Question: oonly question4 , please A B D E F G H 1 J K L M z N o P Buyer ID 1 Data 2

oonly question4 , please

oonly question4 , please

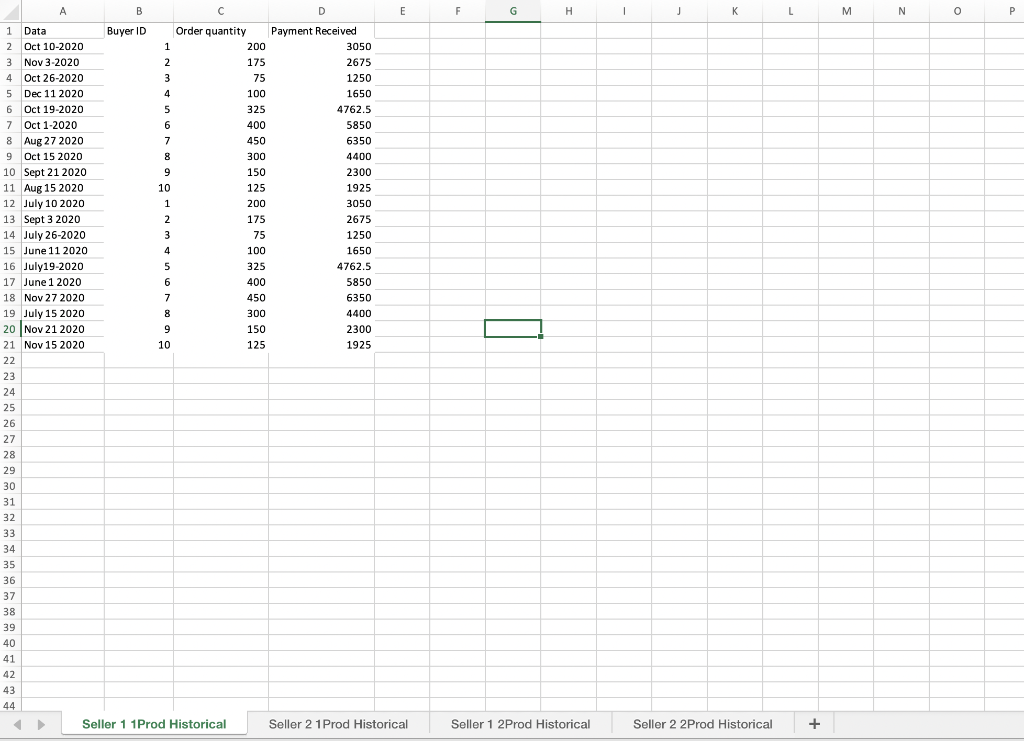

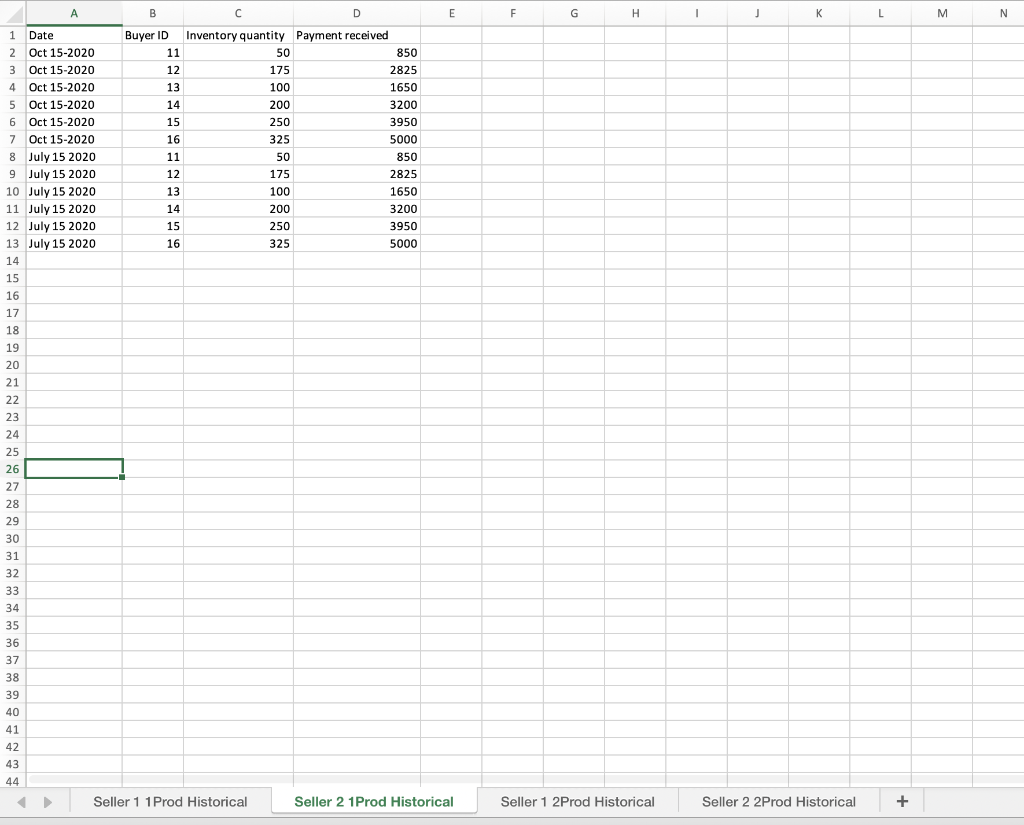

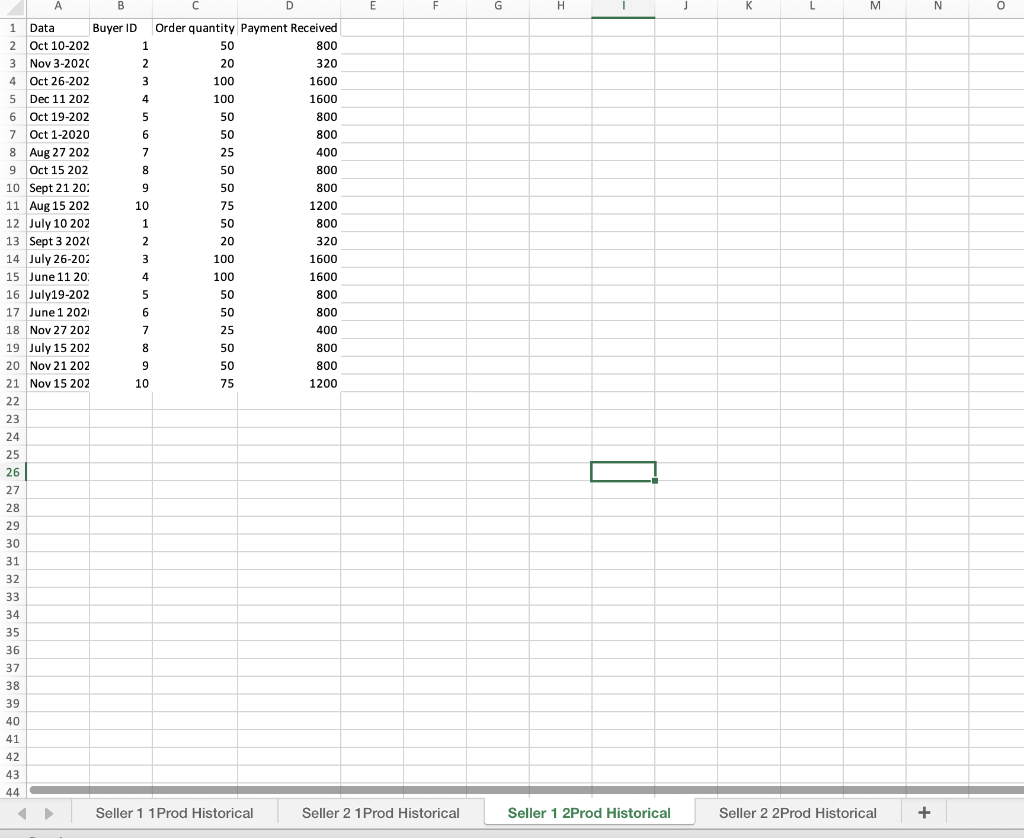

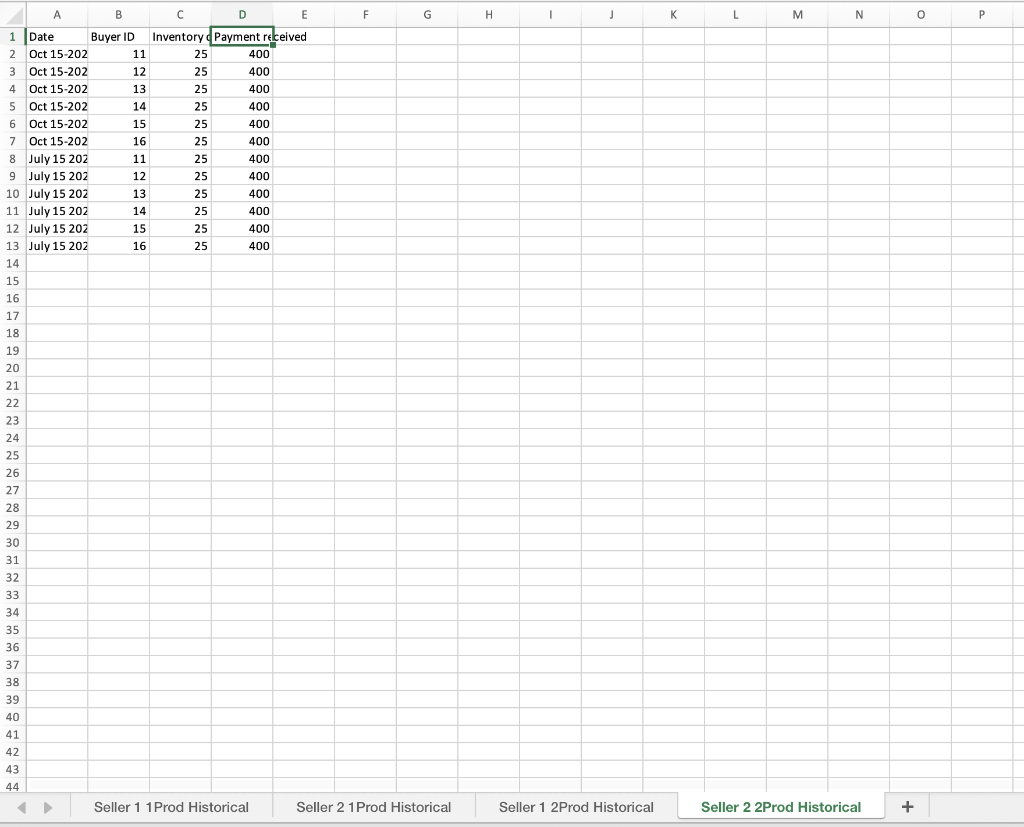

A B D E F G H 1 J K L M z N o P Buyer ID 1 Data 2 Oct 10-2020 3 Nov 3-2020 4 Oct 26-2020 5 Dec 11 2020 6 Oct 19-2020 7 Oct 1-2020 7 8 Aug 27 2020 9 Oct 15 2020 10 Sept 21 2020 11 Aug 15 2020 ave 12 July 10 2020 wa 13 Sept 3 2020 views 14 July 26-2020 15 June 11 2020 20 16 July19-2020 17 June 1 2020 18 Nov 27 2020 19 July 15 2020 20 Nov 21 2020 24 21 Nov 15 2020 - 22 22 23 23 24. 24 25 26 27 28 29 30 31 --- 32 32 33 24 34 35 36 37 38 39 40 41 Order quantity Payment Received 1 200 3050 2 175 2675 3 75 1250 4 100 1650 5 325 4762.5 6 400 5850 7 450 6350 8 300 4400 9 150 2300 10 125 1925 1 200 3050 2 175 2675 - 3 75 1250 4 100 1650 5 325 4762.5 100 6 cor 400 5850 7 450 6350 8 300 4400 9 150 2300 10 125 1925 O 42 43 44 Seller 1 1Prod Historical Seller 2 1 Prod Historical Seller 1 2Prod Historical Seller 2 2Prod Historical + A E F G H ! J j K L M N 3200 1 Date 2 Oct 15-2020 3 Oct 15-2020 4 Oct 15-2020 5 Oct 15-2020 6 6 Oct 15-2020 7 Oct 15-2020 8 July 15 2020 9 July 15 2020 10 July 15 2020 11 July 15 2020 12 July 15 2020 13 July 15 2020 14 B D Buyer ID Inventory quantity Payment received 11 50 850 12 175 2825 13 100 1650 14 200 15 250 3950 16 325 5000 11 50 850 12 175 2825 13 100 1650 14 200 3200 15 250 3950 16 325 5000 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Seller 1 1 Prod Historical Seller 2 1Prod Historical Seller 1 2Prod Historical Seller 2 2Prod Historical + A B D E F G = H ] K K - L M z N 0 3 1 Data Buyer ID Order quantity Payment Received 2 Oct 10-202 1 50 800 3 Nov 3-2020 2 20 320 4 Oct 26-202 3 100 1600 5 Dec 11 202 4 100 1600 6 Oct 19-202 5 50 800 7 Oct 1-2020 6 50 800 8 Aug 27 202 7 25 400 9 Oct 15 202 8 50 800 10 Sept 21 20: 9 50 800 11 Aug 15 202 10 75 1200 12 July 10 202 1 50 800 13 Sept 3 2024 2 20 320 14 July 26-202 3 100 1600 15 June 11 20 4 100 1600 16 July19-202 5 50 800 17 June 1 2021 6 50 800 18 Nov 27 202 7 25 400 19 July 15 202 8 50 800 20 Nov 21 202 9 50 800 21 Nov 15 202 10 75 1200 22 23 24 25 26 27 O 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Seller 1 1 Prod Historical Seller 2 1 Prod Historical Seller 1 2Prod Historical Seller 2 2Prod Historical + F G H 1 * K K L 3 M N 0 B D D E 1 1 Date Buyer ID Inventory Payment received 2 Oct 15-202 11 25 400 3 Oct 15-202 12 25 400 4 Oct 15-202 13 25 400 5 Oct 15-202 14 25 400 6 Oct 15-202 15 25 400 7 Oct 15-202 16 25 400 8 July 15 202 11 25 9 July 15 202 12 25 10 July 15 202 13 25 11 July 15 202 14 25 12 July 15 202 15 25 13 July 15 202 16 25 14 15 ***989 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Seller 1 1 Prod Historical Seller 2 1 Prod Historical Seller 1 2Prod Historical Seller 2 2Prod Historical + + Spreadsheet Seller 1 1Prod Historical contains the latest two orders from each of 10 buyers of a highly- popular projector X; Seller 2 1Prod Historical is for orders for the same projector made by other buyers who purchase through seller 2. Spreadsheet.... 2Prod ... follow the same logic for orders of a less popular projector model Y. For consistency, assume 30% annual holding cost. Write a case report (4 pages max of main text, unlimited appendix) addressing the following: 1. (3 points) Infer the pricing structure of the two Willcoms sellers based on the 1 Product historical data. 2. (3 points) Advise the 16 buyers in the dataset on the most cost-efficient order quantities. You can use either an analytical or a numerical approach. Note that each buyer only has access to one of the sellers, as listed in the dataset. 3. (1 points) What are some reasons the order quantities placed might differ from your recommendations above? 4. (3 points) Pick randomly 2 buyers from seller 1 and 2 from seller 2. Assuming the sellers allow combining products 1 and 2 in the same order (so the ordering cost is shared), what order quantities would you advise these buyers to place for each of the two products? A B D E F G H 1 J K L M z N o P Buyer ID 1 Data 2 Oct 10-2020 3 Nov 3-2020 4 Oct 26-2020 5 Dec 11 2020 6 Oct 19-2020 7 Oct 1-2020 7 8 Aug 27 2020 9 Oct 15 2020 10 Sept 21 2020 11 Aug 15 2020 ave 12 July 10 2020 wa 13 Sept 3 2020 views 14 July 26-2020 15 June 11 2020 20 16 July19-2020 17 June 1 2020 18 Nov 27 2020 19 July 15 2020 20 Nov 21 2020 24 21 Nov 15 2020 - 22 22 23 23 24. 24 25 26 27 28 29 30 31 --- 32 32 33 24 34 35 36 37 38 39 40 41 Order quantity Payment Received 1 200 3050 2 175 2675 3 75 1250 4 100 1650 5 325 4762.5 6 400 5850 7 450 6350 8 300 4400 9 150 2300 10 125 1925 1 200 3050 2 175 2675 - 3 75 1250 4 100 1650 5 325 4762.5 100 6 cor 400 5850 7 450 6350 8 300 4400 9 150 2300 10 125 1925 O 42 43 44 Seller 1 1Prod Historical Seller 2 1 Prod Historical Seller 1 2Prod Historical Seller 2 2Prod Historical + A E F G H ! J j K L M N 3200 1 Date 2 Oct 15-2020 3 Oct 15-2020 4 Oct 15-2020 5 Oct 15-2020 6 6 Oct 15-2020 7 Oct 15-2020 8 July 15 2020 9 July 15 2020 10 July 15 2020 11 July 15 2020 12 July 15 2020 13 July 15 2020 14 B D Buyer ID Inventory quantity Payment received 11 50 850 12 175 2825 13 100 1650 14 200 15 250 3950 16 325 5000 11 50 850 12 175 2825 13 100 1650 14 200 3200 15 250 3950 16 325 5000 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Seller 1 1 Prod Historical Seller 2 1Prod Historical Seller 1 2Prod Historical Seller 2 2Prod Historical + A B D E F G = H ] K K - L M z N 0 3 1 Data Buyer ID Order quantity Payment Received 2 Oct 10-202 1 50 800 3 Nov 3-2020 2 20 320 4 Oct 26-202 3 100 1600 5 Dec 11 202 4 100 1600 6 Oct 19-202 5 50 800 7 Oct 1-2020 6 50 800 8 Aug 27 202 7 25 400 9 Oct 15 202 8 50 800 10 Sept 21 20: 9 50 800 11 Aug 15 202 10 75 1200 12 July 10 202 1 50 800 13 Sept 3 2024 2 20 320 14 July 26-202 3 100 1600 15 June 11 20 4 100 1600 16 July19-202 5 50 800 17 June 1 2021 6 50 800 18 Nov 27 202 7 25 400 19 July 15 202 8 50 800 20 Nov 21 202 9 50 800 21 Nov 15 202 10 75 1200 22 23 24 25 26 27 O 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Seller 1 1 Prod Historical Seller 2 1 Prod Historical Seller 1 2Prod Historical Seller 2 2Prod Historical + F G H 1 * K K L 3 M N 0 B D D E 1 1 Date Buyer ID Inventory Payment received 2 Oct 15-202 11 25 400 3 Oct 15-202 12 25 400 4 Oct 15-202 13 25 400 5 Oct 15-202 14 25 400 6 Oct 15-202 15 25 400 7 Oct 15-202 16 25 400 8 July 15 202 11 25 9 July 15 202 12 25 10 July 15 202 13 25 11 July 15 202 14 25 12 July 15 202 15 25 13 July 15 202 16 25 14 15 ***989 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Seller 1 1 Prod Historical Seller 2 1 Prod Historical Seller 1 2Prod Historical Seller 2 2Prod Historical + + Spreadsheet Seller 1 1Prod Historical contains the latest two orders from each of 10 buyers of a highly- popular projector X; Seller 2 1Prod Historical is for orders for the same projector made by other buyers who purchase through seller 2. Spreadsheet.... 2Prod ... follow the same logic for orders of a less popular projector model Y. For consistency, assume 30% annual holding cost. Write a case report (4 pages max of main text, unlimited appendix) addressing the following: 1. (3 points) Infer the pricing structure of the two Willcoms sellers based on the 1 Product historical data. 2. (3 points) Advise the 16 buyers in the dataset on the most cost-efficient order quantities. You can use either an analytical or a numerical approach. Note that each buyer only has access to one of the sellers, as listed in the dataset. 3. (1 points) What are some reasons the order quantities placed might differ from your recommendations above? 4. (3 points) Pick randomly 2 buyers from seller 1 and 2 from seller 2. Assuming the sellers allow combining products 1 and 2 in the same order (so the ordering cost is shared), what order quantities would you advise these buyers to place for each of the two products

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts