Question: **Only part B!** Please show all work! **And part C if possible!** 1. You are advising a group of investors who are considering the purchase

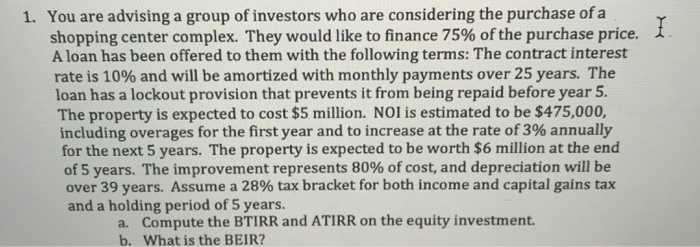

1. You are advising a group of investors who are considering the purchase of a shopping center complex. They would like to finance 75% of the purchase price. A loan has been offered to them with the following terms: The contract interest rate is 10% and will be amortized with monthly payments over 25 years. The loan has a lockout provision that prevents it from being repaid before year 5. The property is expected to cost $5 million. NOI is estimated to be $475,00 0, including overages for the first year and to increase at the rate of 3% annually for the next 5 years. The property is expected to be worth $6 million at the end of 5 years. The improvement represents 80% of cost, and depreciation will be over 39 years. Assume a 28% tax bracket for both income and capital gains tax and a holding period of 5 years. t Compute the BTIRR and ATIRR on the equity investment b. What is the BEIR? a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts