Question: only question B please Question 9 A machine shop owner is attempting to decide whether to purchase a new drill press, a lathe, or a

only question B please

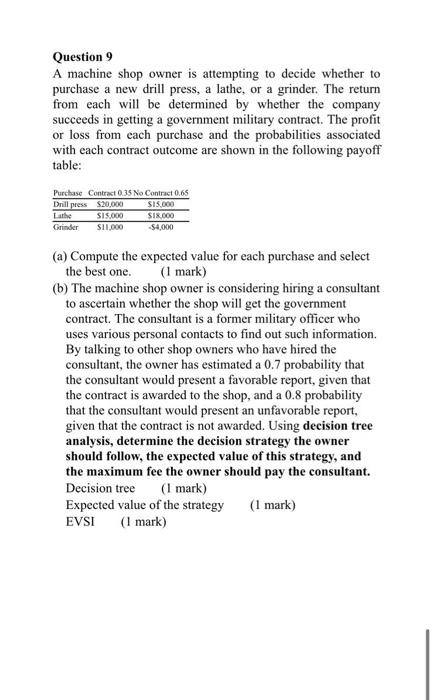

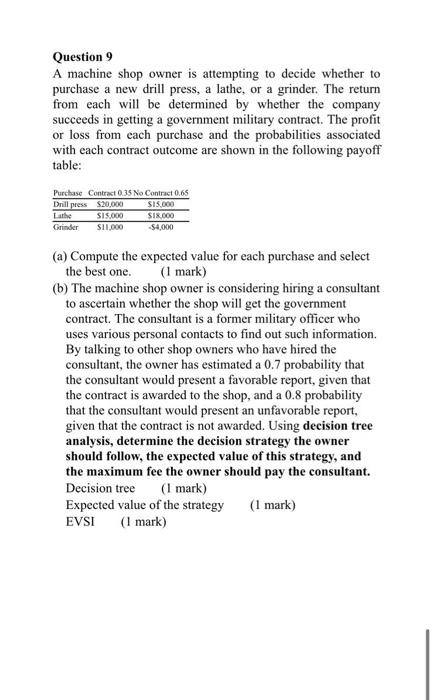

Question 9 A machine shop owner is attempting to decide whether to purchase a new drill press, a lathe, or a grinder. The return from each will be determined by whether the company succeeds in getting a government military contract. The profit or loss from each purchase and the probabilities associated with each contract outcome are shown in the following payoff table: Purchase Contract 0.35 No Contract 0.65 Drill press $20,000 $15,000 Lathe $15,000 $18,000 Grinder $11,000 -$4,000 (a) Compute the expected value for each purchase and select the best one. (1 mark) (b) The machine shop owner is considering hiring a consultant to ascertain whether the shop will get the government contract. The consultant is a former military officer who uses various personal contacts to find out such information. By talking to other shop owners who have hired the consultant, the owner has estimated a 0.7 probability that the consultant would present a favorable report, given that the contract is awarded to the shop, and a 0.8 probability that the consultant would present an unfavorable report, given that the contract is not awarded. Using decision tree analysis, determine the decision strategy the owner should follow, the expected value of this strategy, and the maximum fee the owner should pay the consultant. Decision tree (1 mark) Expected value of the strategy (1 mark) EVSI (1 mark)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock