Question: only need the second part B SECTION 5-18 Amortization 1. Suppose you borrowed $30,000 on a student loan at a rate of 8% and must

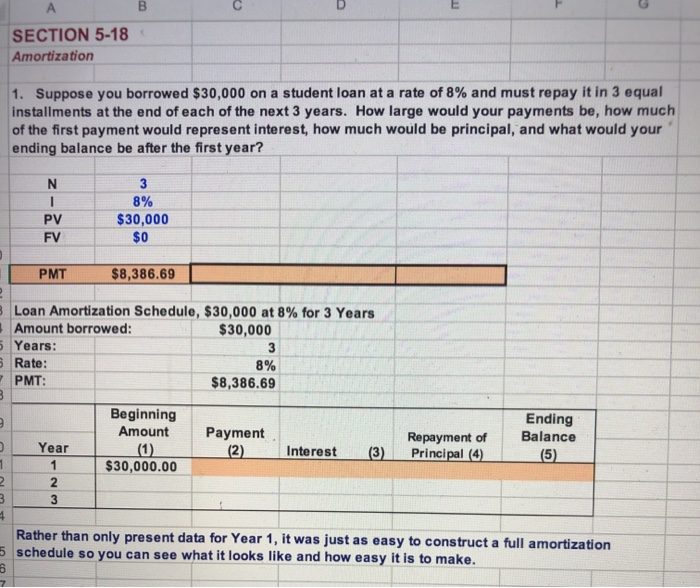

B SECTION 5-18 Amortization 1. Suppose you borrowed $30,000 on a student loan at a rate of 8% and must repay it in 3 equal installments at the end of each of the next 3 years. How large would your payments be, how much of the first payment would represent interest, how much would be principal, and what would your ending balance be after the first year? 8% $30,000 $0 FV PMT $8,386.69 3 Loan Amortization Schedule, $30,000 at 8% for 3 Years Amount borrowed: $30,000 5 Years: S Rate: 8% PMT: $8,386.69 Payment mm Omst Beginning Amount (1) $30,000.00 Ending Balance (5) (2) Interest Repayment of Principal (4) (3) Rather than only present data for Year 1, it was just as easy to construct a full amortization schedule so you can see what it looks like and how easy it is to make. ON

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts