Question: onlycthe second question please A stock has a current price of $96. An option on this stock that expires in eight months has an exercise

onlycthe second question please

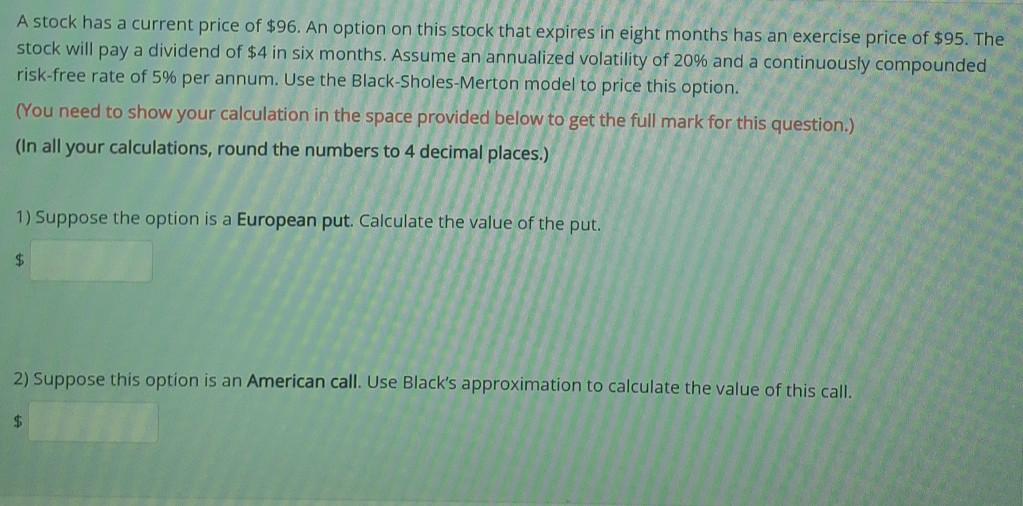

A stock has a current price of $96. An option on this stock that expires in eight months has an exercise price of $95. The stock will pay a dividend of $4 in six months. Assume an annualized volatility of 20% and a continuously compounded risk-free rate of 5% per annum. Use the Black-Sholes-Merton model to price this option. (You need to show your calculation in the space provided below to get the full mark for this question.) (In all your calculations, round the numbers to 4 decimal places.) 1) Suppose the option is a European put. Calculate the value of the put. $ 2) Suppose this option is an American call. Use Black's approximation to calculate the value of this call. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts