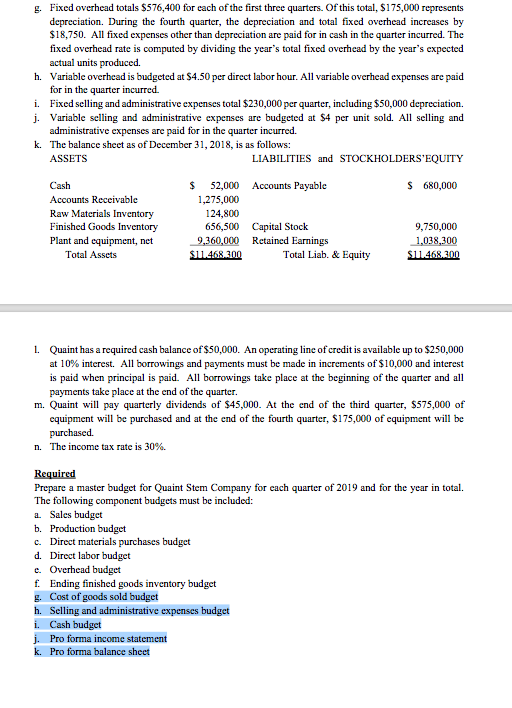

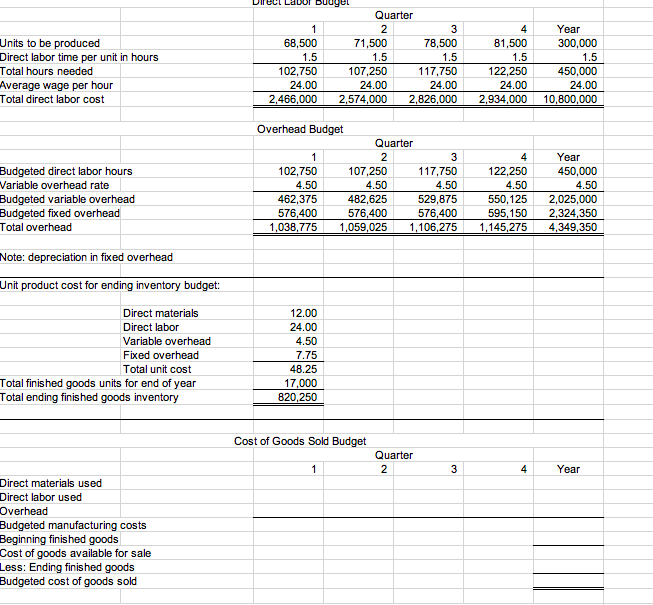

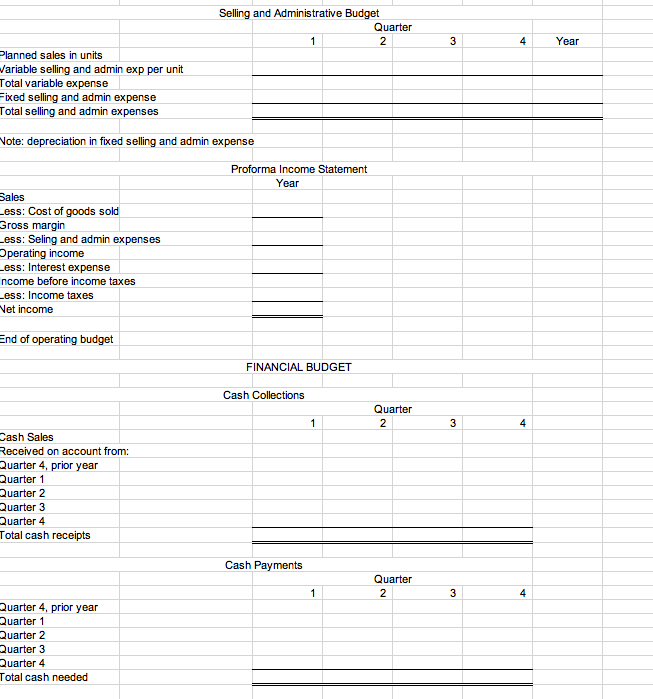

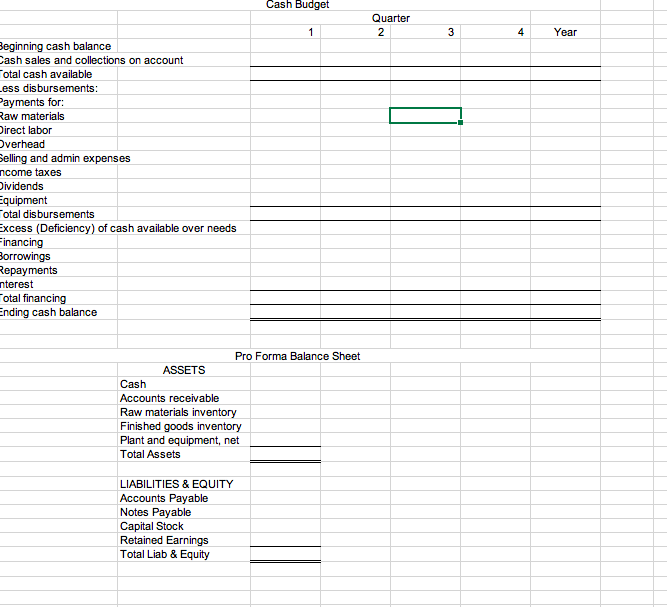

Fixed overhead totals $576,400 for each of the first three quarters. Of this total, $175,000 represents depreciation. During the fourth quarter, the depreciation and total fixed overhead increases by $18,750. All fixed expenses other than depreciation are paid for in cash in the quarter incurred. The fixed overhead rate is computed by dividing the year's total fixed overhead by the year's expected actual units produced h. Variable overhead is budgeted at $4.50 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred 1. Fixed selling and administrative expenses total $230,000 per quarter, including $50,000 depreciation j. Variable selling and administrative expenses are budgeted at S4 per unit sold. All selling and administrative expenses are paid for in the quarter incurred. k. The balance sheet as of December 31, 2018, is as follows: ASSETS LIABILITIES and STOCKHOLDERS'EQUITY Accounts Payable $ 680,000 Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Plant and equipment, net Total Assets $ 52,000 1,275,000 124,800 656,500 9,360,000 S11468.300 Capital Stock Retained Earnings Total Liab. & Equity 9,750,000 1,038,300 S11468.3.00 1. Quaint has a required cash balance of $50,000. An operating line of credit is available up to $250,000 at 10% interest. All borrowings and payments must be made in increments of $10,000 and interest is paid when principal is paid. All borrowings take place at the beginning of the quarter and all payments take place at the end of the quarter. m. Quaint will pay quarterly dividends of $45,000. At the end of the third quarter, $575,000 of equipment will be purchased and at the end of the fourth quarter, $175,000 of equipment will be purchased. n. The income tax rate is 30%. Required Prepare a master budget for Quaint Stem Company for each quarter of 2019 and for the year in total. The following component budgets must be included: a Sales budget b. Production budget c. Direct materials purchases budget d. Direct labor budget e. Overhead budget f Ending finished goods inventory budget . Cost of goods sold budget h. Selling and administrative expenses budget i. Cash budget j. Pro forma income statement k. Pro forma balance sheet 4 81,500 DIFLUL LIDUI Duugel Quarter 3 68,500 71,500 78,500 1.5 1.5 1.5 102,750 107,250 117,750 24.00 24.00 24.00 2,466,000 2,574,000 2,826,000 Units to be produced Direct labor time per unit in hours Total hours needed Average wage per hour Total direct labor cost 1.5 Year 300,000 1.5 450,000 24.00 10,800,000 2.46824.00 122,250 24.00 2,934,000 Budgeted direct labor hours Variable overhead rate Budgeted variable overhead Budgeted fixed overhead Total overhead Overhead Budget Quarter 3 102,750 107,250 117,750 4.50 4.50 4.50 462,375 482,625 529,875 576,400 576,400 576,400 1,038,775 1,059,025 1,106,275 4 122,250 4.50 550,125 5 95, 150 1,145,275 Year 450,000 4.50 2,025,000 2,324,350 4,349,350 Note: depreciation in fixed overhead Unit product cost for ending inventory budget: Direct materials Direct labor Variable overhead Fixed overhead Total unit cost Total finished goods units for end of year Total ending finished goods inventory 12.00 24.00 4.50 7.75 48.25 17,000 820,250 Cost of Goods Sold Budget Quarter 1 2 3 4 Year Direct materials used Direct labor used Overhead Budgeted manufacturing costs Budgeted manufacturing costs Beginning finished goods Cost of goods available for sale Less: Ending finished goods Budgeted cost of goods sold Selling and Administrative Budget Quarter Year Planned sales in units Jariable selling and admin exp per unit Total variable expense Fixed selling and admin expense Total selling and admin expenses Note: depreciation in fixed selling and admin expense Proforma Income Statement Year Sales Less: Cost of goods sold Gross margin Less: Seling and admin expenses Operating income Less: Interest expense ncome before income taxes Less: Income taxes Vet income End of operating budget FINANCIAL BUDGET Cash Collections Quarter 12 Cash Sales Received on account from: Quarter 4. prior year Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total cash receipts Cash Payments 1 Quarter 2 Quarter 4, prior year Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total cash needed Cash Budget Quarter 3 4 Year Beginning cash balance Cash sales and collections on account Total cash available Less disbursements: Payments for: Raw materials Direct labor Overhead Selling and admin expenses ncome taxes Dividends Equipment Total disbursements Excess (Deficiency) of cash available over needs Financing Borrowings Repayments nterest Total financing Ending cash balance Pro Forma Balance Sheet ASSETS Cash Accounts receivable Raw materials inventory Finished goods inventory Plant and equipment, net Total Assets LIABILITIES & EQUITY Accounts Payable Notes Payable Capital Stock Retained Earnings Total Liab & Equity Fixed overhead totals $576,400 for each of the first three quarters. Of this total, $175,000 represents depreciation. During the fourth quarter, the depreciation and total fixed overhead increases by $18,750. All fixed expenses other than depreciation are paid for in cash in the quarter incurred. The fixed overhead rate is computed by dividing the year's total fixed overhead by the year's expected actual units produced h. Variable overhead is budgeted at $4.50 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred 1. Fixed selling and administrative expenses total $230,000 per quarter, including $50,000 depreciation j. Variable selling and administrative expenses are budgeted at S4 per unit sold. All selling and administrative expenses are paid for in the quarter incurred. k. The balance sheet as of December 31, 2018, is as follows: ASSETS LIABILITIES and STOCKHOLDERS'EQUITY Accounts Payable $ 680,000 Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Plant and equipment, net Total Assets $ 52,000 1,275,000 124,800 656,500 9,360,000 S11468.300 Capital Stock Retained Earnings Total Liab. & Equity 9,750,000 1,038,300 S11468.3.00 1. Quaint has a required cash balance of $50,000. An operating line of credit is available up to $250,000 at 10% interest. All borrowings and payments must be made in increments of $10,000 and interest is paid when principal is paid. All borrowings take place at the beginning of the quarter and all payments take place at the end of the quarter. m. Quaint will pay quarterly dividends of $45,000. At the end of the third quarter, $575,000 of equipment will be purchased and at the end of the fourth quarter, $175,000 of equipment will be purchased. n. The income tax rate is 30%. Required Prepare a master budget for Quaint Stem Company for each quarter of 2019 and for the year in total. The following component budgets must be included: a Sales budget b. Production budget c. Direct materials purchases budget d. Direct labor budget e. Overhead budget f Ending finished goods inventory budget . Cost of goods sold budget h. Selling and administrative expenses budget i. Cash budget j. Pro forma income statement k. Pro forma balance sheet 4 81,500 DIFLUL LIDUI Duugel Quarter 3 68,500 71,500 78,500 1.5 1.5 1.5 102,750 107,250 117,750 24.00 24.00 24.00 2,466,000 2,574,000 2,826,000 Units to be produced Direct labor time per unit in hours Total hours needed Average wage per hour Total direct labor cost 1.5 Year 300,000 1.5 450,000 24.00 10,800,000 2.46824.00 122,250 24.00 2,934,000 Budgeted direct labor hours Variable overhead rate Budgeted variable overhead Budgeted fixed overhead Total overhead Overhead Budget Quarter 3 102,750 107,250 117,750 4.50 4.50 4.50 462,375 482,625 529,875 576,400 576,400 576,400 1,038,775 1,059,025 1,106,275 4 122,250 4.50 550,125 5 95, 150 1,145,275 Year 450,000 4.50 2,025,000 2,324,350 4,349,350 Note: depreciation in fixed overhead Unit product cost for ending inventory budget: Direct materials Direct labor Variable overhead Fixed overhead Total unit cost Total finished goods units for end of year Total ending finished goods inventory 12.00 24.00 4.50 7.75 48.25 17,000 820,250 Cost of Goods Sold Budget Quarter 1 2 3 4 Year Direct materials used Direct labor used Overhead Budgeted manufacturing costs Budgeted manufacturing costs Beginning finished goods Cost of goods available for sale Less: Ending finished goods Budgeted cost of goods sold Selling and Administrative Budget Quarter Year Planned sales in units Jariable selling and admin exp per unit Total variable expense Fixed selling and admin expense Total selling and admin expenses Note: depreciation in fixed selling and admin expense Proforma Income Statement Year Sales Less: Cost of goods sold Gross margin Less: Seling and admin expenses Operating income Less: Interest expense ncome before income taxes Less: Income taxes Vet income End of operating budget FINANCIAL BUDGET Cash Collections Quarter 12 Cash Sales Received on account from: Quarter 4. prior year Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total cash receipts Cash Payments 1 Quarter 2 Quarter 4, prior year Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total cash needed Cash Budget Quarter 3 4 Year Beginning cash balance Cash sales and collections on account Total cash available Less disbursements: Payments for: Raw materials Direct labor Overhead Selling and admin expenses ncome taxes Dividends Equipment Total disbursements Excess (Deficiency) of cash available over needs Financing Borrowings Repayments nterest Total financing Ending cash balance Pro Forma Balance Sheet ASSETS Cash Accounts receivable Raw materials inventory Finished goods inventory Plant and equipment, net Total Assets LIABILITIES & EQUITY Accounts Payable Notes Payable Capital Stock Retained Earnings Total Liab & Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts