Question: Only typing. ...don't upload images....step by step solutions for both question .... Assume the following information for Nasdaq Composite on January 2015: Trading at 12.8

Only typing. ...don't upload images....step by step solutions for both question ....

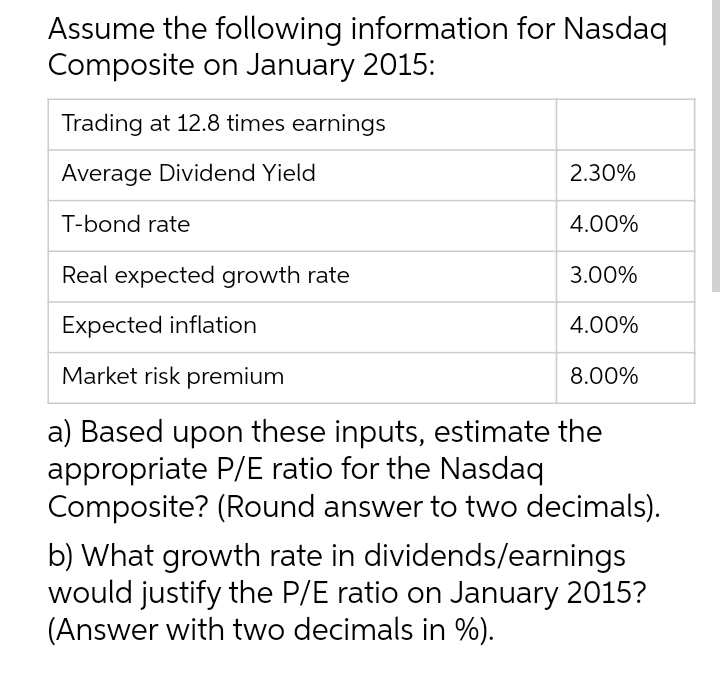

Assume the following information for Nasdaq Composite on January 2015: Trading at 12.8 times earnings Average Dividend Yield 2.30% Tibond rate 100% Real expected growth rate 300% Expected ination 400% Market risk premium 8.00% a) Based upon these inputs, estimate the appropriate P/E ratio for the Nasdaq Composite? (Round answer to two decimals). b) What growth rate in dividends/earnings would justify the P/E ratio on January 2015? (Answer with two decimals in %)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts