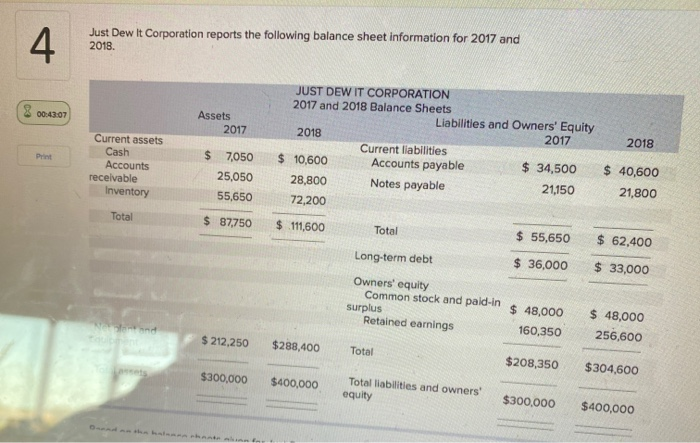

Question: ONLY NEED THE LAST 4 SECTIONS FOR AN UPVOTE Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. 8 00:43:07

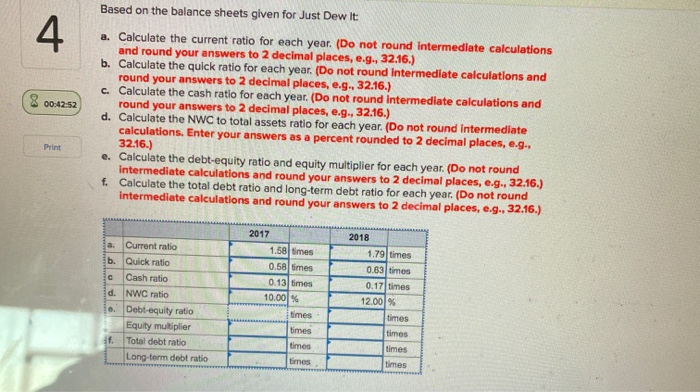

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. 8 00:43:07 Assets 2017 JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets Liabilities and Owners' Equity 2018 2017 Current liabilities $ 10,600 Accounts payable $ 34,500 28,800 Notes payable 21,150 72,200 Current assets Cash Accounts receivable Inventory 2018 $ 39,50 $ 7,050 25,050 55,650 $ 87,750 $ 40,600 21,800 Total $ 111,600 Total $ 62,400 Long-term debt $ 55,650 $ 36,000 $ 33,000 surplus Owners' equity Common stock and paid-in $ 48,000 Retained earnings 160,350 $ 48,000 256,600 $ 212,250 $288,400 Total $208,350 $304,600 $300,000 $400,000 Total liabilities and owners' equity $300.000 $400,000 Based on the balance sheets given for Just Dew it 8 00:42:52 a. Calculate the current ratio for each year. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the quick ratio for each year. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) C. Calculate the cash ratio for each year. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Calculate the NWC to total assets ratio for each year. (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g.. 32.16.) e. Calculate the debt-equity ratio and equity multiplier for each year. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Calculate the total debt ratio and long-term debt ratio for each year. (Do not round Intermediate calculations and round your answers to 2 decimal places, e... 32.16.) 1.79 times 2017 F 1.58 times 0.58 times 0.13 times 10.00% 0.17 times a. Current ratio b. Quick ratio C Cash ratio d. NWC ratio Debt-equity ratio Equity multiplier f. Total debt ratio Long-term debt ratio mes times timos

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts