Question: ONOFF Chap 5 Problems Due Friday by 11:59pm Points 15 Submitting a text entry box or a file upload Use the examples provided here to

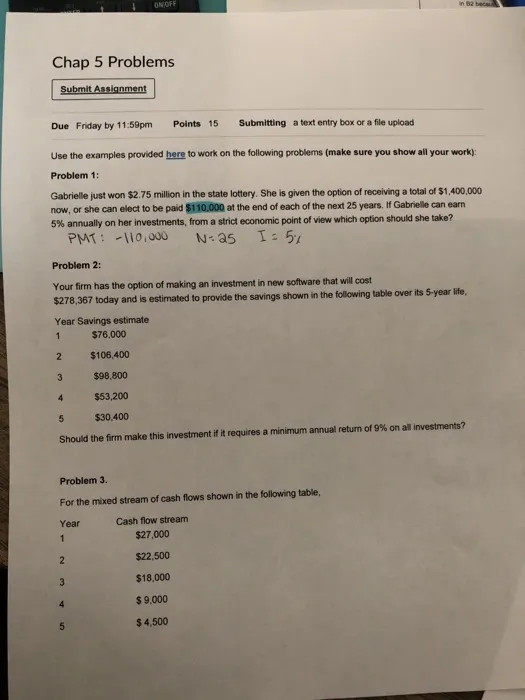

ON OFF Chap 5 Problems Submit Assignment Due Friday by 11:59pm Points 15 Submitting a text entry box or a file upload in 82 beca Use the examples provided here to work on the following problems (make sure you show all your work): Problem 1: Gabrielle just won $2.75 million in the state lottery. She is given the option of receiving a total of $1,400,000 now, or she can elect to be paid $110,000 at the end of each of the next 25 years. If Gabrielle can earn 5% annually on her investments, from a strict economic point of view which option should she take? N=25 I = 5% PMT: Problem 2: 110,000 Your firm has the option of making an investment in new software that will cost $278,367 today and is estimated to provide the savings shown in the following table over its 5-year life, Year Savings estimate 1 $76,000 2 $106,400 3 $98,800 4 $53,200 5 $30,400 Should the firm make this investment if it requires a minimum annual return of 9% on all investments? Problem 3. For the mixed stream of cash flows shown in the following table, Year Cash flow stream 1 $27,000 2 $22,500 3 $18,000 4 $9,000 5 $4,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts