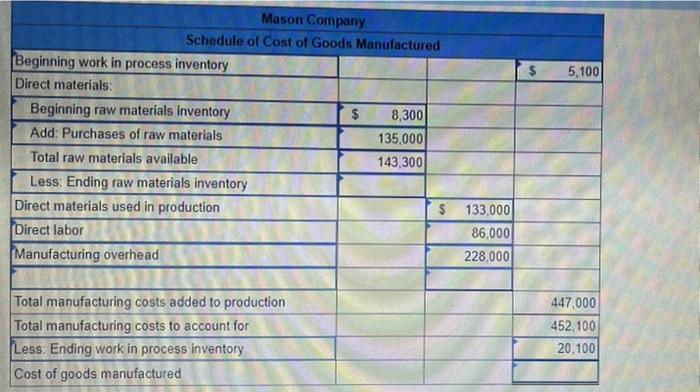

Question: only thing i am stuck on is computing the cost of goods manufactured, help!? thank you! 5,100 Mason Company Schedule of Cost of Goods Manufactured

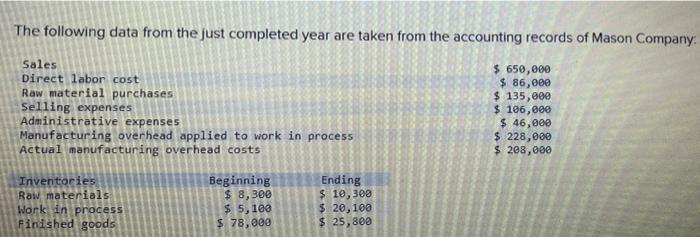

5,100 Mason Company Schedule of Cost of Goods Manufactured Beginning work in process inventory Direct materials: Beginning raw materials inventory $ 8,300 Add: Purchases of raw materials 135,000 Total raw materials available 143,300 Less: Ending raw materials inventory Direct materials used in production $ Direct labor Manufacturing overhead 133.000 86,000 228,000 Total manufacturing costs added to production Total manufacturing costs to account for Less Ending work in process inventory Cost of goods manufactured 447,000 452,100 20.100 The following data from the just completed year are taken from the accounting records of Mason Company Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Beginning Ending Raw materials $ 8,300 $ 10,300 Work in process $ 5,188 $ 20,100 Finished goods $ 78,000 $ 25,800 $ 650,000 $ 86,000 $ 135,000 $ 196,000 $ 46,000 $ 228,000 $ 208,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts