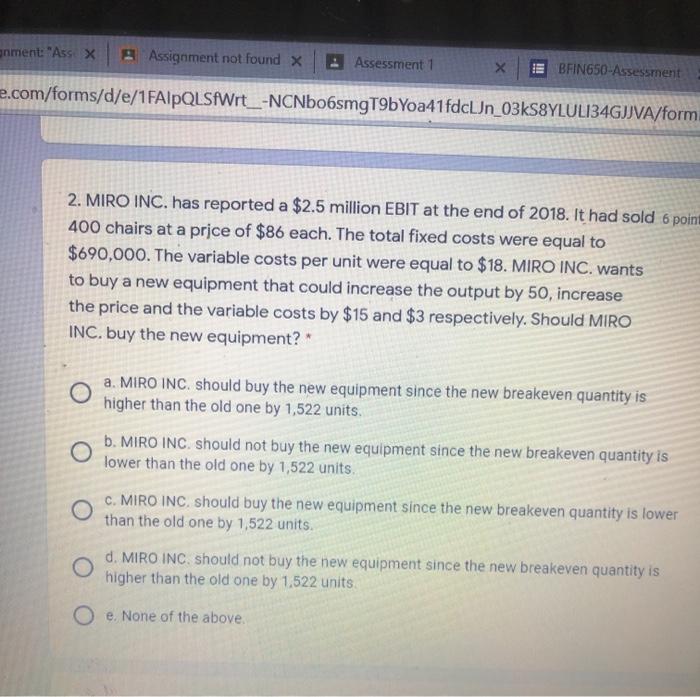

Question: onment: Ass X Assignment not found X Assessment 1 E BFIN650-Assessment 2.com/forms/d/e/1FAIpQLSfWrt_-NCNbobsmgT9bYoa41fdcLJn_03kS8YLULI34GJJVA/form 2. MIRO INC. has reported a $2.5 million EBIT at the end of

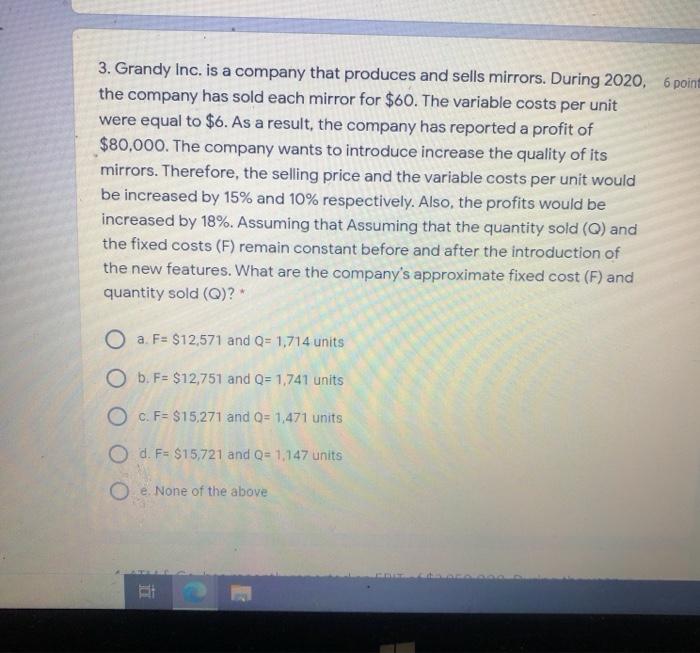

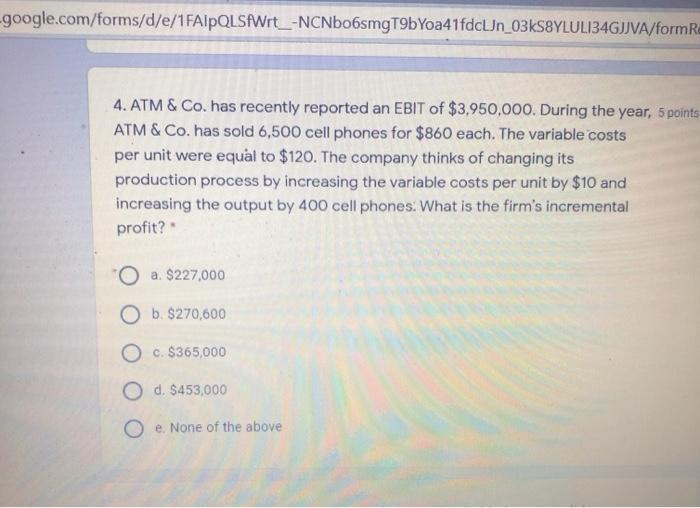

onment: "Ass X Assignment not found X Assessment 1 E BFIN650-Assessment 2.com/forms/d/e/1FAIpQLSfWrt_-NCNbobsmgT9bYoa41fdcLJn_03kS8YLULI34GJJVA/form 2. MIRO INC. has reported a $2.5 million EBIT at the end of 2018. It had sold 6 poin 400 chairs at a price of $86 each. The total fixed costs were equal to $690,000. The variable costs per unit were equal to $18. MIRO INC. wants to buy a new equipment that could increase the output by 50, increase the price and the variable costs by $15 and $3 respectively. Should MIRO INC. buy the new equipment? O a. MIRO INC. should buy the new equipment since the new breakeven quantity is higher than the old one by 1,522 units. b. MIRO INC. should not buy the new equipment since the new breakeven quantity is lower than the old one by 1,522 units. C. MIRO INC should buy the new equipment since the new breakeven quantity is lower than the old one by 1,522 units. d. MIRO INC should not buy the new equipment since the new breakeven quantity is higher than the old one by 1,522 units O e. None of the above. 3. Grandy Inc. is a company that produces and sells mirrors. During 2020, 6 point the company has sold each mirror for $60. The variable costs per unit were equal to $6. As a result, the company has reported a profit of $80,000. The company wants to introduce increase the quality of its mirrors. Therefore, the selling price and the variable costs per unit would be increased by 15% and 10% respectively. Also, the profits would be increased by 18%. Assuming that Assuming that the quantity sold (Q) and the fixed costs (F) remain constant before and after the introduction of the new features. What are the company's approximate fixed cost (F) and quantity sold (Q)? O a F= $12,571 and Q= 1,714 units O b. F= $12,751 and 0= 1,741 units O C. F= $15,271 and 0= 1,471 units O d. F= $15,721 and Q=1,147 units O e None of the above -google.com/forms/d/e/1FAIpQLSfWrt_-NCNbobsmgT9b Yoa41fdcLn_03kSSYLULI34GJJVA/form 4. ATM & Co. has recently reported an EBIT of $3,950,000. During the year, 5 points ATM & Co. has sold 6,500 cell phones for $860 each. The variable costs per unit were equal to $120. The company thinks of changing its production process by increasing the variable costs per unit by $10 and increasing the output by 400 cell phones. What is the firm's incremental profit? a. $227,000 O b. $270,600 O c. $365,000 O d. $453,000 O e None of the above onment: "Ass X Assignment not found X Assessment 1 E BFIN650-Assessment 2.com/forms/d/e/1FAIpQLSfWrt_-NCNbobsmgT9bYoa41fdcLJn_03kS8YLULI34GJJVA/form 2. MIRO INC. has reported a $2.5 million EBIT at the end of 2018. It had sold 6 poin 400 chairs at a price of $86 each. The total fixed costs were equal to $690,000. The variable costs per unit were equal to $18. MIRO INC. wants to buy a new equipment that could increase the output by 50, increase the price and the variable costs by $15 and $3 respectively. Should MIRO INC. buy the new equipment? O a. MIRO INC. should buy the new equipment since the new breakeven quantity is higher than the old one by 1,522 units. b. MIRO INC. should not buy the new equipment since the new breakeven quantity is lower than the old one by 1,522 units. C. MIRO INC should buy the new equipment since the new breakeven quantity is lower than the old one by 1,522 units. d. MIRO INC should not buy the new equipment since the new breakeven quantity is higher than the old one by 1,522 units O e. None of the above. 3. Grandy Inc. is a company that produces and sells mirrors. During 2020, 6 point the company has sold each mirror for $60. The variable costs per unit were equal to $6. As a result, the company has reported a profit of $80,000. The company wants to introduce increase the quality of its mirrors. Therefore, the selling price and the variable costs per unit would be increased by 15% and 10% respectively. Also, the profits would be increased by 18%. Assuming that Assuming that the quantity sold (Q) and the fixed costs (F) remain constant before and after the introduction of the new features. What are the company's approximate fixed cost (F) and quantity sold (Q)? O a F= $12,571 and Q= 1,714 units O b. F= $12,751 and 0= 1,741 units O C. F= $15,271 and 0= 1,471 units O d. F= $15,721 and Q=1,147 units O e None of the above -google.com/forms/d/e/1FAIpQLSfWrt_-NCNbobsmgT9b Yoa41fdcLn_03kSSYLULI34GJJVA/form 4. ATM & Co. has recently reported an EBIT of $3,950,000. During the year, 5 points ATM & Co. has sold 6,500 cell phones for $860 each. The variable costs per unit were equal to $120. The company thinks of changing its production process by increasing the variable costs per unit by $10 and increasing the output by 400 cell phones. What is the firm's incremental profit? a. $227,000 O b. $270,600 O c. $365,000 O d. $453,000 O e None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts