Question: only question no 2 SCIM 204 Operations Research Example 5.5 (adapted from Eiselt and Sandblom, 2012) An investor would like to invest $25,000 among 5

only question no 2

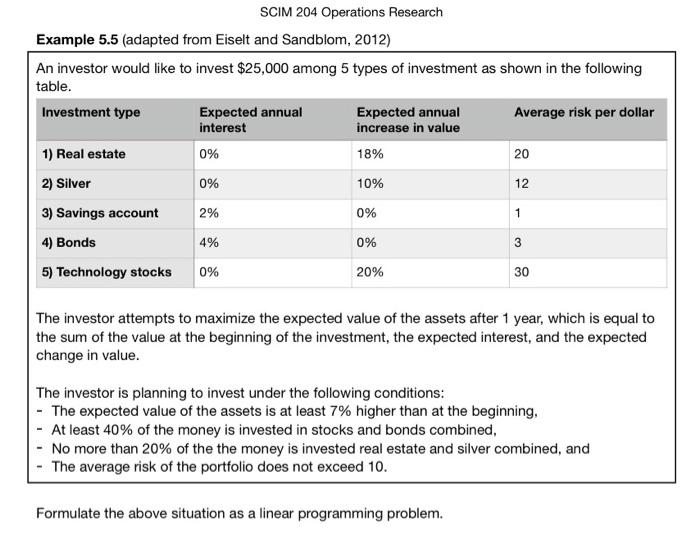

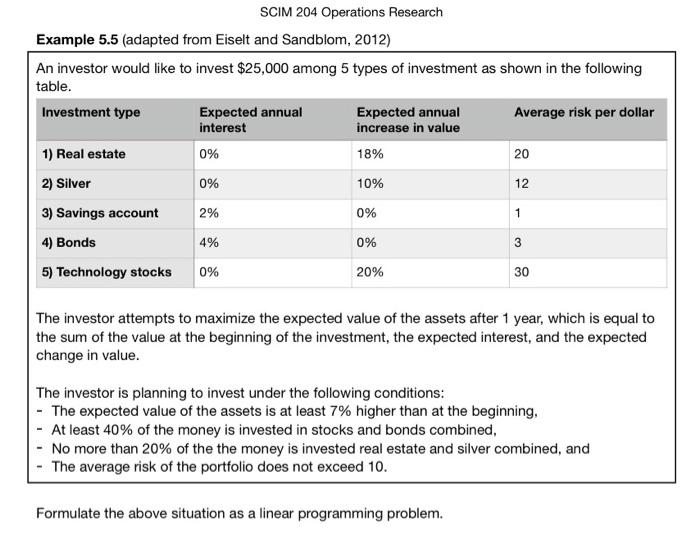

SCIM 204 Operations Research Example 5.5 (adapted from Eiselt and Sandblom, 2012) An investor would like to invest $25,000 among 5 types of investment as shown in the following table. Investment type Expected annual Expected annual Average risk per dollar interest increase in value 1) Real estate 0% 18% 20 2) Silver 0% 10% 12 2% 0% 1 3) Savings account 4) Bonds 4% 0% 3 5) Technology stocks 0% 20% 30 The investor attempts to maximize the expected value of the assets after 1 year, which is equal to the sum of the value at the beginning of the investment, the expected interest, and the expected change in value. The investor is planning to invest under the following conditions: - The expected value of the assets is at least 7% higher than at the beginning, - At least 40% of the money is invested in stocks and bonds combined, No more than 20% of the the money is invested real estate and silver combined, and The average risk of the portfolio does not exceed 10. Formulate the above situation as a linear programming problem. 2) From Example 5.5, write an equation or inequality for the following additional constraint: the profit from domestic frame should be at least equal to 30% of the profit from export frames

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock