Question: ONLY ONE QUESTION...Record the year end adjusting entry for the LIFO reserve assuming the balance at the beginning was 13000 Record the year-end adjusting entry

ONLY ONE QUESTION...Record the year end adjusting entry for the LIFO reserve assuming the balance at the beginning was 13000

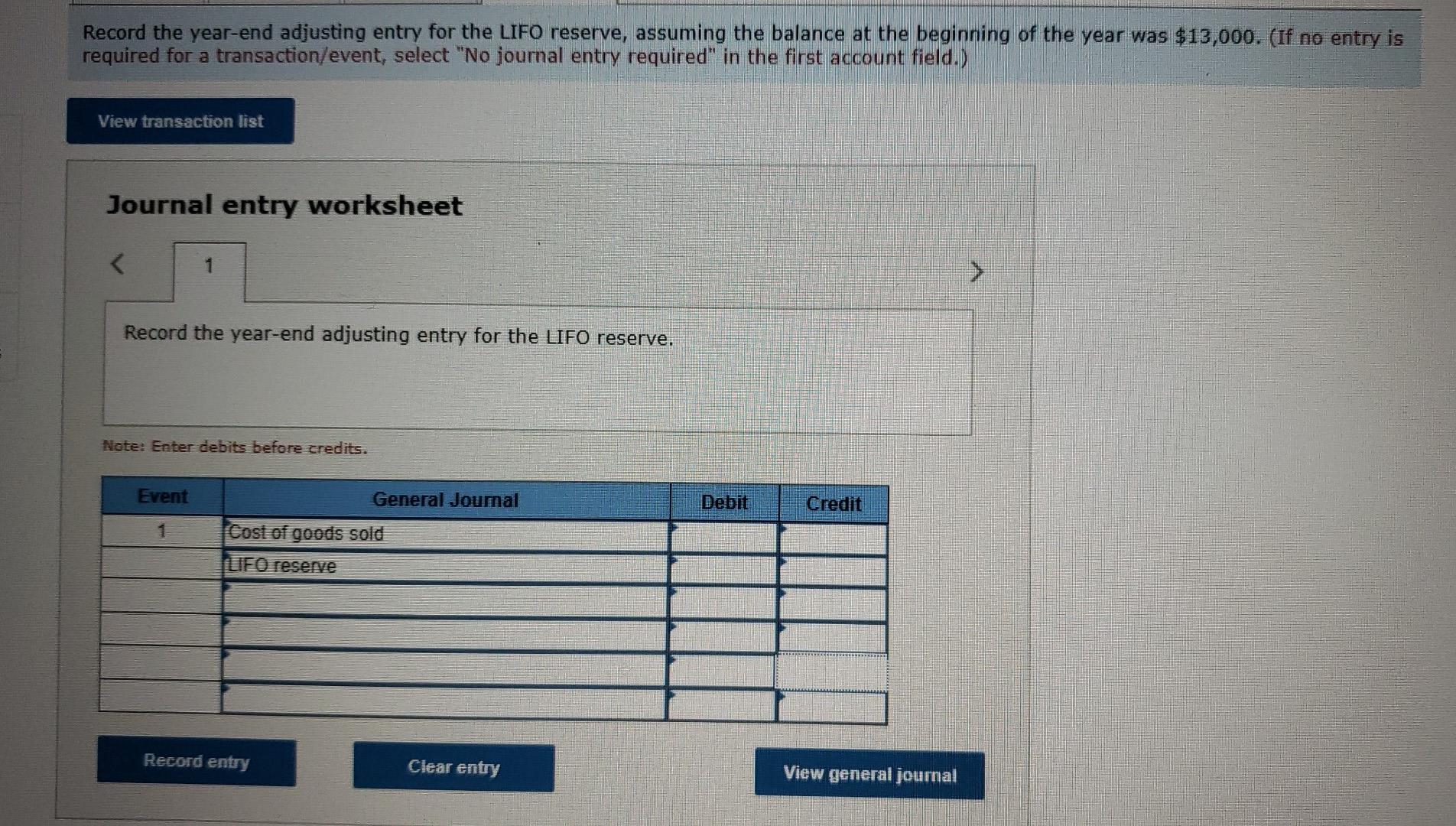

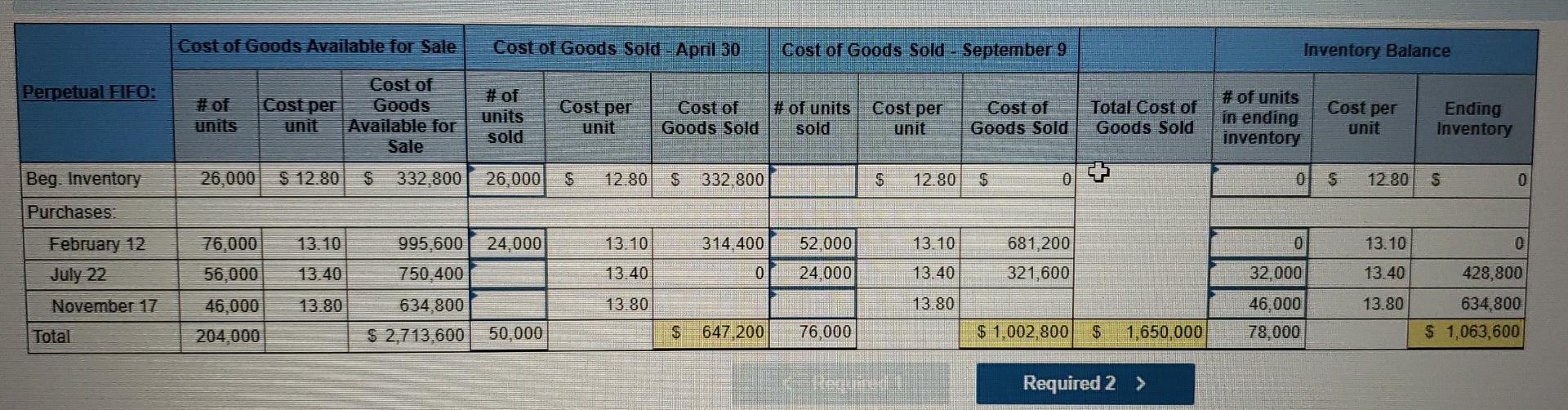

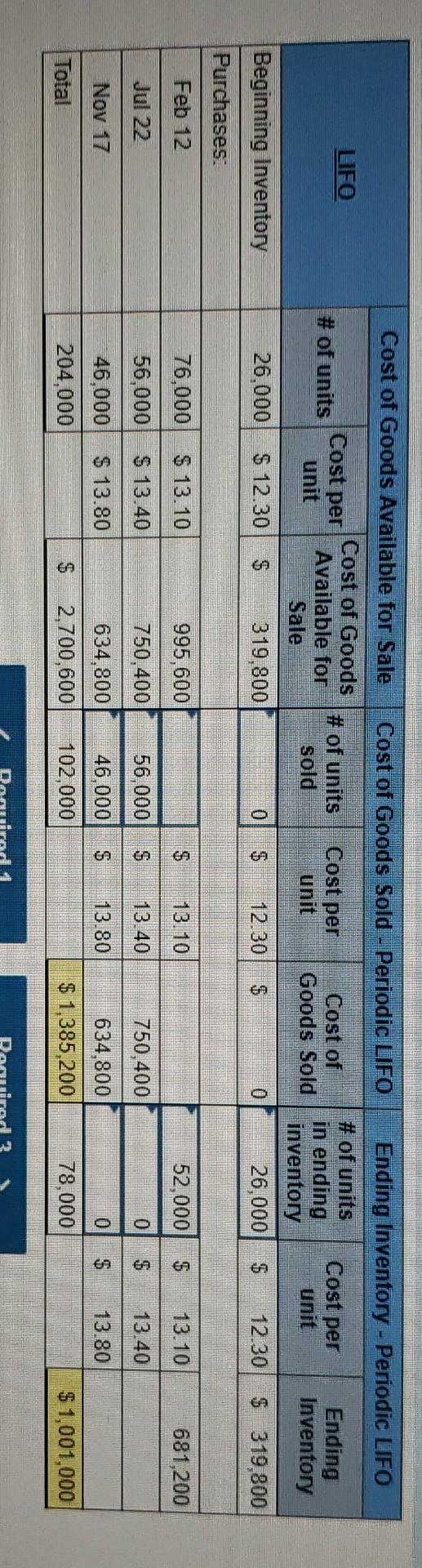

Record the year-end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the year was $13,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Cost of Goods Sold - Periodic LIFO LIFO Cost of Goods Available for Sale Cost of Goods # of units Available for unit Sale Cost per # of units sold Cost per unit Cost of Goods Sold Ending Inventory - Periodic LIFO # of units Cost per Ending in ending unit Inventory inventory 26,000 $ 12.30 $ 319,800 26,000 $ 12.30 319,800 0 $ 12.30 $ Beginning Inventory Purchases: Feb 12 995,600 $ 13.10 52,000 13.10 681,200 $ $ Jul 22 750,400 56,000 $ 13.40 0 13.40 76,000 $13.10 56,000 $13.40 46,000 $13.80 204,000 Nov 17 GA 13.80 0 750,400 634.800 $ 1,385,200 $ 634,800 2,700,600 13.80 46,000 102,000 Total $ 78,000 $ 1,001,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts