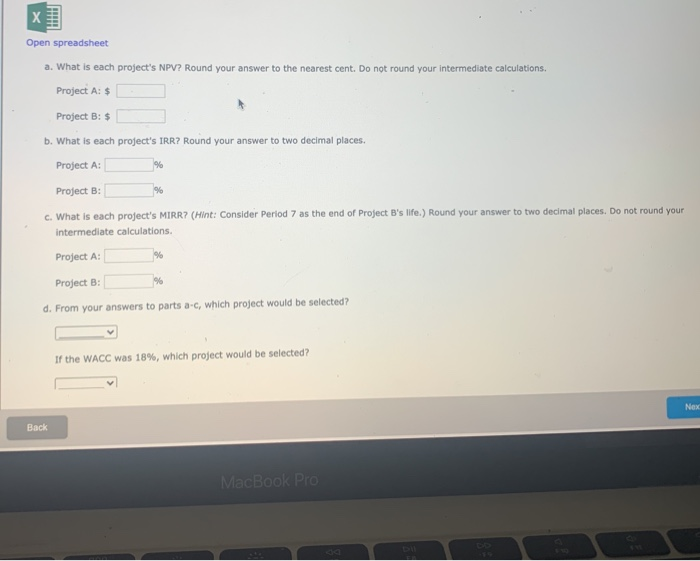

Question: . Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations, Project A: $

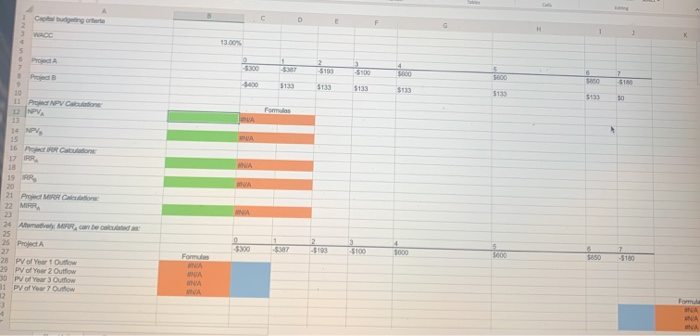

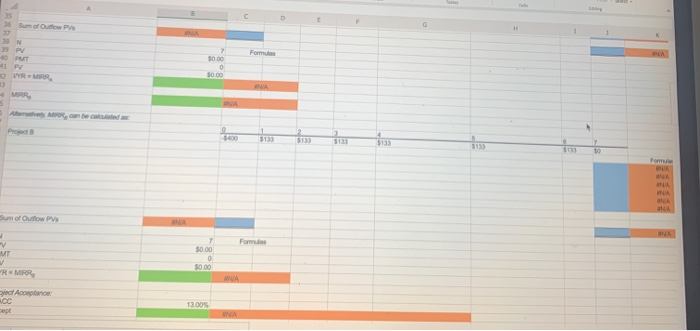

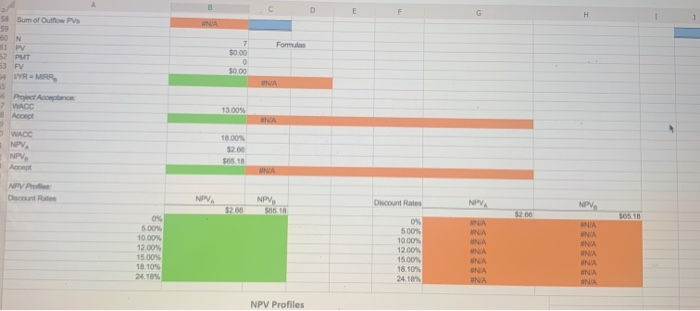

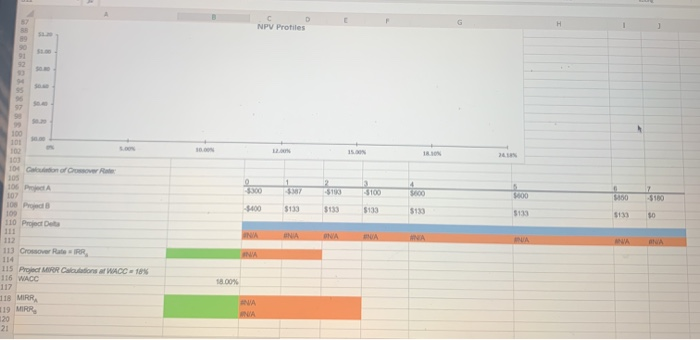

. Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations, Project A: $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places. Project A: Project B: c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % Project B: d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? Nex Back MacBook Pro G H WACC $300 -5387 $100 4 SO 5800 So 7 $180 $130 5133 $133 5135 $0 Formus 10 11 P NPV Cabutions 12 NPVA 13 14 NPV 15 16 PR Con UA UA 18 19 20 21 PMR Con 22 MIRRA 223 24 AMR, bed 25 25 Pred 27 28 PV of Year 1 Outlow 29 PV of Year 2 Outflow 30 PV of Year Outflow 31 PV of Year 7 Outflow 12 3 0 -$100 4 5000 Solo S000 6 5850 Fom NA NA Surs of Our P G NA 38 N 39 PM > Formulas 41 F 2 WYR = MR 0 1000 NA MRR NA 0 5 5133 $133 7 to NA ANA Sum of Outlow PV Form MT $0.00 0 $0.00 > " RRR oct Acoplanos CC Copt 13.00% NA B D E F G H NA 3 58Sum of Outflow PV 59 60 N 11 PV 52 PUIT 53 PV 4WYR = MRR Formu 7 $0.00 0 $0.00 UNA Pod Aco 7 WACC 18 Accept 13.00% NA WACC NPVA 18.00% $2.06 $65.18 Acompt WNIA NPVA Chcount Rates NPVA NPV Discount Rates NPVA 5260 $2.00 0% WNIA UNIA 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.18% UNA 10.00 12.00% 15.00 18.10% 24.18% UNA UNA NA NA UNA NA NPV Profiles NPV Profiles H $8.50 7 100 101 1.com 18 2 104 Confort 100 1 2 4 $300 387 3700 5 000 100 7 -$180 102 108 PB 100 110 Project Det $133 $133 $130 5135 $133 30 UNIA NA ONA ANA 113 Crossover Rate RR INA 18.00% 115 Project MR Calculations at WACC - 10% 116 WACC 117 118 MIRRA 119 MIRR, 120 21 ANA NA . Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations, Project A: $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places. Project A: Project B: c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % Project B: d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? Nex Back MacBook Pro G H WACC $300 -5387 $100 4 SO 5800 So 7 $180 $130 5133 $133 5135 $0 Formus 10 11 P NPV Cabutions 12 NPVA 13 14 NPV 15 16 PR Con UA UA 18 19 20 21 PMR Con 22 MIRRA 223 24 AMR, bed 25 25 Pred 27 28 PV of Year 1 Outlow 29 PV of Year 2 Outflow 30 PV of Year Outflow 31 PV of Year 7 Outflow 12 3 0 -$100 4 5000 Solo S000 6 5850 Fom NA NA Surs of Our P G NA 38 N 39 PM > Formulas 41 F 2 WYR = MR 0 1000 NA MRR NA 0 5 5133 $133 7 to NA ANA Sum of Outlow PV Form MT $0.00 0 $0.00 > " RRR oct Acoplanos CC Copt 13.00% NA B D E F G H NA 3 58Sum of Outflow PV 59 60 N 11 PV 52 PUIT 53 PV 4WYR = MRR Formu 7 $0.00 0 $0.00 UNA Pod Aco 7 WACC 18 Accept 13.00% NA WACC NPVA 18.00% $2.06 $65.18 Acompt WNIA NPVA Chcount Rates NPVA NPV Discount Rates NPVA 5260 $2.00 0% WNIA UNIA 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.18% UNA 10.00 12.00% 15.00 18.10% 24.18% UNA UNA NA NA UNA NA NPV Profiles NPV Profiles H $8.50 7 100 101 1.com 18 2 104 Confort 100 1 2 4 $300 387 3700 5 000 100 7 -$180 102 108 PB 100 110 Project Det $133 $133 $130 5135 $133 30 UNIA NA ONA ANA 113 Crossover Rate RR INA 18.00% 115 Project MR Calculations at WACC - 10% 116 WACC 117 118 MIRRA 119 MIRR, 120 21 ANA NA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts