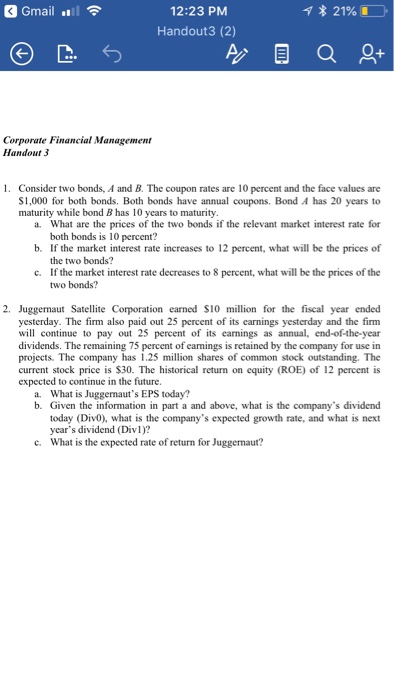

Question: Only problem #1. Note that this question is also an example of interest rate risk. Gmail . 12:23 PM Handout3 (2) Corporate Financial Management 1.

Only problem #1. Note that this question is also an example of interest rate risk.

Only problem #1. Note that this question is also an example of interest rate risk. Gmail . 12:23 PM Handout3 (2) Corporate Financial Management 1. Consider two bonds, A and B. The coupon rates are 10 percent and the face values are 1,000 for both bonds. Both bonds have annual coupons. Bond A has 20 years to a. What are the prices of the two bonds if the relevant market interest rate for b. If the market interest rate increases to 12 percent, what will be the prices of c. If the market interest rate decreases to 8 percent, what will be the prices of the maturity while bond B has 10 years to maturity 2. Juggemaut Satellite Corporation earned S10 million for the fiscal year ended yesterday. The firm also paid out 25 percent of its carnings yesterday and the firm will continue to pay out 25 percent of its earnings as annual, end-of-the-year dividends. The remaining 75 percent of earnings is retained by the company for use in projects. The company has 1.25 million shares of common stock outstanding. The current stock price is $30. The historical return on equity (ROE) of 12 percent is expected to continue in the future. a. What is Juggemaut's EPS today? b. Given the information in part a and above, what is the company's dividend today (DivO), what is the company's expected growth rate, and what is next year's dividend (Div1)? What is the expected rate of return for Juggemaut? c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts