Question: ONLY QUESTION TWO; I DID Q1 ALREADY. THNX! II. Arbitrage Suppose the economy can be in one of the following three states: (i) Boom or

ONLY QUESTION TWO; I DID Q1 ALREADY. THNX!

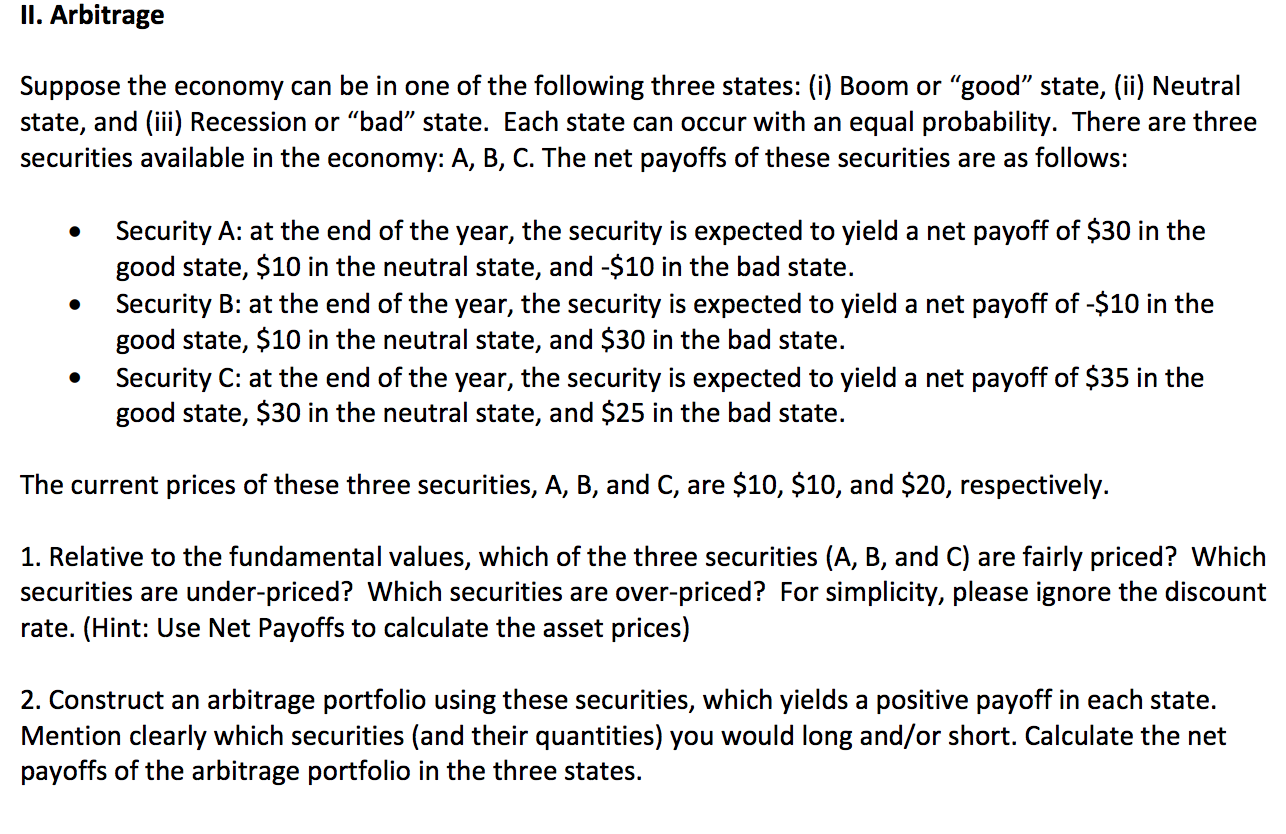

II. Arbitrage Suppose the economy can be in one of the following three states: (i) Boom or good state, (ii) Neutral state, and (iii) Recession or "bad" state. Each state can occur with an equal probability. There are three securities available in the economy: A, B, C. The net payoffs of these securities are as follows: Security A: at the end of the year, the security is expected to yield a net payoff of $30 in the good state, $10 in the neutral state, and -$10 in the bad state. Security B: at the end of the year, the security is expected to yield a net payoff of -$10 in the good state, $10 in the neutral state, and $30 in the bad state. Security C: at the end of the year, the security is expected to yield a net payoff of $35 in the good state, $30 in the neutral state, and $25 in the bad state. The current prices of these three securities, A, B, and C, are $10, $10, and $20, respectively. 1. Relative to the fundamental values, which of the three securities (A, B, and C) are fairly priced? Which securities are under-priced? Which securities are over-priced? For simplicity, please ignore the discount rate. (Hint: Use Net Payoffs to calculate the asset prices) 2. Construct an arbitrage portfolio using these securities, which yields a positive payoff in each state. Mention clearly which securities (and their quantities) you would long and/or short. Calculate the net payoffs of the arbitrage portfolio in the three states

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts