Question: only question 2 Part 1) Standard Deduction Ken earns $56,601 & Amanda earns $84,272 in gross income during 2021 During 2021, Ken placed $5600 of

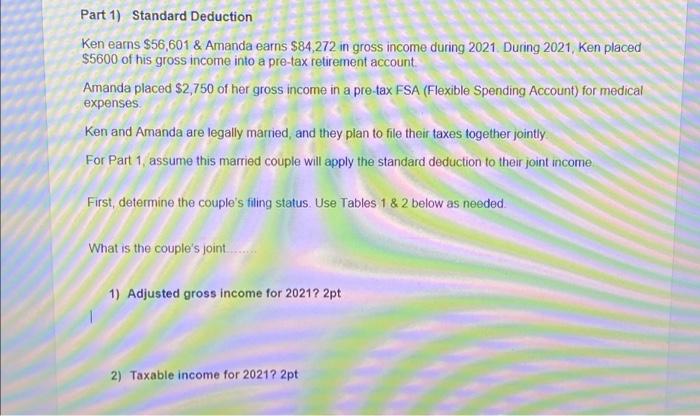

Part 1) Standard Deduction Ken earns $56,601 & Amanda earns $84,272 in gross income during 2021 During 2021, Ken placed $5600 of his gross income into a pre-tax retirement account Amanda placed $2,750 of her gross income in a pre-tax FSA (Flexible Spending Account) for medical expenses Ken and Amanda are legally marned, and they plan to file their taxes together jointly For Part 1 assume this married couple will apply the standard deduction to their joint income First, determine the couple's filing status. Use Tables 1 & 2 below as needed What is the couple's joint........ 1) Adjusted gross income for 2021? 2pt 2) Taxable income for 2021? 2pt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts