Question: ONLY PART 3 Proforma Income Statement Part 1 - Here, we simply want to work through a proforma income statement to determine the cash flows

ONLY PART 3

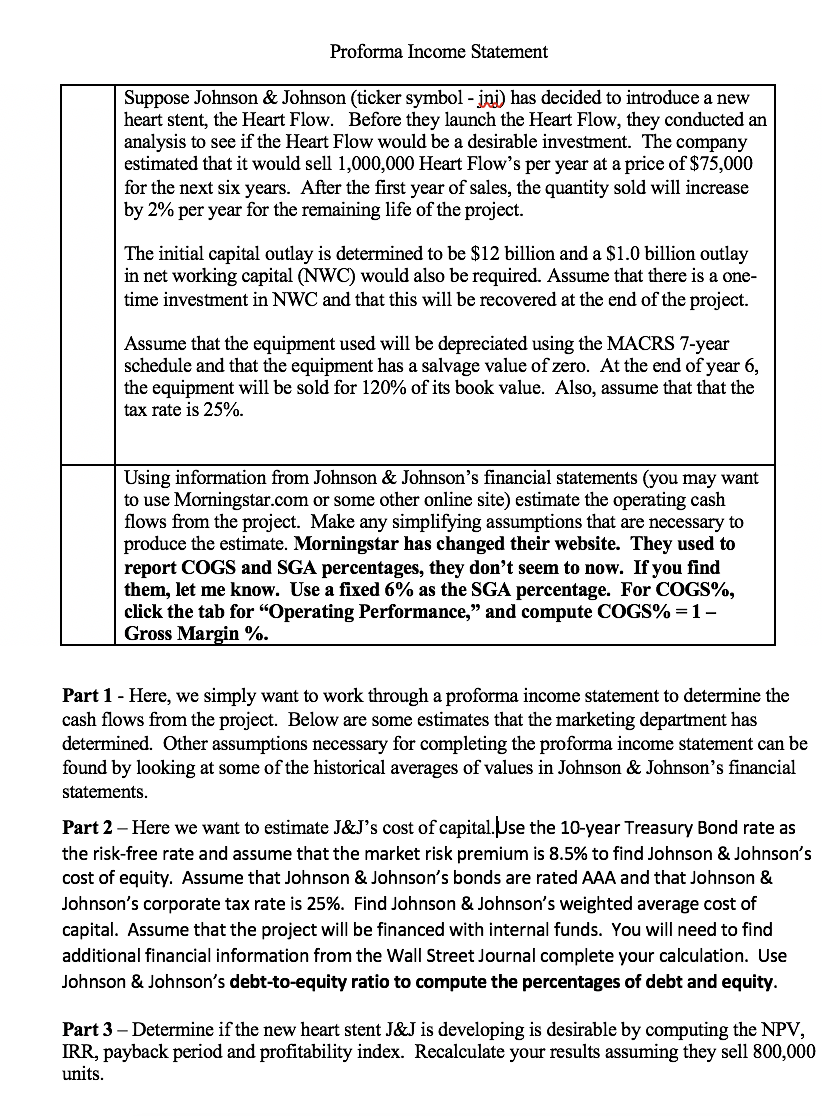

Proforma Income Statement Part 1 - Here, we simply want to work through a proforma income statement to determine the cash flows from the project. Below are some estimates that the marketing department has determined. Other assumptions necessary for completing the proforma income statement can be found by looking at some of the historical averages of values in Johnson \& Johnson's financial statements. Part 2 - Here we want to estimate J\&J's cost of capital.Jse the 10-year Treasury Bond rate as the risk-free rate and assume that the market risk premium is 8.5% to find Johnson \& Johnson's cost of equity. Assume that Johnson \& Johnson's bonds are rated AAA and that Johnson \& Johnson's corporate tax rate is 25%. Find Johnson \& Johnson's weighted average cost of capital. Assume that the project will be financed with internal funds. You will need to find additional financial information from the Wall Street Journal complete your calculation. Use Johnson \& Johnson's debt-to-equity ratio to compute the percentages of debt and equity. Part 3 - Determine if the new heart stent J\&J is developing is desirable by computing the NPV, IRR, payback period and profitability index. Recalculate your results assuming they sell 800,000 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts