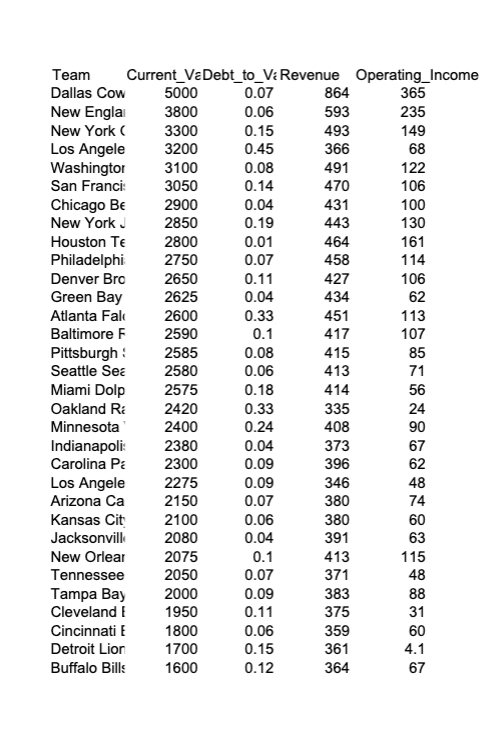

Question: Open the NFLTEAMVALUES 2 0 1 8 dataset in RStudio. Here we are interested in modeling the relationship between current value of an NFL team

Open the NFLTEAMVALUES dataset in RStudio. Here we are interested in modeling the relationship between current value of an NFL team and their debt relative to value. The relevant columns of the dataset are CurrentValue and DebttoValue Note that all values in these columns are in millions. Suppose we can use a simple linear regression model to describe the relationship where we treat DebttoValue as the predictor variable.

Compute a confidence interval for the slope coefficient in front of DebttoValue. What does this confidence interval tell us

Conduct a confidence level hypothesis test to test whether or not the true slope coefficient is equal to

What is our best estimate for the variance of the residuals?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock