Question: Only work on #14, 15, and 18. Please only reference with Ref. #. Don't give me the names of the account. Please answer the question

Only work on #14, 15, and 18.

Please only reference with Ref. #. Don't give me the names of the account.

Please answer the question the way you see it in the excel. The same format you see.

You do not need to put any initials there. Just put the reference number from the workpaper.

I only need references from the excel the question is asking about. I do not need any calculations or formulas. Open the excel link check each question and just put the reference number in the reference column. For example Ref B-1

Use this excel link provided

Excel link:

https://docs.google.com/spreadsheets/d/1xtFEBFJxN6buakz5jrNrwNlLBE1wfxcp/edit?usp=sharing&ouid=108523303290885083995&rtpof=true&sd=true

PRELIMINARY WORK

Assume that you are beginning the substantive audit procedures for the Storage Sheds, Inc. 2009 annual audit on December 31, 2009. The audit planning procedures have already been completed, and an audit planning memo has been included in the workpaper file. In addition, risk assessment procedures were also completed, and are summarized in the risk assessment and control assessment memos included in the workpaper file. Some pro-forma and partially completed workpapers have already been prepared. Further, some of the substantive audit procedures have already been completed, and the staff auditor has indicated which procedures have been conducted by initialing those steps in the audit programs. Note that the audit programs were developed during the planning stage, and therefore may include procedures that are not applicable, based upon the information discovered during the current year audit. In that event, indicate that the procedures are not applicable by initialing the audit program step and entering N/A in the workpaper reference column.

Begin the audit procedures by familiarizing yourself with the information available in each of the simulation files provided. Some information that may be available in an actual audit may not be available in the simulation. Should you encounter such a circumstance, you may assume that no errors, discrepancies, issues, etc. exist outside of the information provided in the simulation. The reports and information available in the simulation are included in the following files:

A) AUDIT WORKPAPERS

1) 2008WORKPAPERS

2) 2009 PLANNING DOCUMENTS

a) Audit Programs

b) Engagement Letter

3) 2009 AUDIT DOCUMENTS

a) Bank Statements

b) Bank Confirmations

c) Accounts Receivable Confirmations

d) Accounts Payable Confirmations

e) Broker's Confirmation

f) Insurance Confirmation

g) Attorneys' Letters

h) Management Representation Letter

4) 2009 PRO-FORMA WORKPAPERS

5) 2008/2009 FINANCIAL STATEMENTS

B) CLIENT RECORDS

1) ACCOUNTING RECORDS

a) General Ledger/General Journal

b) Other Records:

* Cash Receipts Journal

* Cash Disbursements Journal-

Operating Account

* Aged Accounts Receivable Sched.

* Aged Accounts Payable Sched.

* Sales Journal

* Sales Invoice Register

* Purchases Journal

* Check Register- Operating Account

* Inventory Valuation Report

* Inventory Unit Activity Report

* Inventory Item Costing Report

* Cost of Goods Sold Journal

2) CLIENT DOCUMENTS

a) Sales Invoices

b) Cash Receipts Vouchers

c) Deposit Tickets

d) Duplicate Check Copies- Operating Account

e) Brokerage Advices

f) Standard Price List

g) Vendor Invoices- Operating Account

h) Vendor Invoices- Inventory

3) PAYROLL RECORDS

a) Payroll Accounting Records

* Payroll Journal

* Payroll Cash Disbursements Journal

* Payroll Check Registers

b) Payroll Tax Returns

c) Duplicate Check Copies- Payroll Account

d) State Withholding Taxes

To begin the simulation, you must copy the following files on to your computer or a separate CD:

A-2) Audit Planning Documents

A-4) 2009 Pro-Forma Workpapers

A-5) 2008/2009 Financial Statements

All of the work that you perform and changes that you make in completing the simulation must be performed on the copy of those files that you have made. No changes should be made to the information provided in the simulation, as you made need that original information to complete the simulation. Students may also find it helpful to print a hard copy of each assignment's pro-forma workpapers for reference purposes before starting the assignment. The audit workpapers for each assignment can be completed using the computer, or the pro-forma workpapers can be printed first and completed manually.

At the conclusion of the audit, all workpapers, along with the comparative financial statements for 2008/2009 and audit opinion, should be printed and assembled in a final workpaper file for submission.

ACCOUNTS RECEIVABLE / SALES

All sales of inventory units to customers are on a credit basis. There are no cash sales. Sales terms are n/30; no cash discounts are offered to customers. The company established a standard price list for all inventory units to be sold during 2009. All unit sales were at the standard prices.

Sales invoices are created upon delivery of the goods to customers. All units are delivered to customers by company trucks. Sales invoices are pre-numbered and sequentially issued, and include a description of the units sold, selling prices per unit, freight (handling charge per delivery), and total invoice amount. The company charged a $120 per delivery as a handling charge to help defray the cost of transporting units to customers. Sales invoice totals are recorded in the company's invoice register, and posted to the sales journal, simultaneously with the creation of the invoice.

The company has two independent contractors (C. Carson and B. Yates) that perform services as outside salesmen on a part-time basis. The salesmen receive commissions, at the rate of 4% of annual sales, as compensation for their services. Commission checks are issued annually during the first quarter of the year following the year of sale. During 2009, sales attributable to Carson and Yates totaled $296,200 and $192,120, respectively.

During 2009 the company made sales to approximately twenty different customers. Customer accounts are maintained in a subsidiary accounts receivable ledger. The company analyzes the open accounts receivable balances on a monthly basis through the preparation of an aged trial balance. Customers with balances that are significantly past due are contacted by Millie Miles at the end of each month.

The company maintains an allowance for doubtful accounts for potentially uncollectible accounts receivable. During 2008, an allowance of $5,000 was created, of which only $495 was used due to an account write-off. During 2009 the company added $2,000 to the allowance account as a provision for current year bad debts. No accounts were written off by the company during 2009. The company estimates that an adequate allowance account should be based upon the following:

0-30 days 1% of accounts receivable

31-60 days 3% of accounts receivable

61-90 days 5% of accounts receivable

Over 90 days 20% of accounts receivable

REQUIRED

1.Print the following documents for inclusion in the workpapers:

Aged accounts receivable schedule

Accounts receivable confirmations

Inventory standard price list

Inventory unit activity report

2.Complete each of the steps in the accounts receivable and sales audit program and initial and reference each step to the workpapers.

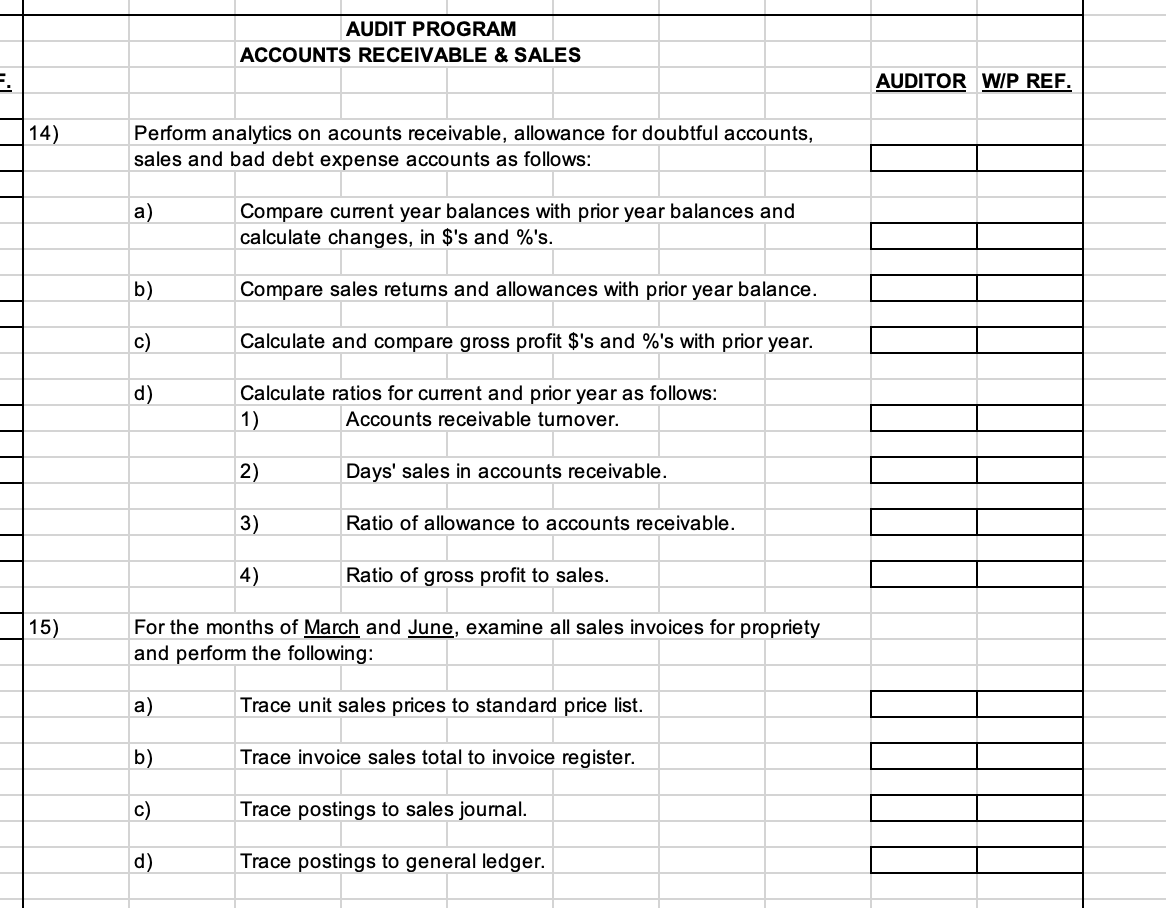

| AUDIT PROGRAM | |||||||||

| ACCOUNTS RECEIVABLE & SALES | |||||||||

| AUDITOR | W/P REF. | ||||||||

| 14) | Perform analytics on acounts receivable, allowance for doubtful accounts, | ||||||||

| sales and bad debt expense accounts as follows: | |||||||||

| a) | Compare current year balances with prior year balances and | ||||||||

| calculate changes, in $'s and %'s. | |||||||||

| b) | Compare sales returns and allowances with prior year balance. | ||||||||

| c) | Calculate and compare gross profit $'s and %'s with prior year. | ||||||||

| d) | Calculate ratios for current and prior year as follows: | ||||||||

| 1) | Accounts receivable turnover. | ||||||||

| 2) | Days' sales in accounts receivable. | ||||||||

| 3) | Ratio of allowance to accounts receivable. | ||||||||

| 4) | Ratio of gross profit to sales. | ||||||||

| 15) | For the months of MarchandJune, examine all sales invoices for propriety | ||||||||

| and perform the following: | |||||||||

| a) | Trace unit sales prices to standard price list. | ||||||||

| b) | Trace invoice sales total to invoice register. | ||||||||

| c) | Trace postings to sales journal. | ||||||||

| d) | Trace postings to general ledger. | ||||||||

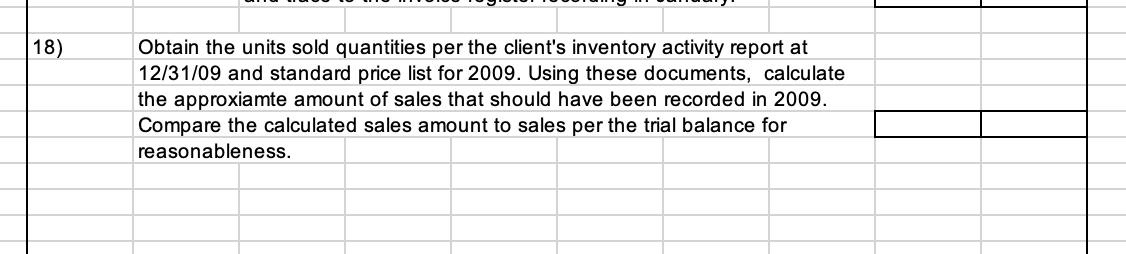

| 18) | Obtain the units sold quantities per the client's inventory activity report at | ||||||||

| 12/31/09 and standard price list for 2009. Using these documents, calculate | |||||||||

| the approxiamte amount of sales that should have been recorded in 2009. | |||||||||

| Compare the calculated sales amount to sales per the trial balance for | |||||||||

| reasonableness. | |||||||||

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts