Question: op Case tule te proposals implemented EXERCISE 6-12 Variable Costing Income Statement; Reconciliation L06-2 , L06-3 Whitman Company has just completed its first year of

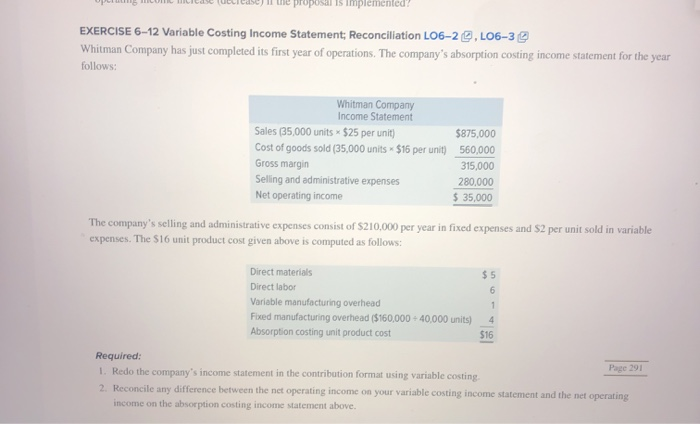

op Case tule te proposals implemented EXERCISE 6-12 Variable Costing Income Statement; Reconciliation L06-2 , L06-3 Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Whitman Company Income Statement Sales (35,000 units $25 per unit) Cost of goods sold (35,000 units $16 per unit) Gross margin Selling and administrative expenses Net operating income $875,000 560,000 315,000 280.000 $ 35,000 The company's selling and administrative expenses consist of S210,000 per year in fixed expenses and $2 per unit sold in variable expenses. The $16 unit product cost given above is computed as follows: $5 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($160,000 - 40,000 units) Absorption costing unit product cost 4 Required: Pre 191 1. Redo the company's income statement in the contribution format using variable costing 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption costing income statement above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts