Question: oo e Module 04 - Competancy Evaluation 0 125% v = 8 = g7 RN A R EBxE N 23R Burrow Machining Inc. Case Facts

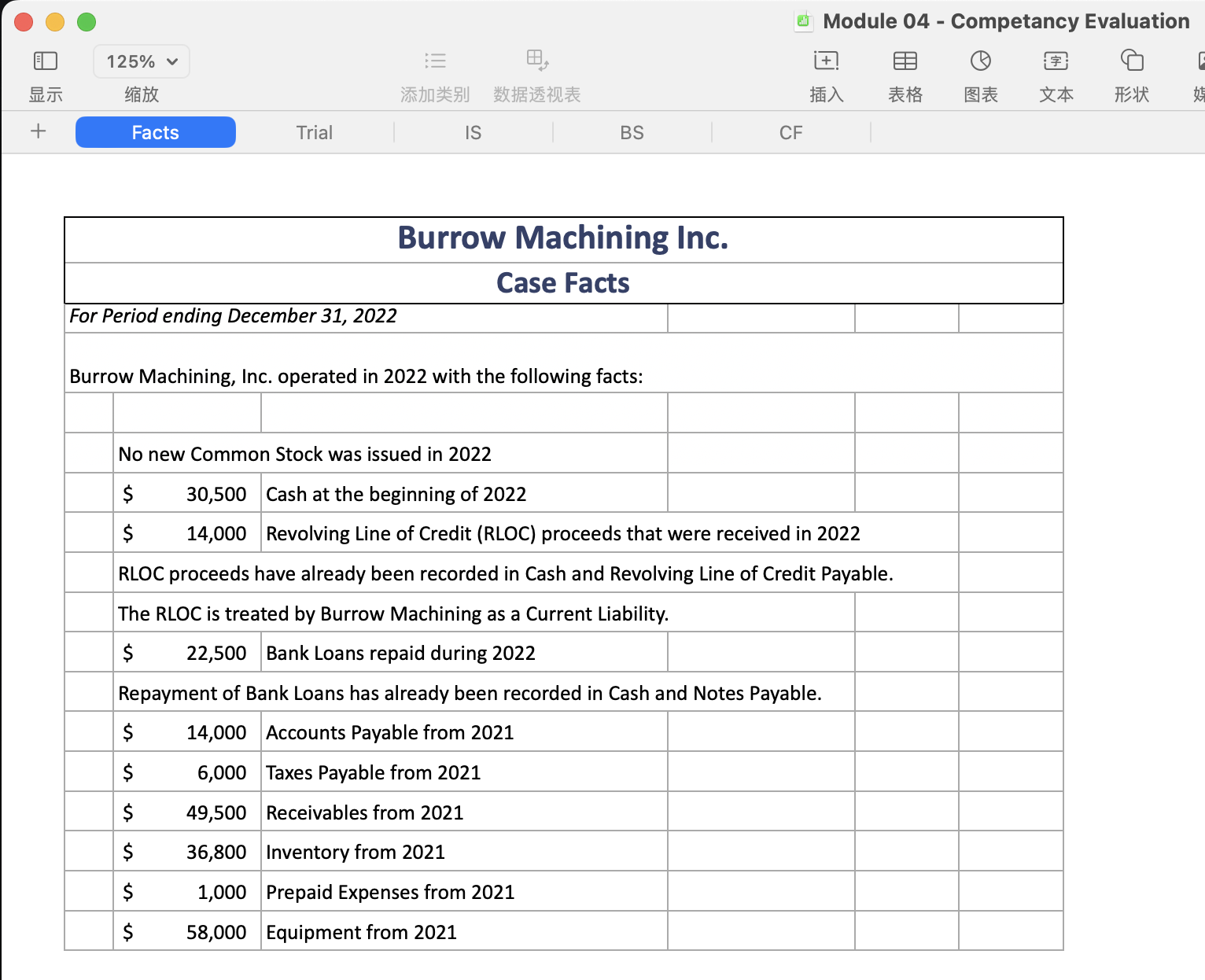

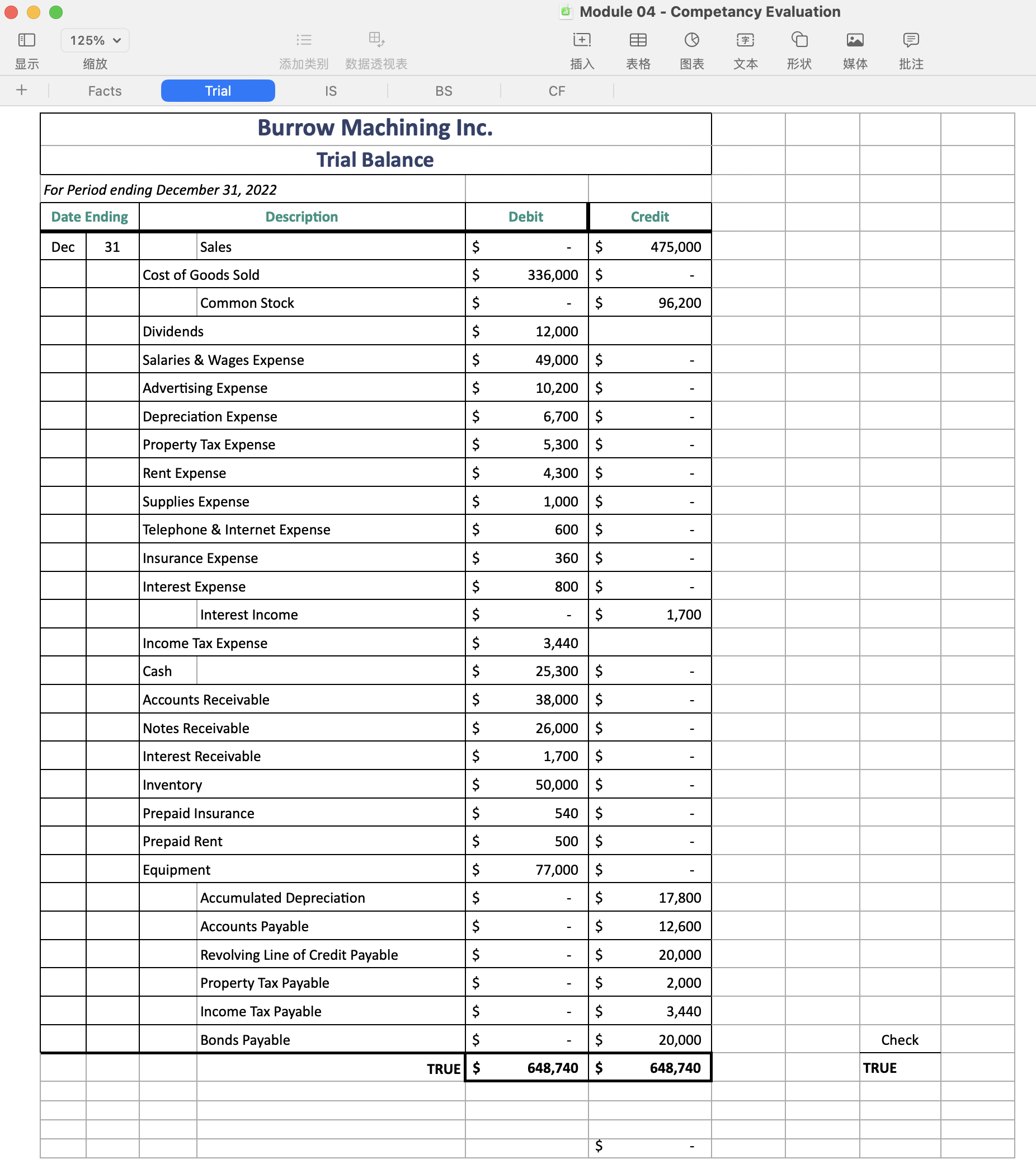

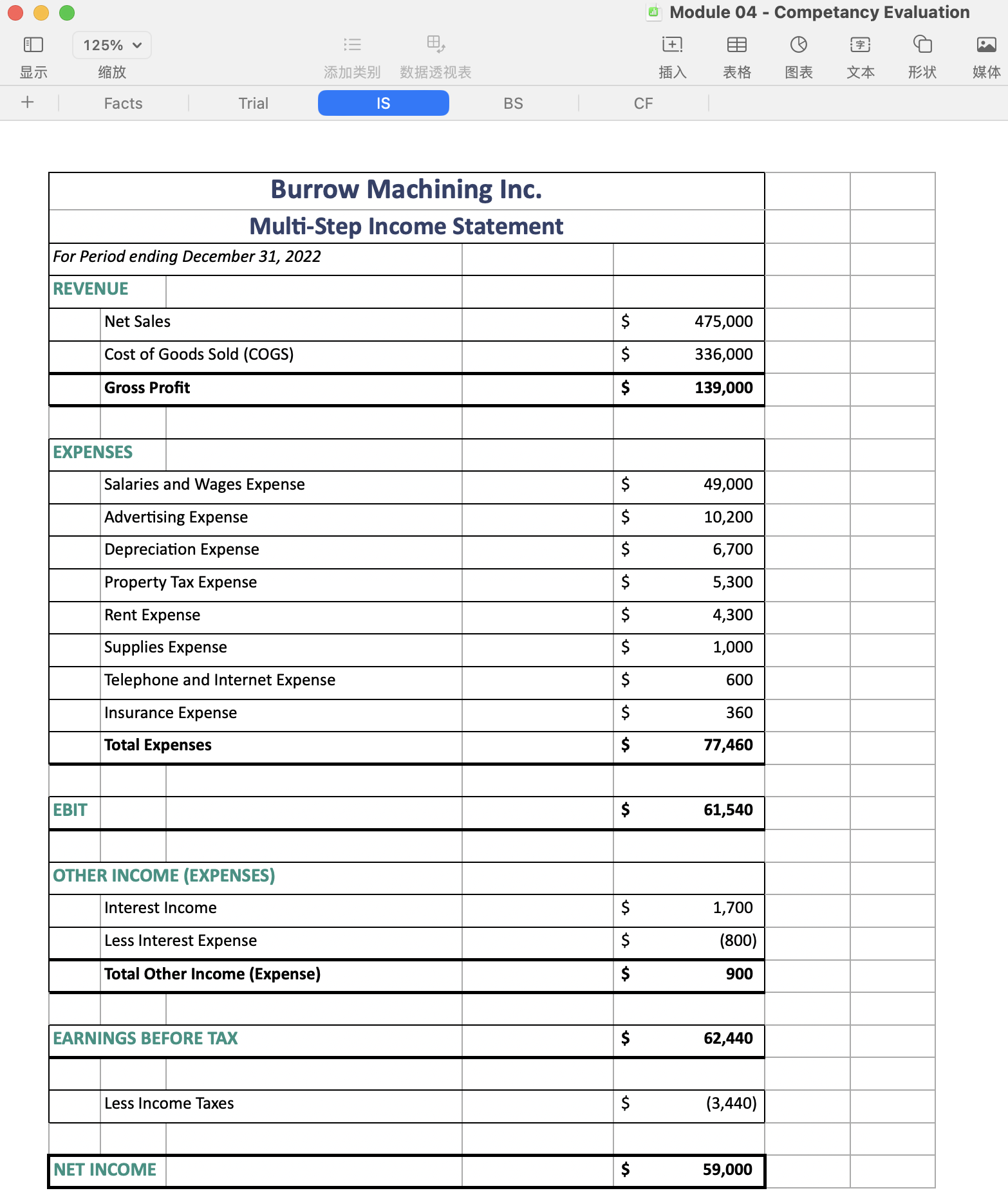

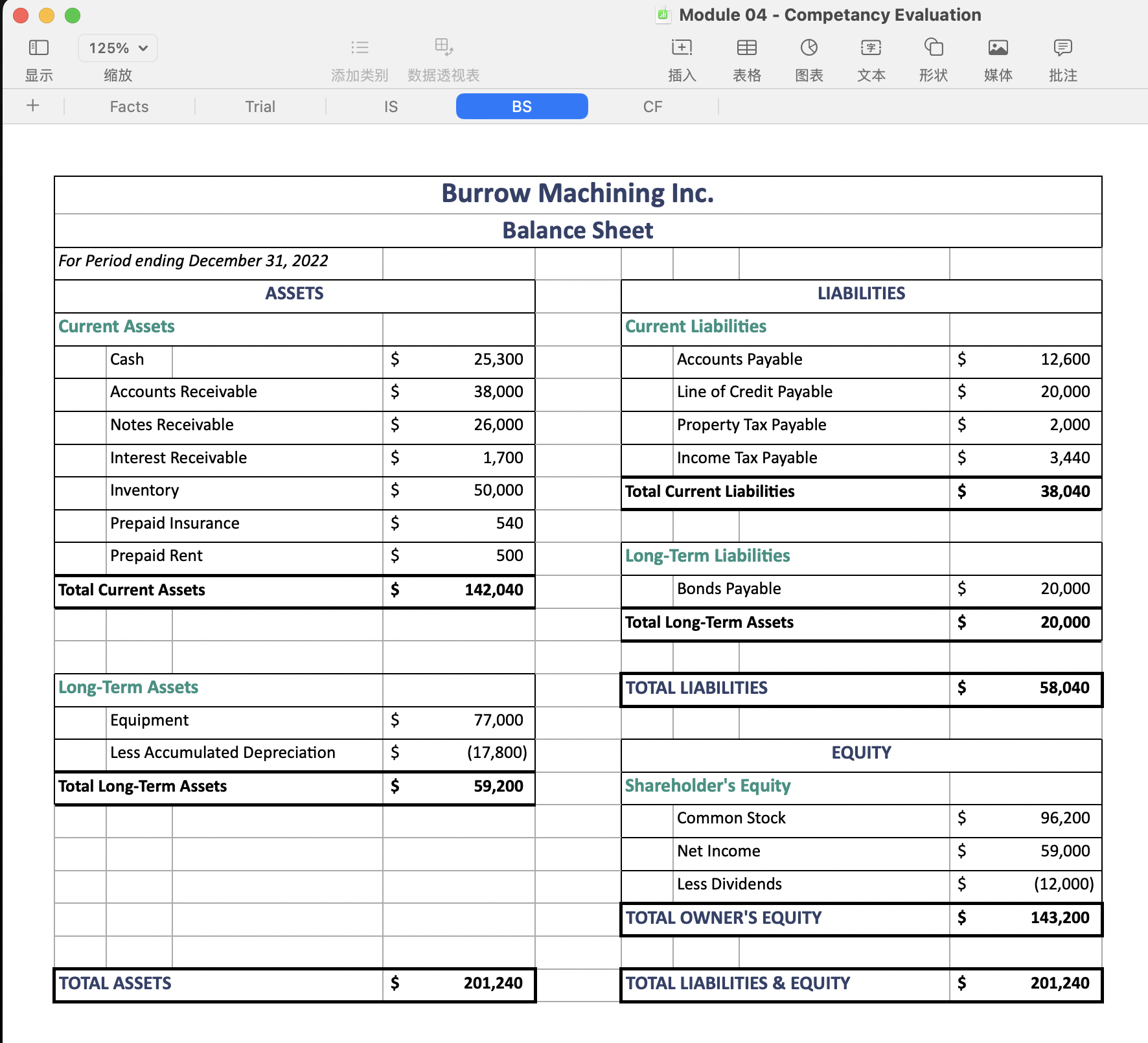

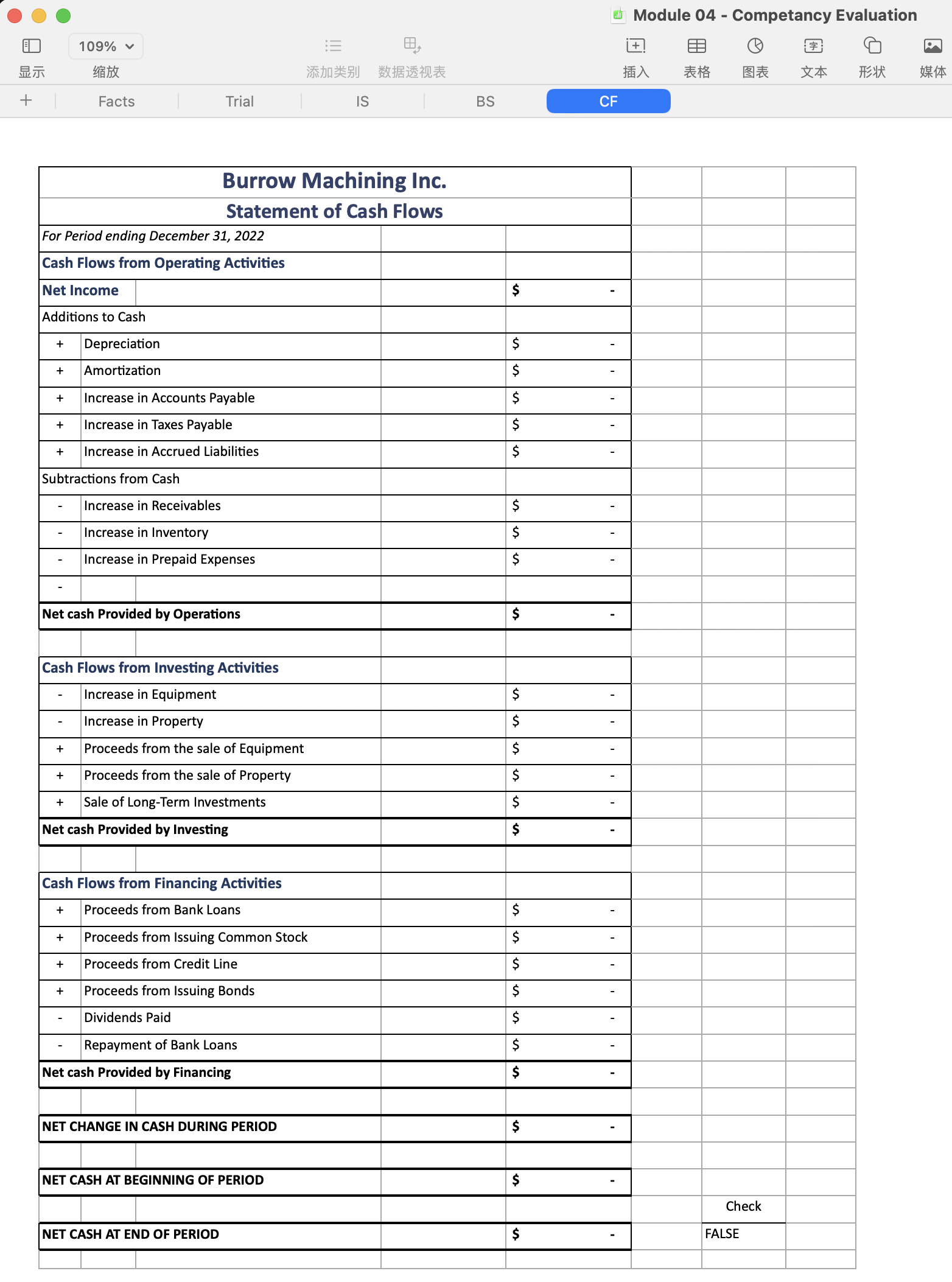

oo e Module 04 - Competancy Evaluation 0 125% v = 8 = g7 RN A R EBxE N 23R Burrow Machining Inc. Case Facts For Period ending December 31, 2022 Burrow Machining, Inc. operated in 2022 with the following facts: No new Common Stock was issued in 2022 S 30,500 |Cash at the beginning of 2022 S 14,000 |Revolving Line of Credit (RLOC) proceeds that were received in 2022 RLOC proceeds have already been recorded in Cash and Revolving Line of Credit Payable. The RLOC is treated by Burrow Machining as a Current Liability. S 22,500 Bank Loans repaid during 2022 Repayment of Bank Loans has already been recorded in Cash and Notes Payable. 14,000 |Accounts Payable from 2021 6,000 |Taxes Payable from 2021 49,500 Receivables from 2021 $ $ $ S 36,800 |Inventory from 2021 S 1,000 |Prepaid Expenses from 2021 $ 58,000 Equipment from 2021 El'@ -+ 3 Module 04 - Competancy Evaluation 125% v = E8 4RHL BN B 5| 7% Facts IS BS CF Burrow Machining Inc. Trial Balance For Period ending December 31, 2022 Date Ending Description Debit Credit Sales $ - |8 475,000 Cost of Goods Sold S 336,000 | $ - Dividends Salaries & Wages Expense - Advertising Expense - Depreciation Expense - Rent Expense - Supplies Expense - Insurance Expense - Interest Expense - Interest Income 1,700 Income Tax Expense S - Accounts Receivable S - Notes Receivable S - S - Inventory S - Prepaid Insurance S - Prepaid Rent S - Equipment S - $ 17,800 Accounts Payable S 12,600 Revolving Line of Credit Payable S 20,000 Property Tax Payable S 2,000 Income Tax Payable S 3,440 Bonds Payable S 20,000 648,740 648,740 w -/ i XA FEAR Check TRUE @ @ ER + Module 04 - Competancy Evaluation 125% v = =2 LT A E Facts Trial o BS CF Burrow Machining Inc. Multi-Step Income Statement Salaries and Wages Expense 49,000 Advertising Expense 10,200 Depreciation Expense 6,700 | n| n| n Property Tax Expense 5,300 Rent Expense 4,300 | in Supplies Expense 1,000 Telephone and Internet Expense 600 Insurance Expense 360 v n| n Total Expenses 77,460 OTHER INCOME (EXPENSES) Less Interest Expense S (800) Total Other Income (Expense) S 900 EARNINGS BEFORE TAX S 62,440 Less Income Taxes S (3,440) NET INCOME S 59,000 B P . 3 XA 2 N s 125% v Em HE = Facts Trial IS Module 04 - Competancy Evaluation # k] = Gal = BA =8 & % XA ek AR Fiin=3 CF Burrow Machining Inc. Balance Sheet For Period ending December 31, 2022 ASSETS Current Assets Cash Prepaid Rent Total Current Assets 142,040 Long-Term Assets Equipment Less Accumulated Depreciation (17,800) Total Long-Term Assets 59,200 TOTAL ASSETS $ 201,240 LIABILITIES Current Liabilities Accounts Payable S 12,600 Line of Credit Payable S 20,000 Property Tax Payable S 2,000 Income Tax Payable S 3,440 Total Current Liabilities S 38,040 Bonds Payable S 20,000 Total Long-Term Assets TOTAL LIABILITIES $ 58,040 EQUITY Shareholder's Equity Common Stock Net Income 59,000 Less Dividends (12,000) TOTAL OWNER'S EQUITY $ 143,200 TOTAL LIABILITIES & EQUITY $ 201,240 . . Module 04 - Competancy Evaluation 109% YKEL + Facts Trial IS BS CF Burrow Machining Inc. Statement of Cash Flows For Period ending December 31, 2022 Cash Flows from Operating Activities Net Income $ Additions to Cash Depreciation + Amortization Increase in Accounts Payable + Increase in Taxes Payable + Increase in Accrued Liabilities Subtractions from Cash Increase in Receivables Increase in Inventory Increase in Prepaid Expenses Net cash Provided by Operations Cash Flows from Investing Activities Increase in Equipm Increase in Property Proceeds from the sale of Equipment + Proceeds from the sale of Property + Sale of Long-Term Investments Net cash Provided by Investing Cash Flows from Financing Activities + from Bank + Proceeds from Issuing Common Stock Proceeds from Credit Line + Proceeds from Issuing Bonds Dividends Paid Repayment of Bank Loans Net cash Provided by Financing NET CHANGE IN CASH DURING PE NET CASH AT BEGINNING OF PERIOD Check NET CASH AT END OF PERIOD $ FALS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts