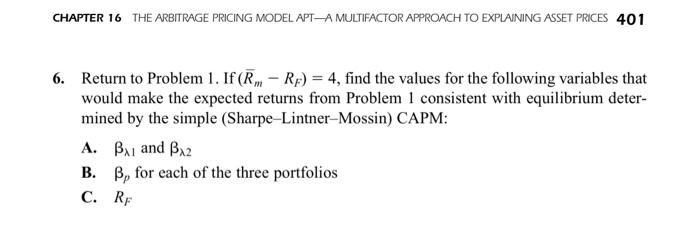

Question: only question 6 needed thank you! CHAPTER 16 THE ARBITRAGE PRICING MODEL APT-A MULTIFACTOR APPROACH TO EXPLAINING ASSET PRICES 401 6. Return to Problem 1.

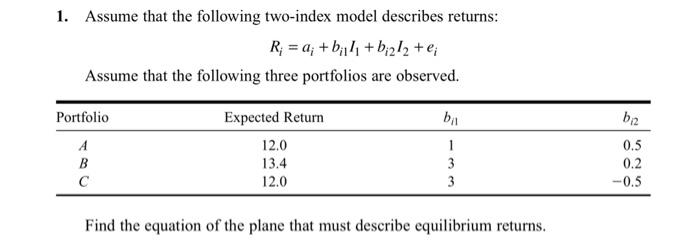

CHAPTER 16 THE ARBITRAGE PRICING MODEL APT-A MULTIFACTOR APPROACH TO EXPLAINING ASSET PRICES 401 6. Return to Problem 1. If(RM - Rp) = 4, find the values for the following variables that would make the expected returns from Problem I consistent with equilibrium deter- mined by the simple (Sharpe-Lintner-Mossin) CAPM: A. B and B2 B. B, for each of the three portfolios C. RF 1. Assume that the following two-index model describes returns: R; = a; +42 +b;272 +e; Assume that the following three portfolios are observed. Portfolio bi b2 Expected Return 12.0 13.4 12.0 B 1 3 3 0.5 0.2 -0.5 Find the equation of the plane that must describe equilibrium returns. CHAPTER 16 THE ARBITRAGE PRICING MODEL APT-A MULTIFACTOR APPROACH TO EXPLAINING ASSET PRICES 401 6. Return to Problem 1. If(RM - Rp) = 4, find the values for the following variables that would make the expected returns from Problem I consistent with equilibrium deter- mined by the simple (Sharpe-Lintner-Mossin) CAPM: A. B and B2 B. B, for each of the three portfolios C. RF 1. Assume that the following two-index model describes returns: R; = a; +42 +b;272 +e; Assume that the following three portfolios are observed. Portfolio bi b2 Expected Return 12.0 13.4 12.0 B 1 3 3 0.5 0.2 -0.5 Find the equation of the plane that must describe equilibrium returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts