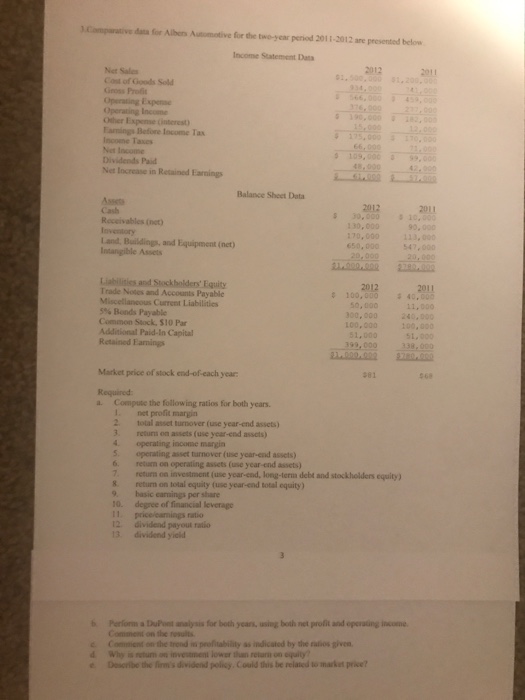

Question: Only questions B, C, D, & E B. Perform a DuPont Analysis for both years, using both net profit and operating income. Then comment on

Comparative data for Albers Automotive for the two-year period 2011-2012 are presented below Income Statement Das 2012 1.500020 Net Sales Cost of Goods Sold Gross Profit 936.999:99 390.00900 Other Expense Ointeres Eamings Befone lecome Tas Income Taxes Net Income Dividends Paid 5,00 109,00099, 090 42-99 Net Increase in Retained Earmings Balance Sheet Data 30,000 130, 000 170, 000 650, 000 10.00 90, 000 113,000 Receivables (not) Land, Buildings, and Equipment (net) Intangible Assets Trade Notes and Accounts Payable Miscellancous Current Liabilities 5% Bonds Payable Common Stock, $10 Par Additional Paid-In Capital Retained Eamings 100,000 50,000 40,000 11,000 300,000240, 00,00000 51,000 199,009 1.000 581 Market price of stock end-of-each year a. Compute the following ratios for both years I net profit margin 2 total asset turnover (use year-end assets) 3 returs on assets (use year-end assets) 4 operating income margin 5 operating asset trnover (use year-end assets) 6. retarm on operating assets (use year end assets) 7 return on investment (use year-end, long-term debt and stockholders equity) 8. return on total equity (use year-end total equity) 9 basic earnings per share 10. degree of financial leverage pricelearnings ratio 12 dividend payout ratio 13 dividond yieid bParform a DuPot analysis for both years, using both net profit and operaing income Comment on the res Comnient on the trond ia peofitability as indicated by the ralios given Why is tu ou invesent ower than retar on spaity e Describe the firm's dividend policy. Could this be related to market price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts