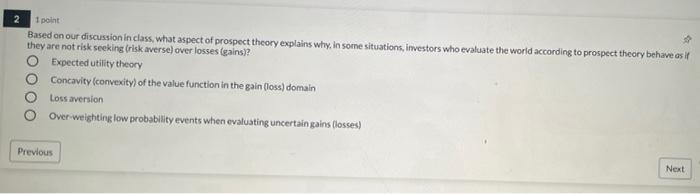

Question: OOOO 1 point Based on our discussion in class, what aspect of prospect theory explains why, in some situations, investors who evaluate the world according

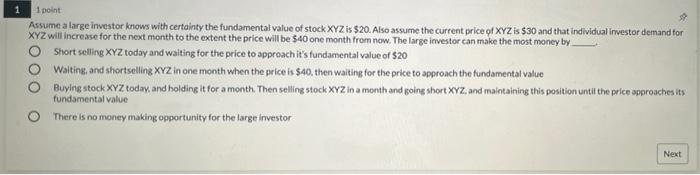

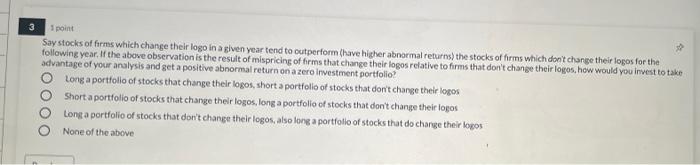

OOOO 1 point Based on our discussion in class, what aspect of prospect theory explains why, in some situations, investors who evaluate the world according to prospect theory behave as ir they are not risk seeking risk averse) over losses (gains)? Expected utility theory Concavity (convexity) of the value function in the gain (loss) domain Loss aversion Over weighting low probability events when evaluating uncertain gains (losses) Previous Next 1 1 point Assume a large investor knows with certainty the fundamental value of stock XYZ is $20. Also assume the current price of XYZ is $30 and that individual investor demand for XYZ will increase for the next month to the extent the price will be $40 one month from now. The large investor can make the most money by Short selling XYZ today and waiting for the price to approach it's fundamental value of $20 Walting and shortseling XYZ in one month when the price is $40, then waiting for the price to approach the fundamental value Buying stock XYZ today, and holding it for a month. Then selling stock XYZ In a month and going short XYZ, and maintaining this position until the price approaches its fundamental value There is no money making opportunity for the large investor Next 1 point Say stocks of forms which change their logo in a given year tend to outperform have higher abnormal returns) the stocks of forms which don't change their logos for the following year. If the above observation is the result of mispricing of firms that change their logos relative to firms that don't change their logos, how would you invest to take advantage of your analysis and get a positive abnormal return on a zero investment portfolio! O Long a portfolio of stocks that change their logos, short a portfolio of stocks that don't change their logos Short a portfolio of stocks that change their logos, long a portfolio of stocks that don't change their logos Long a portfolio of stocks that don't change their logos, also long a portfolio of stocks that do change their logos None of the above OOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts