Question: only question b. that i need b. Now assume that a value-weighted index is used and that it is scaled by a factor of 10

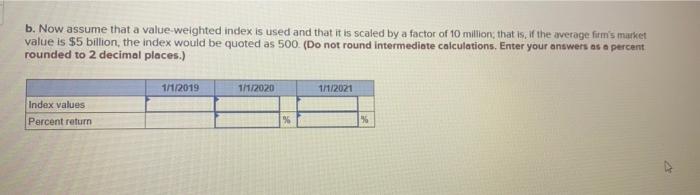

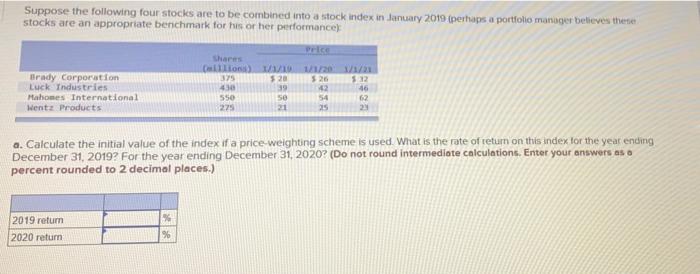

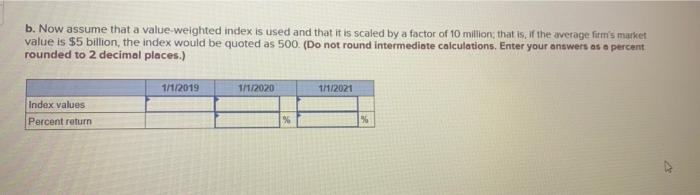

b. Now assume that a value-weighted index is used and that it is scaled by a factor of 10 million that is, the average firm's market value is $5 billion, the index would be quoted as 500. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) 1/1/2019 11/2020 1/1/2021 Index values Percent return % % Suppose the following four stocks are to be combined into a stock index in January 2019 perhaps a portfolio manager believes there stocks are an appropriate benchmark for his or her performances Brady Corporation Luck Industries Mahomes International Wentz Products Pric shares C) 11/20/21 375 520 526 $32 430 39 46 550 se 54 62 225 21 25 2 a. Calculate the initial value of the index if a price weighting scheme is used What is the rate of return on this index for the year ending December 31, 2019? For the year ending December 31, 2020? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) 2019 retum 2020 return b. Now assume that a value weighted index is used and that it is scaled by a factor of 10 million that is, if the average firm's market value is $5 billion, the index would be quoted as 500. (Do not round intermediate calculations, Enter your answers as a percent rounded to 2 decimal places.) 1/1/2019 11/2020 1/1/2021 Index values Percent return %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts