Question: Only need part b. Part a is included for reference. Required information Exercise 16-24 (Static) Present value analysis-cost of capital LO 166 [The following information

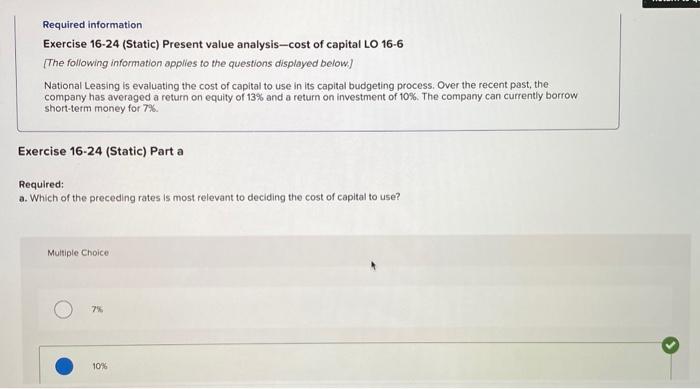

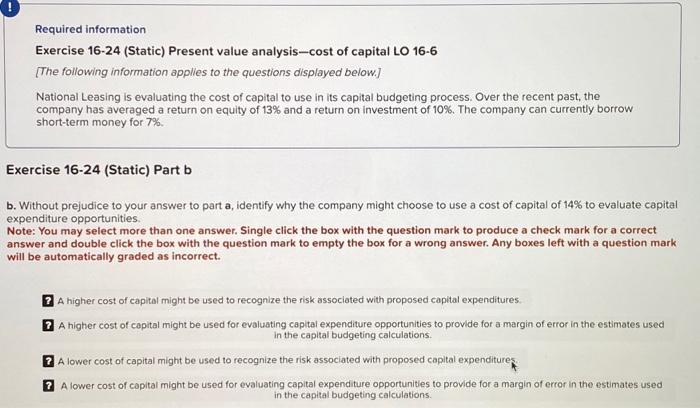

Required information Exercise 16-24 (Static) Present value analysis-cost of capital LO 166 [The following information applies to the questions displayed below.] National Leasing is evaluating the cost of capital to use in its capital budgeting process. Over the recent past, the company has averaged a return on equity of 13% and a return on investment of 10%. The company can currently borrow short-term money for 7%. Exercise 16-24 (Static) Part a Required: a. Which of the preceding rates is most relevant to deciding the cost of capital to use? Multiple Choice 7% 10% Required information Exercise 16-24 (Static) Present value analysis-cost of capital LO 16.6 [The following information applles to the questions displayed below.] National Leasing is evaluating the cost of capital to use in its capital budgeting process. Over the recent past, the company has averaged a return on equity of 13% and a return on investment of 10%. The company can currently borrow short-term money for 7%. Exercise 16-24 (Static) Part b b. Without prejudice to your answer to part a, identify why the company might choose to use a cost of capital of 14% to evaluate capital expenditure opportunities. Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. A higher cost of capital might be used to recognize the risk associated with proposed capital expenditures. A higher cost of copital might be used for evaluating capital expenditure opportunities to provide for a margin of error in the estimates used in the capital budgeting calculations. A lower cost of capital might be used to recognize the risk associated with proposed copital expenditures. A lower cost of copital might be used for evaluating capital expenditure opportunities to provide for a margin of error in the estimates used in the capital budgeting calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts