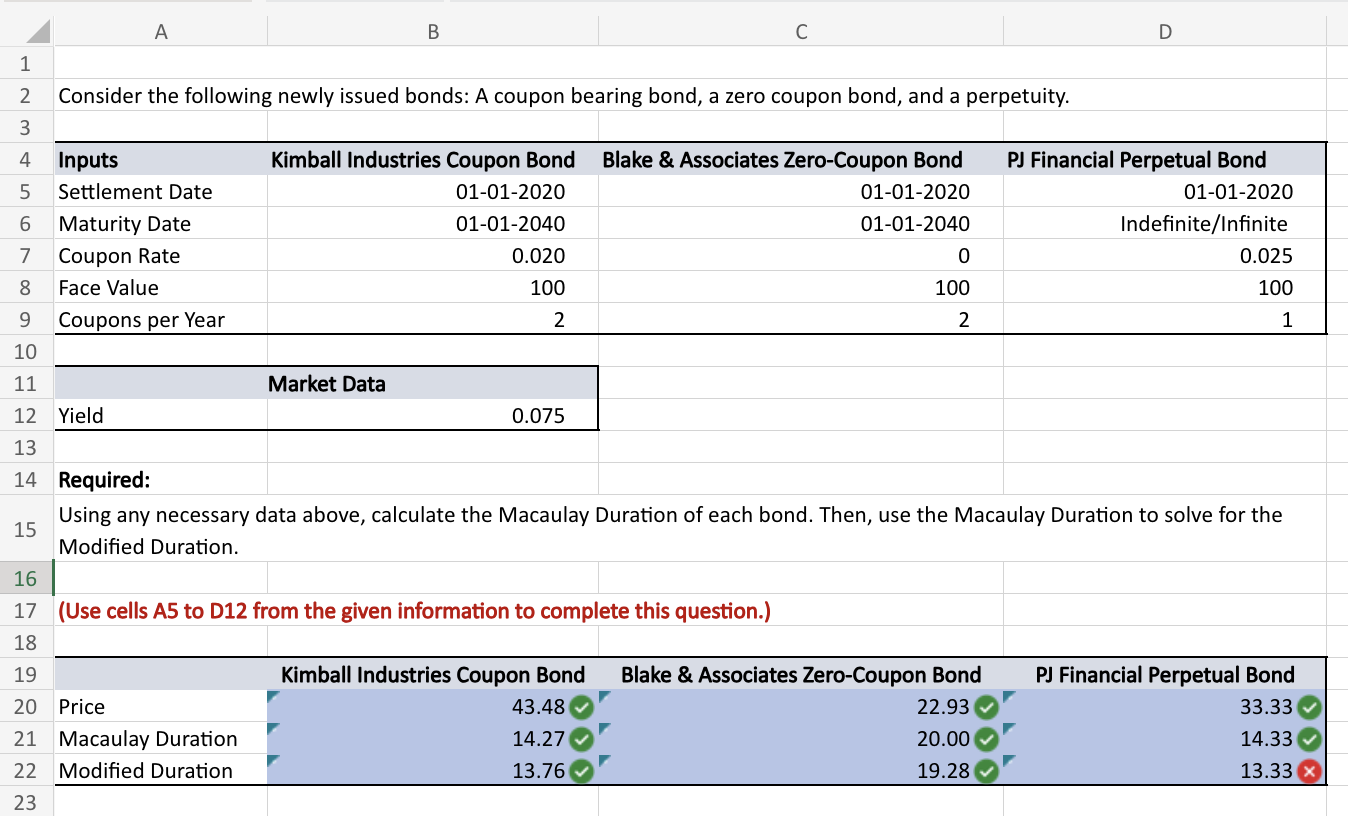

Question: ***ONLY NEED THE WRONG ANS (MODIFIED DURATION PJ FINANCIAL PERPETUAL BOND)*** A B C D Consider the following newly issued bonds: A coupon bearing bond,

***ONLY NEED THE WRONG ANS (MODIFIED DURATION PJ FINANCIAL PERPETUAL BOND)***

A B C D Consider the following newly issued bonds: A coupon bearing bond, a zero coupon bond, and a perpetuity. \begin{tabular}{l|r|r|r|} \hline Inputs & Kimball Industries Coupon Bond & Blake \& Associates Zero-Coupon Bond & PJ Financial Perpetual Bond \\ \hline Settlement Date & 01012020 & 01012020 & 01012020 \\ \hline Maturity Date & 01012040 & 01012040 & Indefinite/Infinite \\ \hline Coupon Rate & 0.020 & 0 & 0.025 \\ \hline Face Value & 100 & 100 & 100 \\ \hline Coupons per Year & 2 & 2 & 1 \\ \hline \end{tabular} 10 11 \begin{tabular}{lll} \hline \multicolumn{3}{c}{ Market Data } \\ Yield & 0.075 \\ \hline \end{tabular} 13 14 Required: Using any necessary data above, calculate the Macaulay Duration of each bond. Then, use the Macaulay Duration to solve for the Modified Duration. 16 17 (Use cells A5 to D12 from the given information to complete this question.) 18 19 20 Price 21 Macaulay Duration 22 Modified Duration Kimball Industries Coupon Bond Blake \& Associates Zero-Coupon Bond PJ Financial Perpetual Bond 43.48 14.27 22.93 33.33 23 13.76 20.00 14.33 19.28 13.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts