Question: Only part B is needed Presented here are the financial statements of Marigold Company. Additional data: 1. Depreciation expense was $15,500. 2. Dividends declared and

Only part B is needed

Only part B is needed

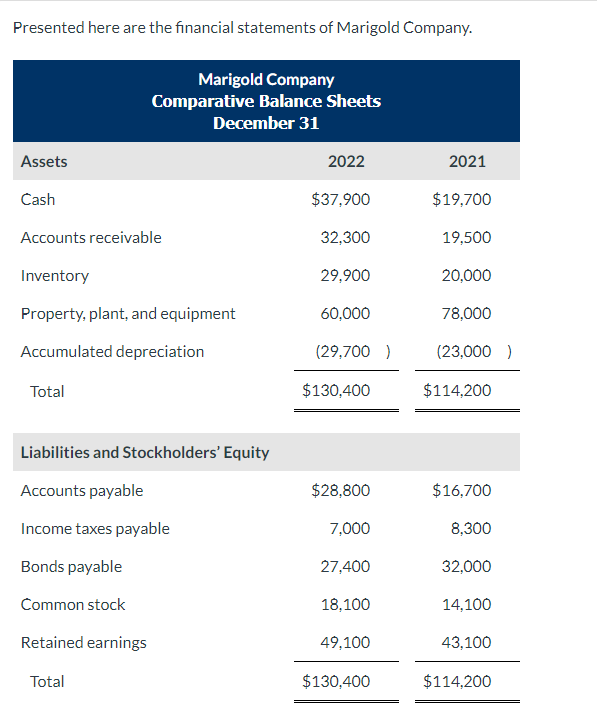

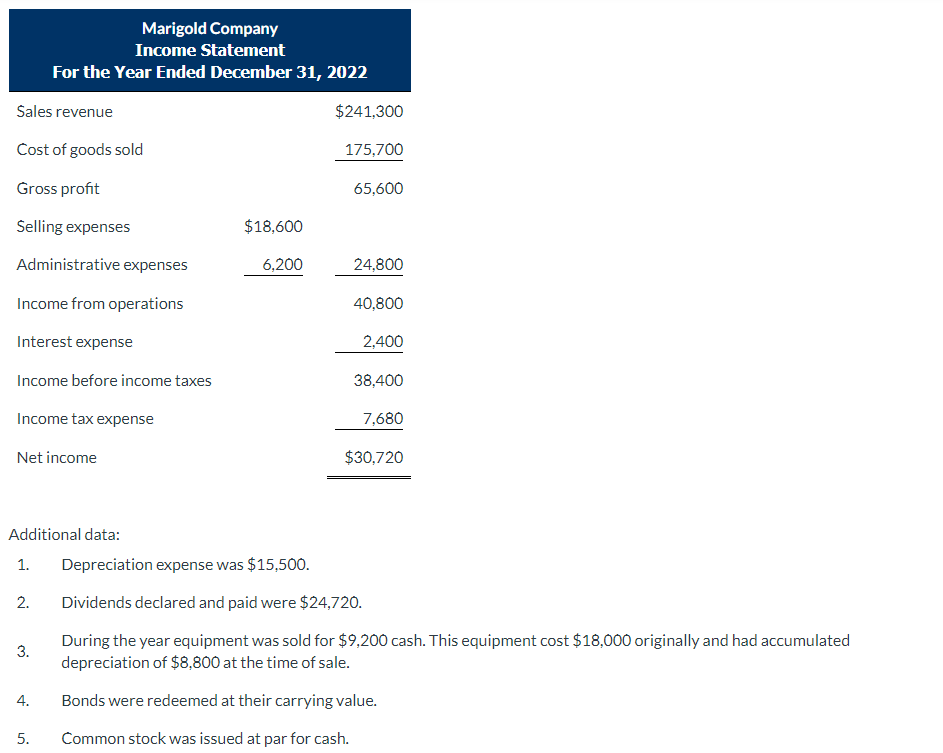

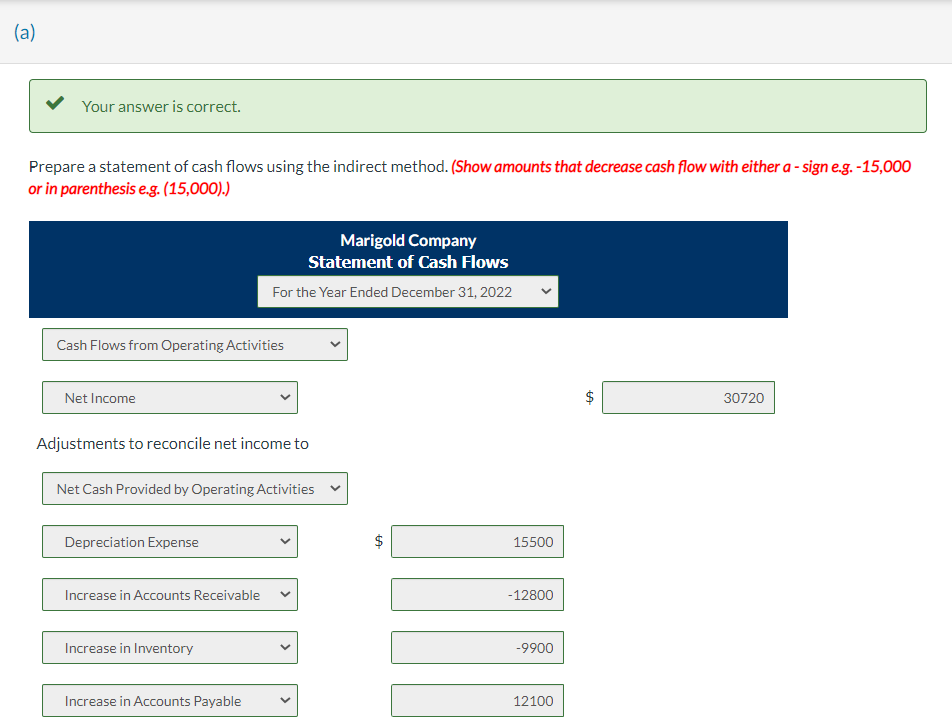

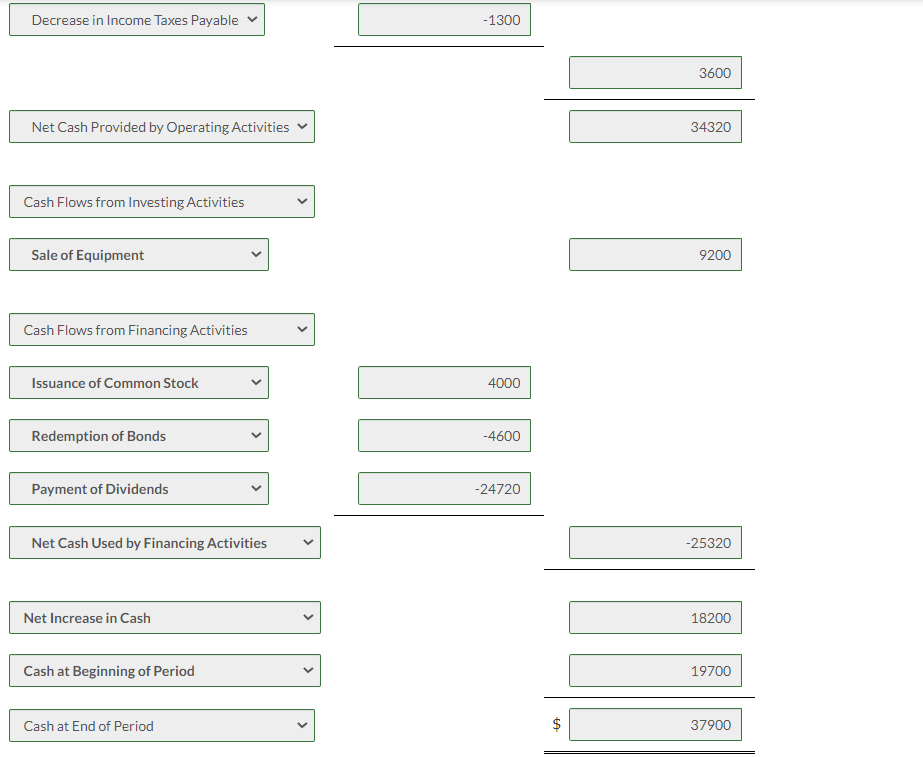

Presented here are the financial statements of Marigold Company. Additional data: 1. Depreciation expense was $15,500. 2. Dividends declared and paid were $24,720. 3. During the year equipment was sold for $9,200 cash. This equipment cost $18,000 originally and had accumulated depreciation of $8,800 at the time of sale. 4. Bonds were redeemed at their carrying value. 5. Common stock was issued at par for cash. (a) Your answer is correct. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Decrease in Income Taxes Payable \begin{tabular}{|r|} \hline1300 \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 3600 \\ \hline 34320 \\ \hline \end{tabular} Net Cash Provided by Operating Activities Cash Flows from Investing Activities 9200 Cash Flows from Financing Activities 4000 4600 \begin{tabular}{|lll|} \hline Payment of Dividends & 24720 \\ \hline \end{tabular} \begin{tabular}{|ll|} \hline Net Cash Used by Financing Activities & \\ \hline \end{tabular} 25320 Net Increase in Cash 18200 Cash at Beginning of Period Cash at End of Period Your answer is incorrect. Compute free cash flow. (Show amounts that decrease cash flow with either a sign e.g. 15,000 or in parenthesis e.g. (15,000).) Free cash flow $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts