Question: only need req 5A-Req 6 Required: Answer eoch question independently based on the original dots 1. What is the product's CM tatio? 2 Use the

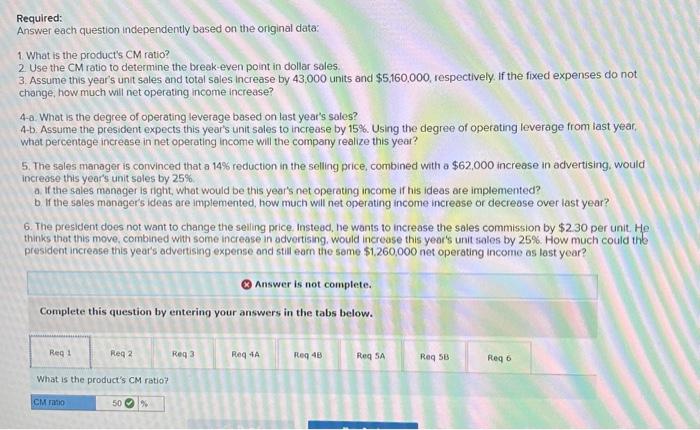

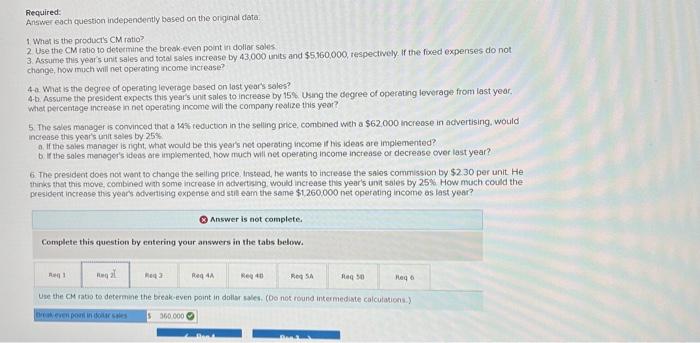

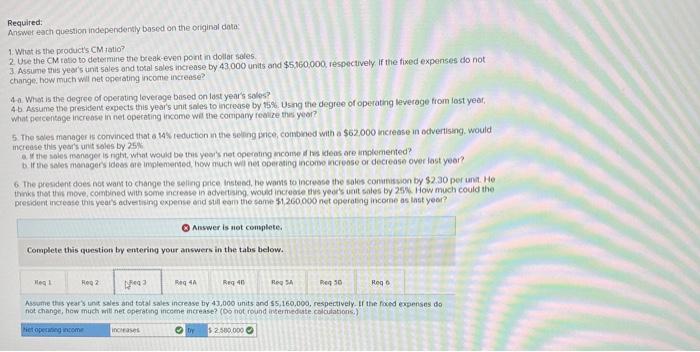

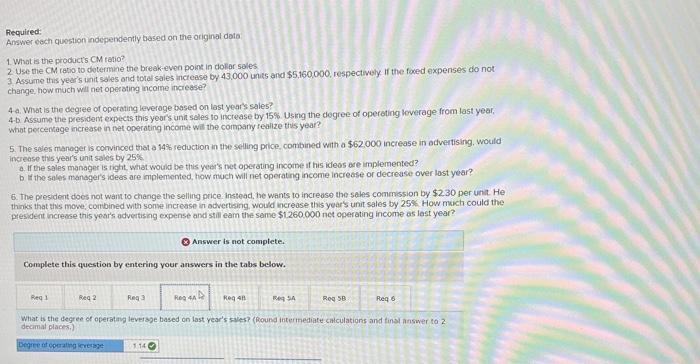

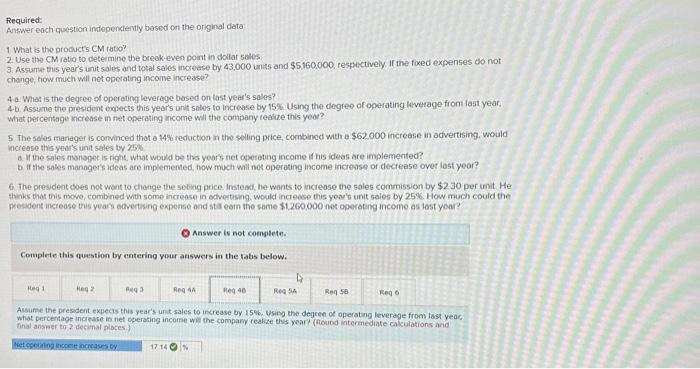

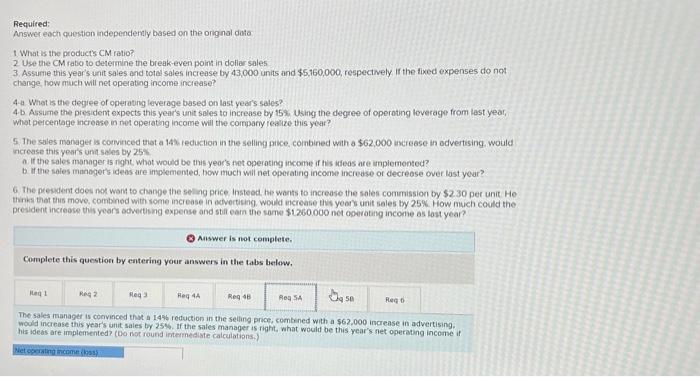

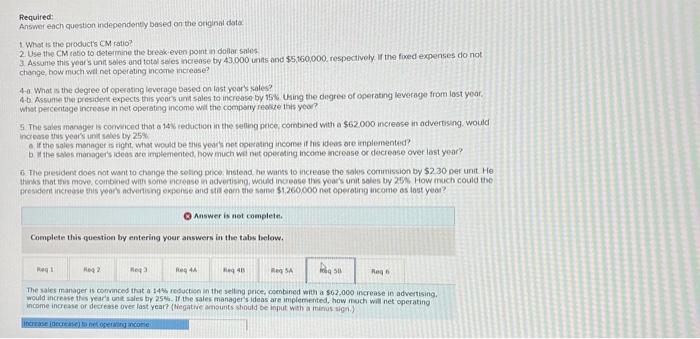

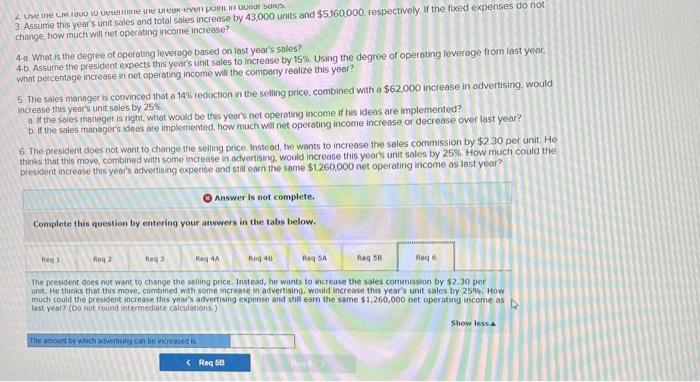

Required: Answer eoch question independently based on the original dots 1. What is the product's CM tatio? 2 Use the CM ratio to dotermine the break-even point in dolar soles 3 Assume this year's unit soles and totar sales increase by 43,000 units and $5,160,000, respectwely if the foxed expenses do not change, how much will net operating income increase? 4a. What is the degree of operating leveroge based on last year's sales? 4. b. Assume the president expects this years unin seles to increase by 15%. Using the degree of operating loverage from last year. what percersage increase in net operating income wis the compary fealize this year? 5. The seles manager is convinced that a 14% seduction in the selling pilce, combined with a $62,000 increase in odvertising, would increase this year's unit sales by 25%. a. If the sales manager is ingtit, what woukd be this year's net operating income if his ideos are implemented? b th the sales manoger's ideas are implemented, how much wil net operating income increase or decrease over last year? 6. The presdent does not want to change the selling price instead, the wants to increase the sales commission by $230 per unat He think that this move, combined with some increase in odvertising, would kcrease this year's unit sales by 25%. How mikh could the piesident increase this year's advertising expense and stili eam the same $1260,000 net operating income as last year? 8 Answer is not complete. Complete this question by entering your answers in the tabs below. What is the degree of operating levesbe based on last vear's sales? (Round intermediate calculations and finsl answer to 2 decimal places.) 3. Assume this year's unit sales and total sales increose by 43,000 units and $5,160,000, respectively if the foxed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4. . Assume the president expects this year's unit sales to increase by 15%. Using the degree of operating leverage from last year. what percentage increase in net operating income will the company realize this year? 5 The sales manager is convinced that a 14% reduction in the selling price, combined with a $62,000 increase in advertising. would increase this year's unit sales by 25% a. If the soles managet is right, what would be this year's net operoting income if his ideas are implemented? b. If the sales manager's ideas are implentented, how much wil net operating income increase or decrease over last year? 6 . The president does not want to change the selling price. Instead, he wants to increase the sales commission by $230 per unit. He thinks that this move, combined with some increase in advertising. would increase this year's unit sales by 25%. How much could the president increase this year's advertising expense ond still earn the same $1,260,000 net operating income as last year? 8 nnswer is not complete. Complete this question by entering your answers in the tabs below. The president does nor want to change the selling price. Instead, he wants to ncrease the sales commission by $2,30 per ueut He thinks that this move, combined whth same increase in advertising, would increase this year's unit sales by 25%. How much could the president inciease this year's advertising expense and stil earn the same $1,260,000 net operating income as last year? (co not round entermediate calcutations.) Required: Answer each question independently bosed on the original data 1 What is the prooucts CM rato? 2 Use the CM ratio to determine the break-even point in dollar soles 3. Assume this year's unit soles and total sales increase by 43,000 units and $5,160,000, respectively. If the foxed expenses do not change, how much will net operating income increase? 4. - What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 15% Using the degree of operating liverage from last year. What percentage increase in net operating income will the company realize this yoor? 5. The soles manager is convinced thot a 14% reduction in the solling price, combined wth a $62.000 increase in advertising. would inciease this years unit sales ty 25N a. If the sules monopot is right, what would bet the yoar's net operating income if his ideas are implemented? b if the soles manoger's ideas are implemented, how much will not operating income increase of dectease over last year? 6. The presudeat does not want to change the sebing price. Instead, he wants to inciease the sales commission by $230 per unit. He thinks that this move, combined with some increase in odvertishg. would increese this year's unit salen by 25%. How much could the president increase this years oovertising expense and sta earn the same $1,260,000 not oporateng income as test yoar? Complete this question by entering your answers in the tabs below. Alsume the president expects this year's unit sales to increase by 15\%6. Using the degren operating leverage from tast year, what percentage increase in net operating incorme wil the company reakize this year? (Roubd intermediate calculations and. final ansper to 2 decimal places.) Required: Answer each question independersly bosed on the original data: 1. Whist is the product's CM satio? 2. Use the CM rasio to determine the beak-even pont in dollar soles. 3. Assume this year's unit sales and toxal soles increase by 43,000 units and $5,160,000 respectively if the fixed expenses do not change, how much wil net operating income increese? 4- What is the degree of cperating loveroge based on last year's solvs? 4b. Assume the president expects this year's unit sales to increase by 75%. Usang the degree of operating leverage from last year, What percentage increase in net opecating income wis the compary fealize thes yoor? inciease this years unt soles by 25% b. If the seles menagers idess are implemented, how much wit net operating incomo nciease or deciease over fast year? 6. The prosdent does not wam to change the seling price insteet, he wams to increase the sales conariswion by $2.30 per unit. He president increase this year's advertising expense end suit earn the same $1,2600000 net operating incorne as tast year? OAnswer is not complete. Complete this question by entering your answers in the tabs below. Assume this years ind sales and total sales increase ty 43,000 units and $5,160,000, respectively - If the faced expenses do not change, how much will net operating income increase? (Oo not round intermedute calculations.) Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2 Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year's unit sales and total sales increase by 43,000 units and $5,160,000, respectively. If the fixed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 15%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year? 5. The sales manager is convinced that a 14% reduction in the selling price, combined with a $62,000 increase in advertising, would increase this year's unit sales by 25% a. If the sales manager is right, what would be this year's net operating income if his ideas are implemented? b If the sales manager's ideas are implemented, how much will net operating income increase or decrease over last year? 6. The president does not want to change the seling price. Instead, he wants to increase the sales commission by $230 per unit. He thinks that this move, combined with some increase in advortising, would increase this year's unit tiales by 25%. How much could the president increase this year's advertising expense and still earn the same $1,260,000 net operating income as last year? Q Answer is not complete. Complete this question by entering your answers in the tabs below. What is the product's CM ratio? Required: Answer eacti question independertly based on the onginal date. 1 What is the product's CM ratio? 2. Use the CM ratio to determine the broak-even pont in dollar soles. 3. Assume this year's unit sales and total sales increase by 43,000 units and $5,160,000, tespectively. If the foved expenses do not change, how much will net operating income inctease? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 15%. Using the chegree of operating leverage from last year. What percentage increase in net operating income wil the company realize this year? 5. The sales manager is comvinced that a 14: reducticon in the seling price. combined with a $62,000 increase in actvertising, would increase this yeor's unit sales by. 25% a. If the sales manager is right, whot would be this year's not operoting incorie if his ideas are implemented? b. If the sales monoger's ideas are implemented, now much will net operating income increase or decrease over last year? 6. The president does not want to change the seiling price. Insteod, he warnts to increase the saies commission by $2.30 per unit. He thinks that this move, combined with some increase in achertsing would increase this year's unit sales by 25% How much could the president increose this year's odvertising expense and stilleam the same $1,260.000 net operating income as last year? Q. Answer is not complete. Complete this question by entering your answers in the tabs below. Required: Answor each question independenty based on the originat data. 1. What is the pioducts CM ratio? 2 Use thiv CM rabio to tetermine the break-even point in dolar salos 3. Assaine this yoars unt soles and totel sales increase by 43.000 unis and $5,160,000, respectivehy if the fioved expenses do not change, how much wal net operaung income increase? 4-a. What is the degree of operating levorage based on last yoars sales? 4-b. Assume the presibens expects this yoar's uni sales to increase by is Us. Using the degreve of operating leverage from last your. what percentage increase in net operating income wit the compary revare this yed? increase thes years unitsebs ty 25% a If the soles manager is right, what would be this yours not ooveting incomen if his ideos ore implemented? b. If the saves manager's ideas are impiemeoted, how much wi nut opeceling incorne increase or decrease over last year? 6. The president does riat want to change the soling price. instend he wans to increase the saks corrunission by $230 gref unit He Q Answer is not completer. Complete this question by entering your answers in the tabs thelow. The sales manager is comvinced that a 14 b resuctice in the selling peice, combined vith a $62,000 increase in advertising. mould increme tivs year's cone sues by 25%. If the sales manager's ideas are implemented, how moch will net operating income incresse or decresse over last year? (thegatrie amsubts should be input wah a minus sion.) Required: Answer eoch question independently based on the original dots 1. What is the product's CM tatio? 2 Use the CM ratio to dotermine the break-even point in dolar soles 3 Assume this year's unit soles and totar sales increase by 43,000 units and $5,160,000, respectwely if the foxed expenses do not change, how much will net operating income increase? 4a. What is the degree of operating leveroge based on last year's sales? 4. b. Assume the president expects this years unin seles to increase by 15%. Using the degree of operating loverage from last year. what percersage increase in net operating income wis the compary fealize this year? 5. The seles manager is convinced that a 14% seduction in the selling pilce, combined with a $62,000 increase in odvertising, would increase this year's unit sales by 25%. a. If the sales manager is ingtit, what woukd be this year's net operating income if his ideos are implemented? b th the sales manoger's ideas are implemented, how much wil net operating income increase or decrease over last year? 6. The presdent does not want to change the selling price instead, the wants to increase the sales commission by $230 per unat He think that this move, combined with some increase in odvertising, would kcrease this year's unit sales by 25%. How mikh could the piesident increase this year's advertising expense and stili eam the same $1260,000 net operating income as last year? 8 Answer is not complete. Complete this question by entering your answers in the tabs below. What is the degree of operating levesbe based on last vear's sales? (Round intermediate calculations and finsl answer to 2 decimal places.) 3. Assume this year's unit sales and total sales increose by 43,000 units and $5,160,000, respectively if the foxed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4. . Assume the president expects this year's unit sales to increase by 15%. Using the degree of operating leverage from last year. what percentage increase in net operating income will the company realize this year? 5 The sales manager is convinced that a 14% reduction in the selling price, combined with a $62,000 increase in advertising. would increase this year's unit sales by 25% a. If the soles managet is right, what would be this year's net operoting income if his ideas are implemented? b. If the sales manager's ideas are implentented, how much wil net operating income increase or decrease over last year? 6 . The president does not want to change the selling price. Instead, he wants to increase the sales commission by $230 per unit. He thinks that this move, combined with some increase in advertising. would increase this year's unit sales by 25%. How much could the president increase this year's advertising expense ond still earn the same $1,260,000 net operating income as last year? 8 nnswer is not complete. Complete this question by entering your answers in the tabs below. The president does nor want to change the selling price. Instead, he wants to ncrease the sales commission by $2,30 per ueut He thinks that this move, combined whth same increase in advertising, would increase this year's unit sales by 25%. How much could the president inciease this year's advertising expense and stil earn the same $1,260,000 net operating income as last year? (co not round entermediate calcutations.) Required: Answer each question independently bosed on the original data 1 What is the prooucts CM rato? 2 Use the CM ratio to determine the break-even point in dollar soles 3. Assume this year's unit soles and total sales increase by 43,000 units and $5,160,000, respectively. If the foxed expenses do not change, how much will net operating income increase? 4. - What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 15% Using the degree of operating liverage from last year. What percentage increase in net operating income will the company realize this yoor? 5. The soles manager is convinced thot a 14% reduction in the solling price, combined wth a $62.000 increase in advertising. would inciease this years unit sales ty 25N a. If the sules monopot is right, what would bet the yoar's net operating income if his ideas are implemented? b if the soles manoger's ideas are implemented, how much will not operating income increase of dectease over last year? 6. The presudeat does not want to change the sebing price. Instead, he wants to inciease the sales commission by $230 per unit. He thinks that this move, combined with some increase in odvertishg. would increese this year's unit salen by 25%. How much could the president increase this years oovertising expense and sta earn the same $1,260,000 not oporateng income as test yoar? Complete this question by entering your answers in the tabs below. Alsume the president expects this year's unit sales to increase by 15\%6. Using the degren operating leverage from tast year, what percentage increase in net operating incorme wil the company reakize this year? (Roubd intermediate calculations and. final ansper to 2 decimal places.) Required: Answer each question independersly bosed on the original data: 1. Whist is the product's CM satio? 2. Use the CM rasio to determine the beak-even pont in dollar soles. 3. Assume this year's unit sales and toxal soles increase by 43,000 units and $5,160,000 respectively if the fixed expenses do not change, how much wil net operating income increese? 4- What is the degree of cperating loveroge based on last year's solvs? 4b. Assume the president expects this year's unit sales to increase by 75%. Usang the degree of operating leverage from last year, What percentage increase in net opecating income wis the compary fealize thes yoor? inciease this years unt soles by 25% b. If the seles menagers idess are implemented, how much wit net operating incomo nciease or deciease over fast year? 6. The prosdent does not wam to change the seling price insteet, he wams to increase the sales conariswion by $2.30 per unit. He president increase this year's advertising expense end suit earn the same $1,2600000 net operating incorne as tast year? OAnswer is not complete. Complete this question by entering your answers in the tabs below. Assume this years ind sales and total sales increase ty 43,000 units and $5,160,000, respectively - If the faced expenses do not change, how much will net operating income increase? (Oo not round intermedute calculations.) Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2 Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year's unit sales and total sales increase by 43,000 units and $5,160,000, respectively. If the fixed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 15%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year? 5. The sales manager is convinced that a 14% reduction in the selling price, combined with a $62,000 increase in advertising, would increase this year's unit sales by 25% a. If the sales manager is right, what would be this year's net operating income if his ideas are implemented? b If the sales manager's ideas are implemented, how much will net operating income increase or decrease over last year? 6. The president does not want to change the seling price. Instead, he wants to increase the sales commission by $230 per unit. He thinks that this move, combined with some increase in advortising, would increase this year's unit tiales by 25%. How much could the president increase this year's advertising expense and still earn the same $1,260,000 net operating income as last year? Q Answer is not complete. Complete this question by entering your answers in the tabs below. What is the product's CM ratio? Required: Answer eacti question independertly based on the onginal date. 1 What is the product's CM ratio? 2. Use the CM ratio to determine the broak-even pont in dollar soles. 3. Assume this year's unit sales and total sales increase by 43,000 units and $5,160,000, tespectively. If the foved expenses do not change, how much will net operating income inctease? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 15%. Using the chegree of operating leverage from last year. What percentage increase in net operating income wil the company realize this year? 5. The sales manager is comvinced that a 14: reducticon in the seling price. combined with a $62,000 increase in actvertising, would increase this yeor's unit sales by. 25% a. If the sales manager is right, whot would be this year's not operoting incorie if his ideas are implemented? b. If the sales monoger's ideas are implemented, now much will net operating income increase or decrease over last year? 6. The president does not want to change the seiling price. Insteod, he warnts to increase the saies commission by $2.30 per unit. He thinks that this move, combined with some increase in achertsing would increase this year's unit sales by 25% How much could the president increose this year's odvertising expense and stilleam the same $1,260.000 net operating income as last year? Q. Answer is not complete. Complete this question by entering your answers in the tabs below. Required: Answor each question independenty based on the originat data. 1. What is the pioducts CM ratio? 2 Use thiv CM rabio to tetermine the break-even point in dolar salos 3. Assaine this yoars unt soles and totel sales increase by 43.000 unis and $5,160,000, respectivehy if the fioved expenses do not change, how much wal net operaung income increase? 4-a. What is the degree of operating levorage based on last yoars sales? 4-b. Assume the presibens expects this yoar's uni sales to increase by is Us. Using the degreve of operating leverage from last your. what percentage increase in net operating income wit the compary revare this yed? increase thes years unitsebs ty 25% a If the soles manager is right, what would be this yours not ooveting incomen if his ideos ore implemented? b. If the saves manager's ideas are impiemeoted, how much wi nut opeceling incorne increase or decrease over last year? 6. The president does riat want to change the soling price. instend he wans to increase the saks corrunission by $230 gref unit He Q Answer is not completer. Complete this question by entering your answers in the tabs thelow. The sales manager is comvinced that a 14 b resuctice in the selling peice, combined vith a $62,000 increase in advertising. mould increme tivs year's cone sues by 25%. If the sales manager's ideas are implemented, how moch will net operating income incresse or decresse over last year? (thegatrie amsubts should be input wah a minus sion.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts