Question: only this Suppose we model 100 obligors using the threshold model of default (X, d)sis100. Suppose for all obligors the threshold is di = 0

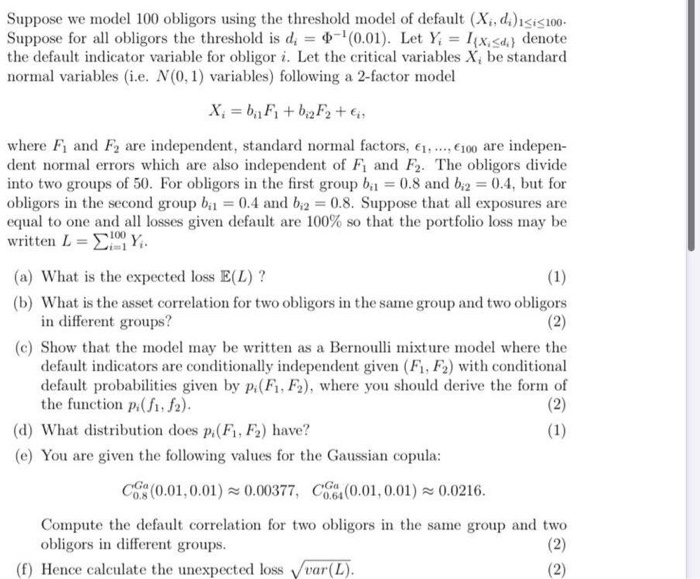

Suppose we model 100 obligors using the threshold model of default (X, d)sis100. Suppose for all obligors the threshold is di = 0 -0.01). Let Y; = 11xisda) denote the default indicator variable for obligor i. Let the critical variables X, be standard normal variables (i.e. N(0.1) variables) following a 2-factor model X, = bFi + b2F, + ) where F and F, are independent, standard normal factors, 61, ..., 100 are indepen- dent normal errors which are also independent of F, and F. The obligors divide into two groups of 50. For obligors in the first group bil = 0.8 and bi2 = 0.4, but for obligors in the second group bi = 0.4 and bi2 = 0.8. Suppose that all exposures are equal to one and all losses given default are 100% so that the portfolio loss may be written L = Y; (a) What is the expected loss E(L) ? (1) (b) What is the asset correlation for two obligors in the same group and two obligors in different groups? (2) (e) Show that the model may be written as a Bernoulli mixture model where the default indicators are conditionally independent given (F, F2) with conditional default probabilities given by pi(F1, F2), where you should derive the form of the function pi(f1, f2). (2) (d) What distribution does p:(F1, F2) have? (1) (e) You are given the following values for the Gaussian copula: CO:(0.01,0.01) - 0.00377, C. (0.01,0.01) 0.0216. Compute the default correlation for two obligors in the same group and two obligors in different groups. (2) (f) Hence calculate the unexpected loss var(L). (2) Suppose we model 100 obligors using the threshold model of default (X, d)sis100. Suppose for all obligors the threshold is di = 0 -0.01). Let Y; = 11xisda) denote the default indicator variable for obligor i. Let the critical variables X, be standard normal variables (i.e. N(0.1) variables) following a 2-factor model X, = bFi + b2F, + ) where F and F, are independent, standard normal factors, 61, ..., 100 are indepen- dent normal errors which are also independent of F, and F. The obligors divide into two groups of 50. For obligors in the first group bil = 0.8 and bi2 = 0.4, but for obligors in the second group bi = 0.4 and bi2 = 0.8. Suppose that all exposures are equal to one and all losses given default are 100% so that the portfolio loss may be written L = Y; (a) What is the expected loss E(L) ? (1) (b) What is the asset correlation for two obligors in the same group and two obligors in different groups? (2) (e) Show that the model may be written as a Bernoulli mixture model where the default indicators are conditionally independent given (F, F2) with conditional default probabilities given by pi(F1, F2), where you should derive the form of the function pi(f1, f2). (2) (d) What distribution does p:(F1, F2) have? (1) (e) You are given the following values for the Gaussian copula: CO:(0.01,0.01) - 0.00377, C. (0.01,0.01) 0.0216. Compute the default correlation for two obligors in the same group and two obligors in different groups. (2) (f) Hence calculate the unexpected loss var(L). (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts