Question: ONLY RESPOND IF YOU CAN PROVIDE MATLAB CODE, WRITTEN OR TYPED. THANK YOU Table 1: Data for the Heston Model (20 marks) (Stochastic Volatility Model)

ONLY RESPOND IF YOU CAN PROVIDE MATLAB CODE, WRITTEN OR TYPED. THANK YOU

ONLY RESPOND IF YOU CAN PROVIDE MATLAB CODE, WRITTEN OR TYPED. THANK YOU

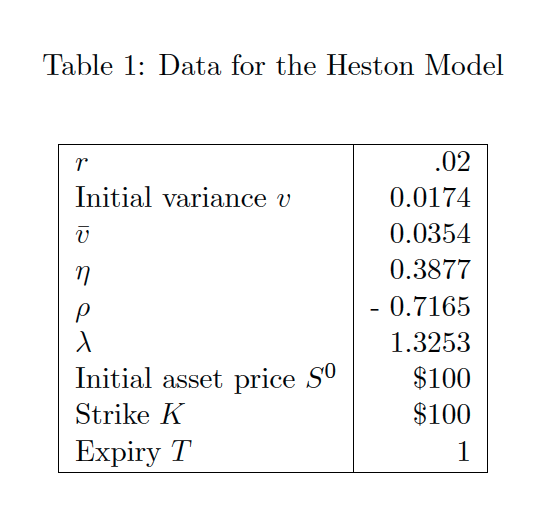

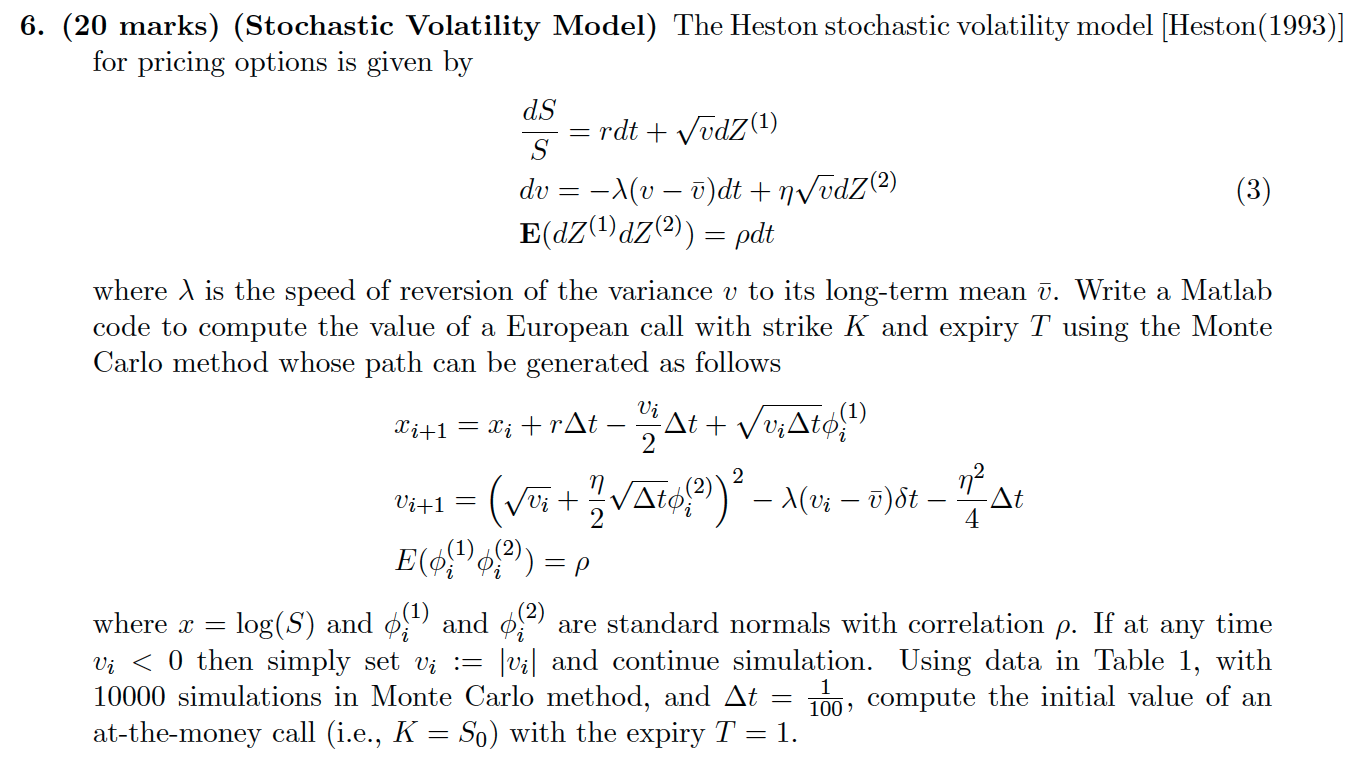

Table 1: Data for the Heston Model (20 marks) (Stochastic Volatility Model) The Heston stochastic volatility model [Heston(19 for pricing options is given by SdS=rdt+vdZ(1)dv=(vv)dt+vdZ(2)E(dZ(1)dZ(2))=dt where is the speed of reversion of the variance v to its long-term mean v. Write a Matlab code to compute the value of a European call with strike K and expiry T using the Monte Carlo method whose path can be generated as follows xi+1=xi+rt2vit+viti(1)vi+1=(vi+2ti(2))2(viv)t42tE(i(1)i(2))= where x=log(S) and i(1) and i(2) are standard normals with correlation . If at any time vi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts