Question: ONLY NEED PART B A rancher must choose between two possible investments that both require an initial outlay of $270,000 and will have no salvage

ONLY NEED PART B

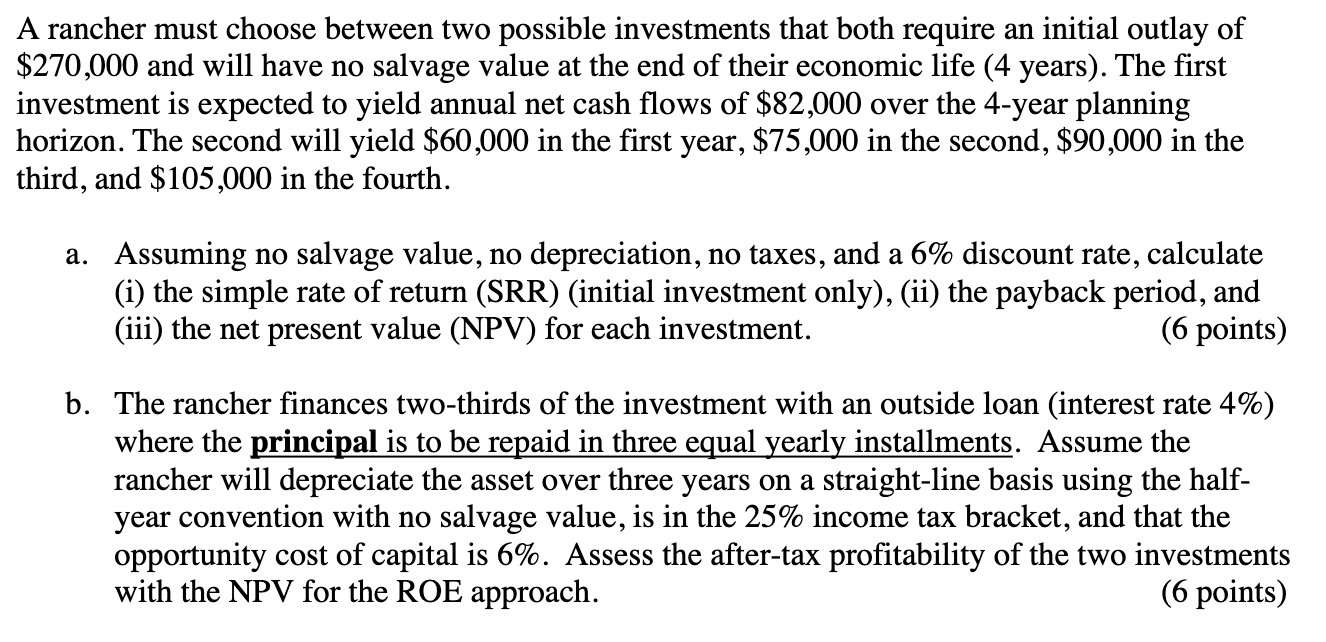

A rancher must choose between two possible investments that both require an initial outlay of $270,000 and will have no salvage value at the end of their economic life (4 years). The first investment is expected to yield annual net cash flows of $82,000 over the 4-year planning horizon. The second will yield $60,000 in the first year, $75,000 in the second, $90,000 in the third, and $105,000 in the fourth. a. Assuming no salvage value, no depreciation, no taxes, and a 6% discount rate, calculate (i) the simple rate of return (SRR) (initial investment only), (ii) the payback period, and (iii) the net present value (NPV) for each investment. (6 points) b. The rancher finances two-thirds of the investment with an outside loan (interest rate 4%) where the principal is to be repaid in three equal yearly installments. Assume the rancher will depreciate the asset over three years on a straight-line basis using the half- year convention with no salvage value, is in the 25% income tax bracket, and that the opportunity cost of capital is 6%. Assess the after-tax profitability of the two investments with the NPV for the ROE approach. (6 points) A rancher must choose between two possible investments that both require an initial outlay of $270,000 and will have no salvage value at the end of their economic life (4 years). The first investment is expected to yield annual net cash flows of $82,000 over the 4-year planning horizon. The second will yield $60,000 in the first year, $75,000 in the second, $90,000 in the third, and $105,000 in the fourth. a. Assuming no salvage value, no depreciation, no taxes, and a 6% discount rate, calculate (i) the simple rate of return (SRR) (initial investment only), (ii) the payback period, and (iii) the net present value (NPV) for each investment. (6 points) b. The rancher finances two-thirds of the investment with an outside loan (interest rate 4%) where the principal is to be repaid in three equal yearly installments. Assume the rancher will depreciate the asset over three years on a straight-line basis using the half- year convention with no salvage value, is in the 25% income tax bracket, and that the opportunity cost of capital is 6%. Assess the after-tax profitability of the two investments with the NPV for the ROE approach. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts