Question: only one project is acceptable and purchased. please ensure correct work! thank you Over-the-Top Canopies (OTC) is evaluating two independent investments. Project S costs $140,000

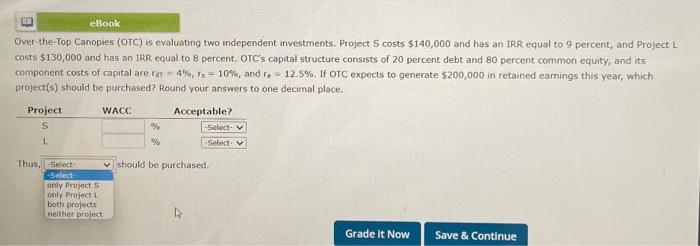

Over-the-Top Canopies (OTC) is evaluating two independent investments. Project S costs $140,000 and has an IRR equal to 9 percent, and Project 1 costs $130,000 and has an IRR equal to 8 percent. OTC's capital structure consists of 20 percent debt and 80 percent common equity, and its component costs of capital are r0t=4%,rs=10%, and re=12.5%. If orC expects to generate $200,000 in retained earnings this year, which project(s) should be purchased? Round your answers to one decimal place. Over-the-Top Canopies (OTC) is evaluating two independent investments. Project S costs $140,000 and has an IRR equal to 9 percent, and Project 1 costs $130,000 and has an IRR equal to 8 percent. OTC's capital structure consists of 20 percent debt and 80 percent common equity, and its component costs of capital are r0t=4%,rs=10%, and re=12.5%. If orC expects to generate $200,000 in retained earnings this year, which project(s) should be purchased? Round your answers to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts